18Jun11:59 amEST

Amid the Daily Melt-Up, Homebuilders Are Done

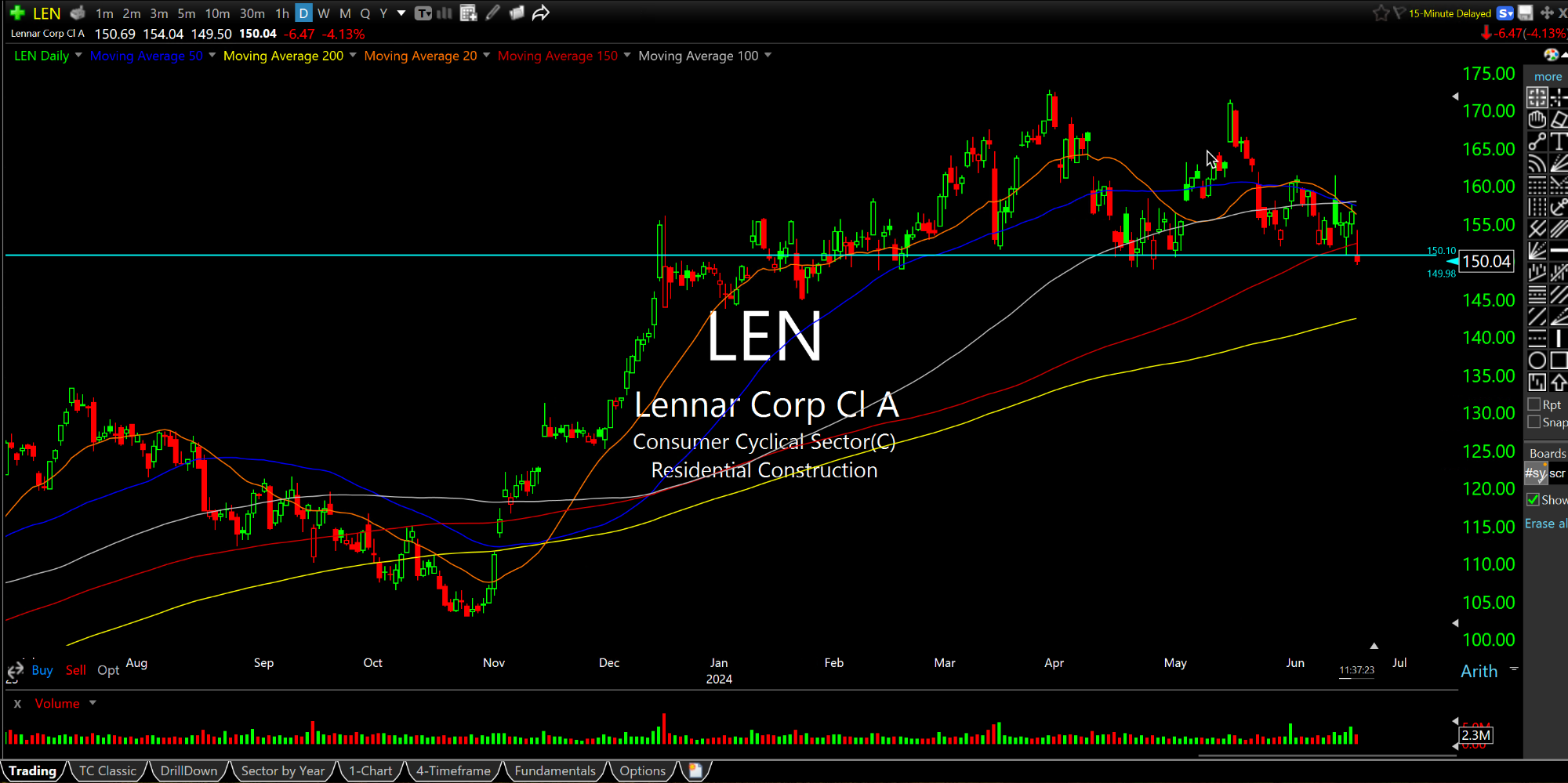

Despite beating estimates, homebuilder Lennar (first daily chart, below) is being sold fairly aggressively on lowered forward guidance.

