14Sep10:49 amEST

Europe Needs a New Marshall Plan

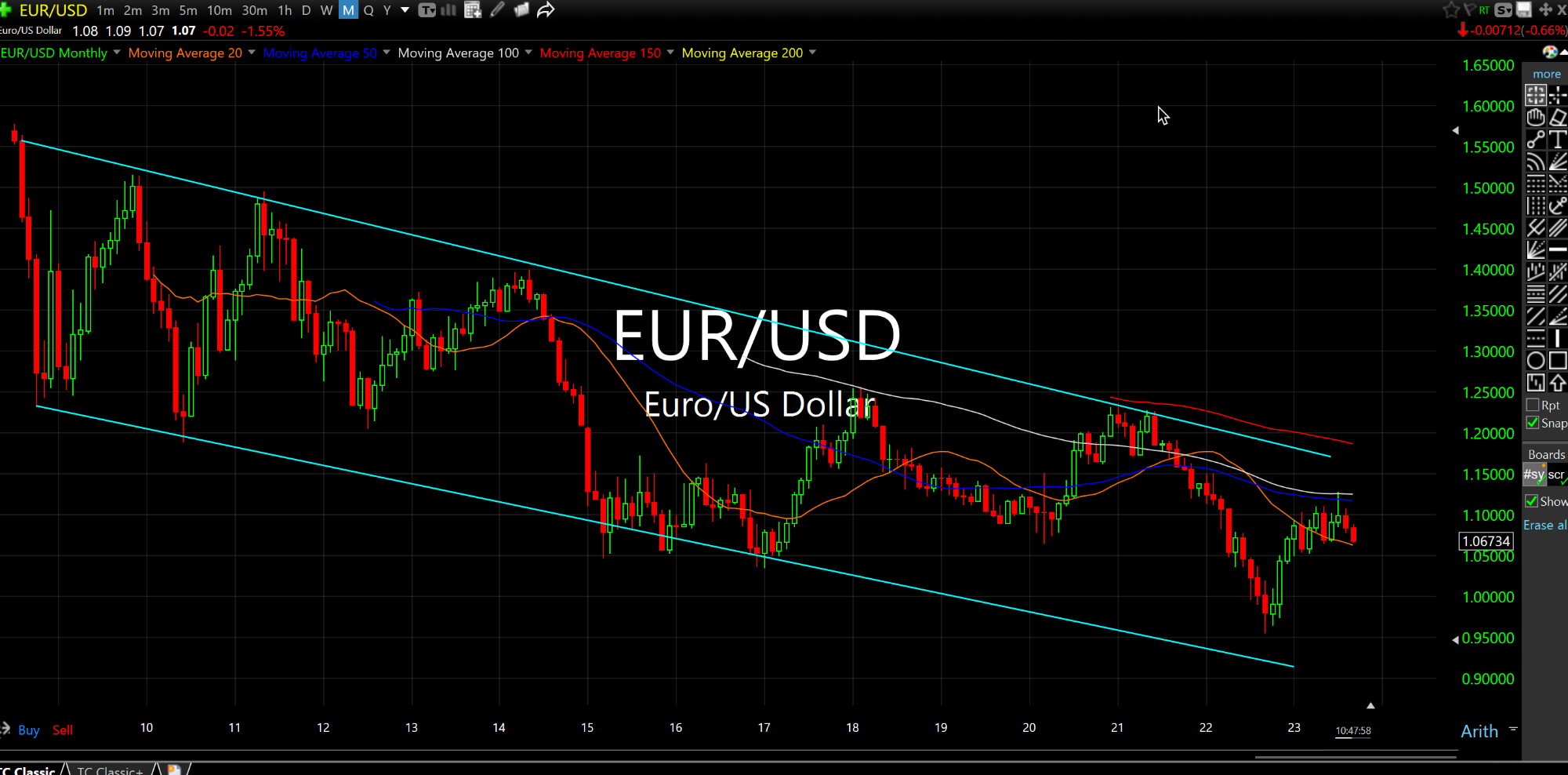

With the ECB raising rates again this morning and also lowering growth forecasts, the Euro is selling off against the Dollar.

On the Euro/Dollar monthly chart, below, I see no evidence of a long-term bottom in the face of a strong multi-year downtrend.

In fact, risk looks much lower here into 2024, as the European Union in general could finally come apart at the seams, something which feels like has been brewing for a good while now. Might that be the big "black swan" which could finally derail global markets?

One thing is for sure: All of this is taking its sweet old time to play out, leaving us with one of the more unimpressive markets I have seen in twenty-plus years of being in this game. The action is narrow, random, and largely uninspired other than to try to celebrate bad news while then fizzling out on the upside.

As crude oil pushes higher again, various economic nihilists are out and about proclaiming that The Fed should pause or even cut rates next week at the FOMC because hiking further will do nothing to impede the gains in energy.

Of course that is a delusional view: Hiking rates eventually destroys end user demand, which is the main weapon against inflation in the first place--No one said there was an easy, fun solution. But the solution is simple: Keep raising rates, ramp up quantitative tightening, and reign in federal spending. The Fed controls two of those three factors and as of now they are coming up short on both counts.