28Jun1:04 pmEST

It All Comes Down to Apple, Buffett

How is this for drama?

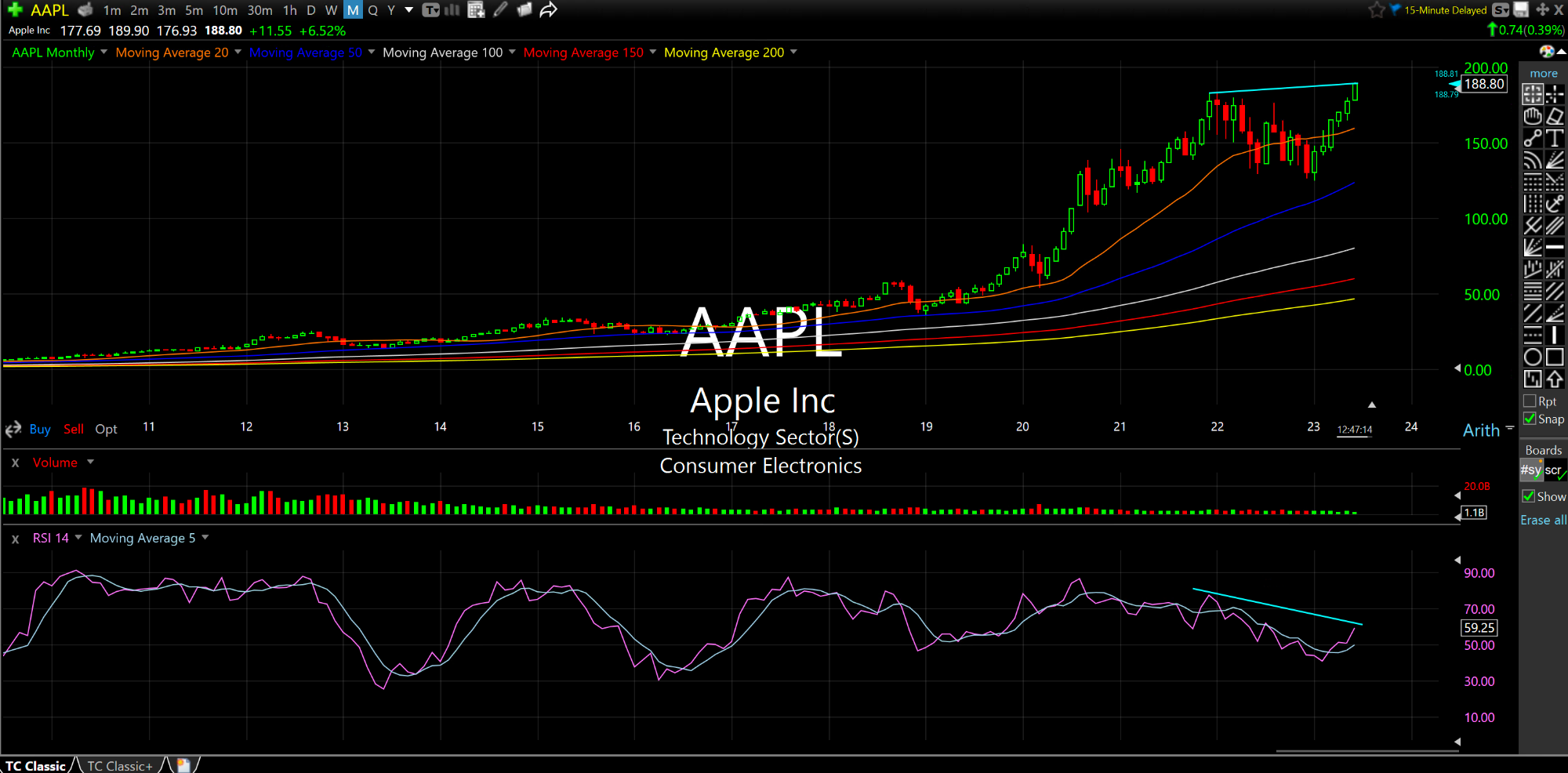

With CNBC on an "Apple $3 trillion market cap alert," the stock is trading at roughy thirty times forward earnings (and a PEG of 4) and has been a one-way melt-up machine in 2023. The AAPL monthly chart, below, shows one of the most glaring bearish RSI divergences to price (bottom pane) you will ever see for a stock this size.

In other words, if you have a hankering to see intense drama, action, and suspense you need not flock to the movie theater for a summer blockbuster (not that they even really make those anymore).

No, all you need to do is tune in to the AAPL chart and gauge whether the party continues throughout the summer, as many now expect July seasonality to take hold--Even once steadfast bears.

But not I. I think this is just about all she wrote for the rally, especially with the intraday fade we are seeing now and the near consensus of an inevitable further melt-up from here.

We can talk NVDA TSLA AMZN, even homebuilders.

But in the end there's no replacing Apple. This is ground zero for the market's next big move whichever way you lean.

Sunday Matinée at Market Ch... Consumer Stocks Winning at t...