26Jun11:24 amEST

Holy Meta Gap Man, Zuck

After getting absolutely throttled in 2022, Meta (formerly Facebook) has staged one of the more epic one way melt-ups in recent memory for a stock its size coming off a thrashing.

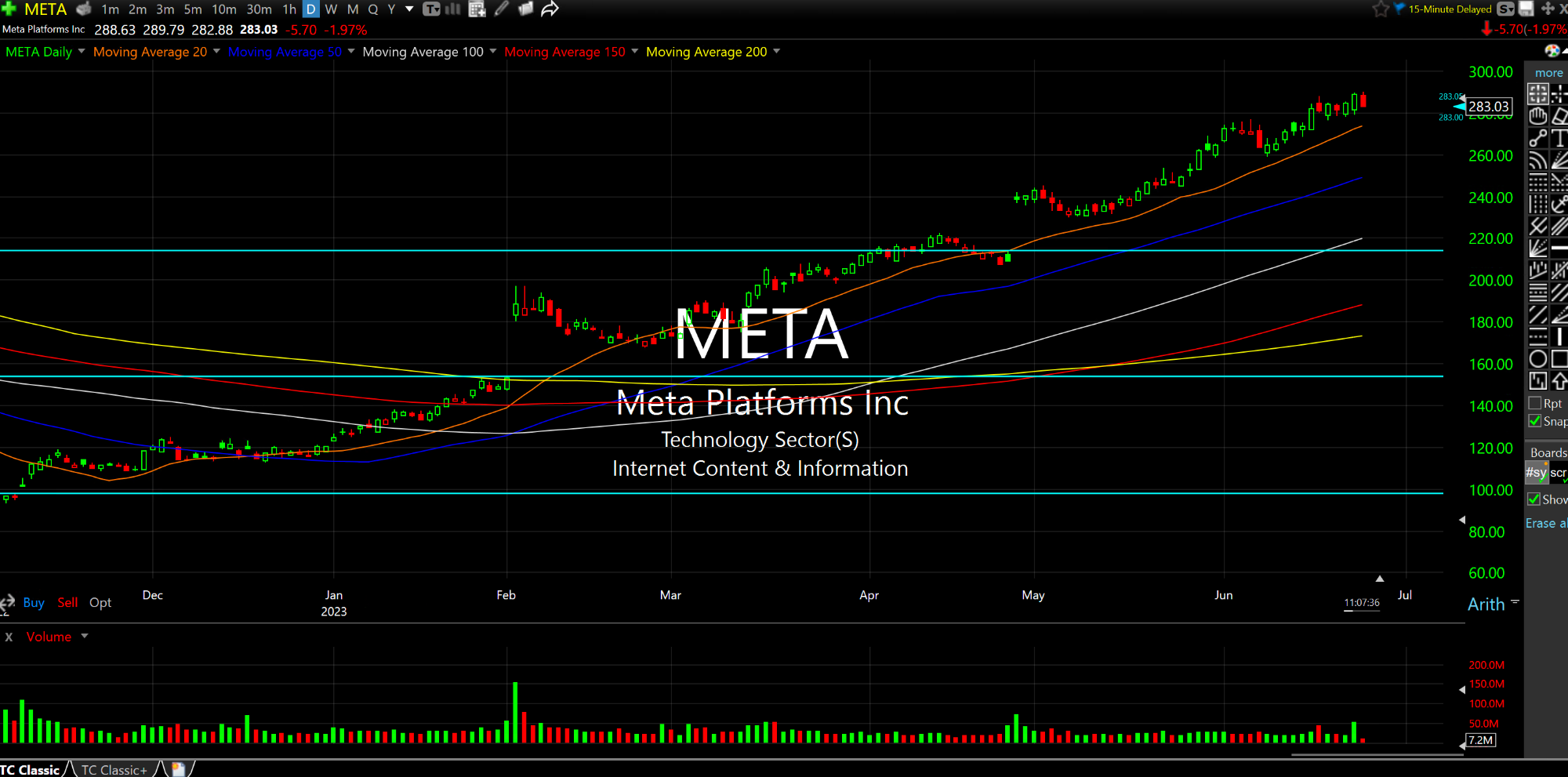

On the updated META daily chart below, two things seem noteworthy: 1) The steepness of the uptrend for prolonged period of time for, again, such a mega cap name, and 2) The sheer amount of open gaps below on the way up, a consequence of such a one-way move without the usual ebb-and-flow of markets.

Of course, in this central bank-dominated world of liquidity, the "usual" ebb and flow seems like an obsolete concept, whereby stocks take a few steps forward and naturally a few back even during strong bull runs. No, in a Fed-dominated world it is up, up, and away, followed by brief periods of bedlam before more Fed liquidity.

Still, I cannot help but think that sticky high inflation will prove to be the kryptonite to that seemingly new-era bullish scenario, notwithstanding how quickly The Fed moved back in March with Silicon Valley. While that maneuver did take away the near-term fat left tail risk of markets cratering, we are now headed into a moment where liquidity should recede.

And now we are doing with some steep, expensive leaders like META.

What if, perchance, META should start filling gaps below? Look at how many of them there are (light blue lines) and how far below spot price they are on percentage terms. Do you really, truly, think it will be orderly?

Much like TSLA, the META rally takes the stock back not to all-time highs but to highs from 2021, a difficult area which should provide overhead supply, or resistance, into the summer months.