09Jun11:54 amEST

Pause?! You're Talking Pause?

The consensus among economists on The Street headed into next week's FOMC is now that The Fed will pause its rate hiking regime and see how things shake out, hoping for the best of a "soft landing."

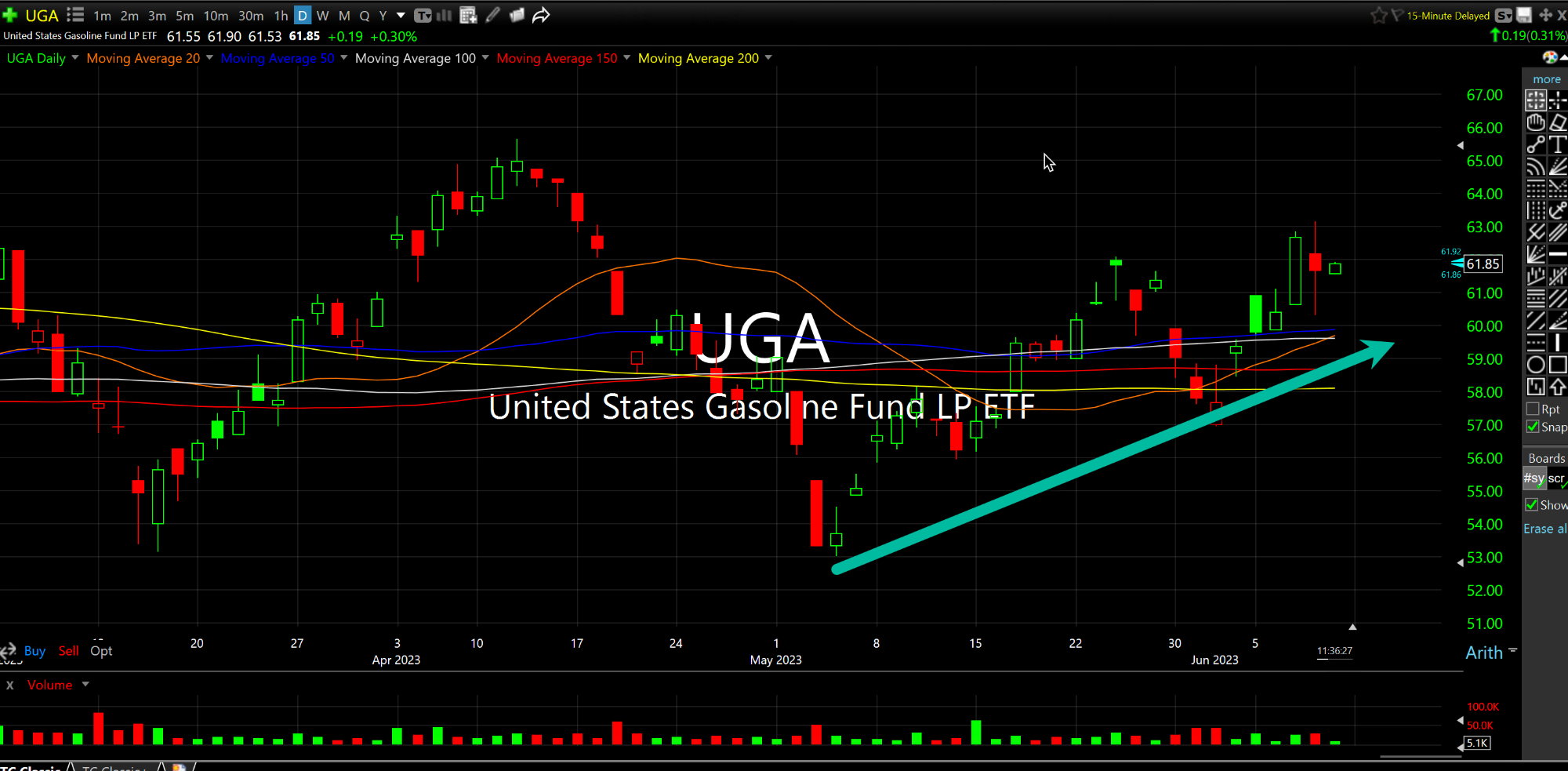

Meanwhile, back in the real world, gasoline prices have gone virtually straight up since the beginning of May (see UGA daily chart, below, the ETF for gasoline futures across the country). And, as we know, speculative fervor has taken hold in equities, with names like CVNA TSLA splashing around with glee to the upside.

Home prices remain historically high, and food prices have not exactly come crashing down either.

Under these circumstances, a pause is uniquely dangerous for this Fed especially after their "transitory" embarrassment in recent years--We know the Bank of Canada just had to resume its rate hiking cycle after pausing for several months.

But, then again, Mr. Powell and his band of merry money printers are not exactly tough-minded, and we know they can be susceptible to political pressure. So, a pause is certainly in the cards.

If we do see a Fed pause next week it raises two key issues: 1) Has the market already priced it in? 2) Will the market begin to back off the bull case and interpret a Fed pause as a sign of panic from Powell that the economy is actually beginning to crumble?

You might say The Fed is trapped--and I do--as either decision to hike or pause at this juncture is a red flag going forward. Markets have been uniquely complacent to this outcome up until now. But I fully expect that to change starting next week, pause or hike.

Bears Are Taking Their Summe... Weekend Overview and Analysi...