22Jun12:24 pmEST

Unsinkable Rates

You may have noticed that Jerome Powell is out talking like a tough guy this week in front of Congress.

Naturally, he is doing so after failing to raise rates last week and essentially backstopping wealthy depositors for regional banks back in March, essentially eliminating a fat left tail risk to markets for the time being which, in turn, helped to erase any tightening of financial conditions since The Fed started raising rates in March of 2022.

But talk tough he is doing, nonetheless. And rates on the 10-Year Notes remain firm, coiled, and possibly hinting at the ultimate pain trade being another extended spike higher back over 4% and perhaps into the 5% range.

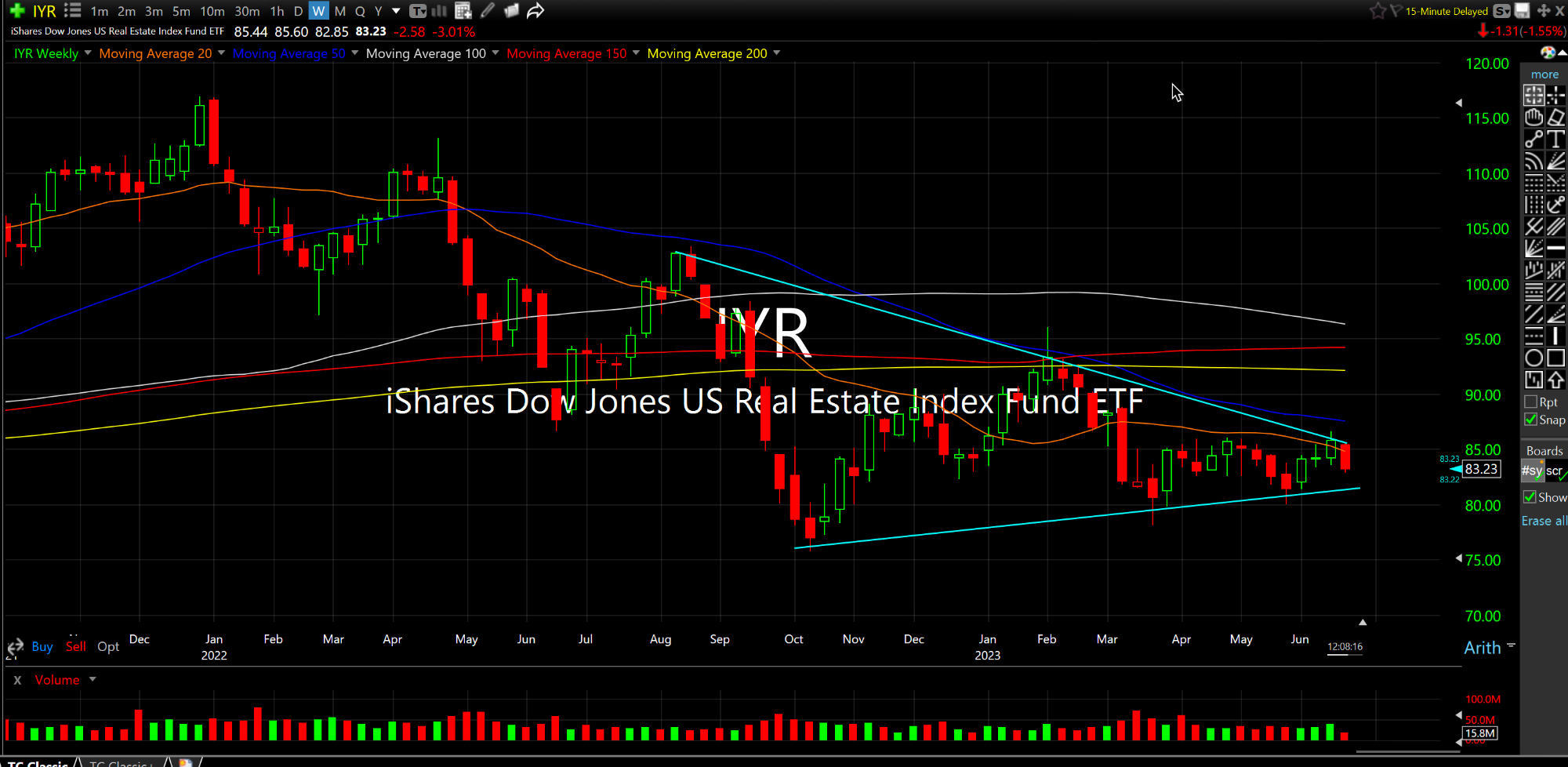

You will also note that both the IYR (commercial real estate) and KRE (regional banks) ETFs are among the very worst performers amid a mixed session so far today. This is not a coincidence at all, as rates this cycle are inversely correlated to the levered REITs and regional banks who assumed rates who remain low indefinitely.

However, the only way rates are going back to zero anytime soon is we have something akin to the 1929 crash and subsequent Great Depression--And even then I think you will find this inflation will remain more entrenched than most will ever care to admit.

On the IYR weekly chart, below, as bearish as this setup looks the TNX (rates on the 10-year Index) looks equally bullish, to drive home the inverse correlation. DRV is the triple bear ETF for IYR, and is fairly liquid.

I expect this summer and certainly into autumn to see a ton more trouble in paradise for REITs and regionals with rates sticky high.

This Market Needs a Kite Exp... Stock Market Recap 04/24/17 ...