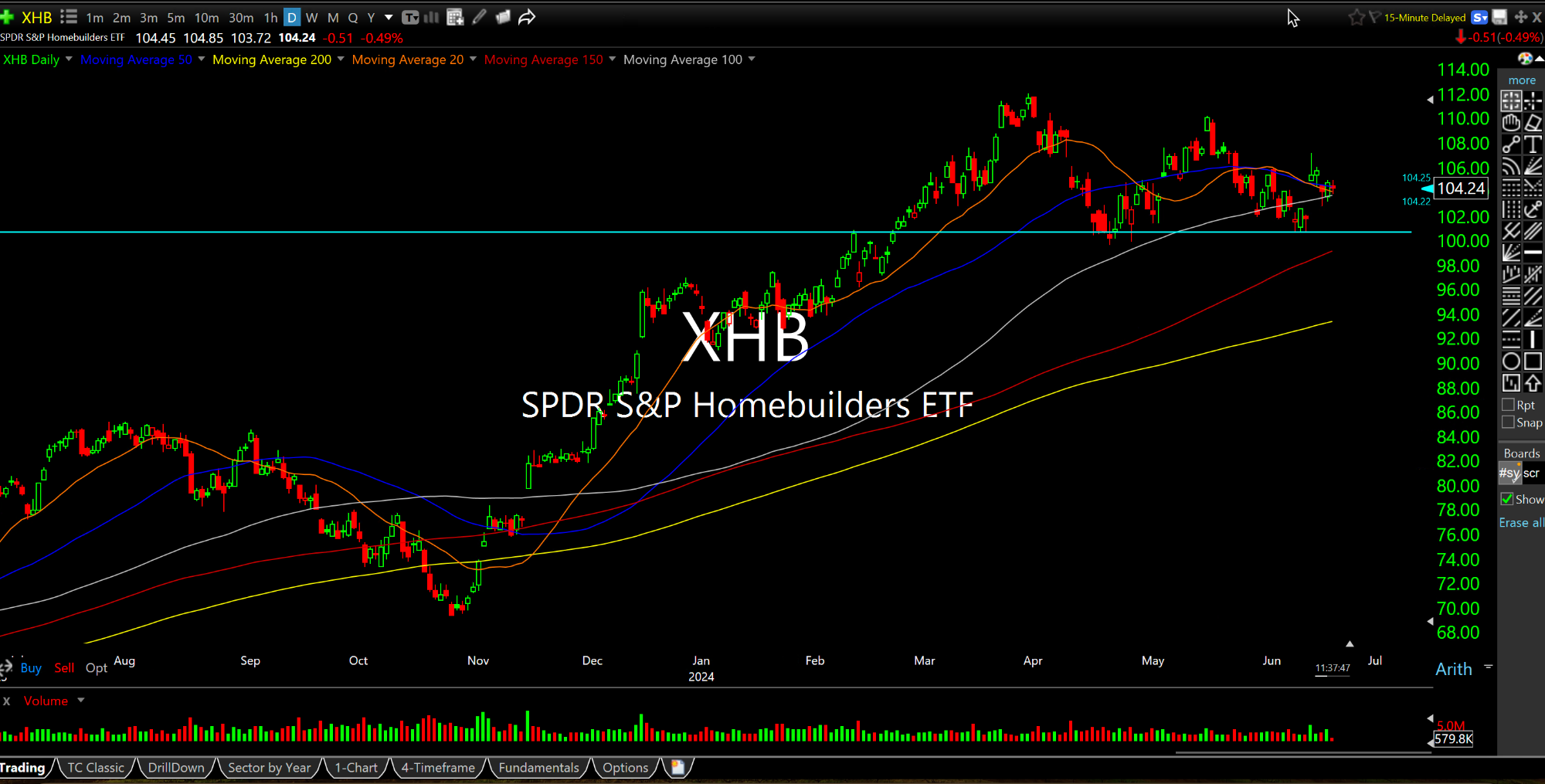

After an epic rally from last Halloween 2023 into April of this year, the XHB (second daily chart, below) sector ETF for the homebuilders finally cooled off. Many assumed it was a mere pauses which refreshes the bull run.

However, my view is that the sector, including Lennar, priced in all the good news that fits to print, so to speak, during the melt-up. And the fact that LEN is selling on beating the numbers, especially, at critical technical support at $150 (highlighted) leads me to believe that view holds water.

The XHB is still above its own $100 critical support. But I suspect that gets tested and breached in short order as the sector begins to reprice lower as supply becomes less of an issue in places like Florida (where, if anything, existing homes are hitting the market now in droves).

So while the semiconductors stage their daily melt-up, it instructive to pay attention to other sectors continuing to wobble.