09Oct10:35 amEST

Isn't That Just Like a Commodity Market?

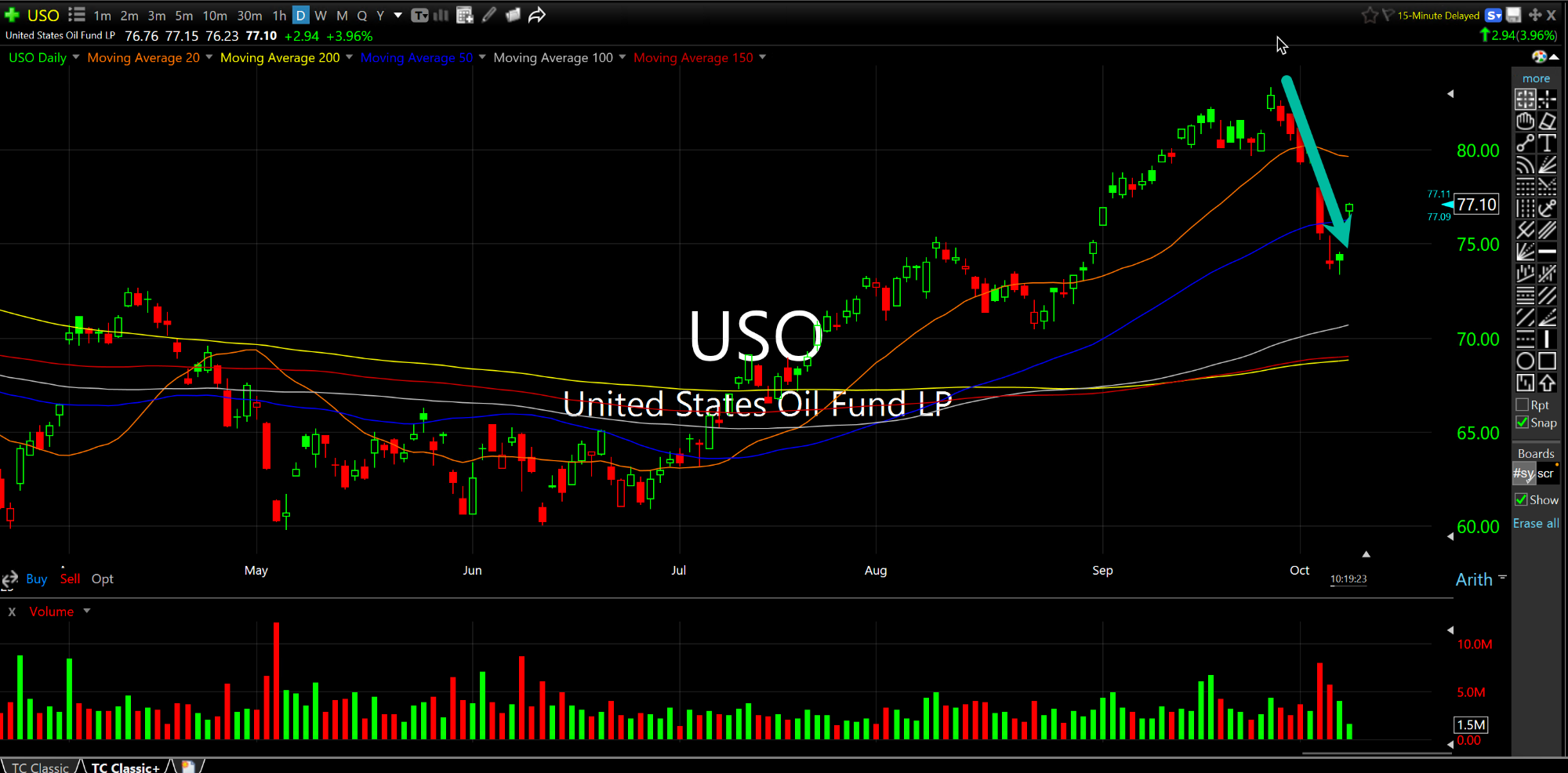

Over the weekend Israel declared war following a surprise attack from Hamas. It is a rather convenient fact, indeed, that crude oil had been sharply pulling back for about the last week and a half following a prior, steep rally, rending this gap up perhaps just the start of a new move higher rather than a typical sell-the-news setup. Commodity markets are notorious for convenient timing of news events happening with the commodities at actionable technical junctures.

In fact, from a sentiment perspective I see quite a bit of a folks assuming that this oil rally is a classic overreaction to news and is bound to fade.

But what if it does not?

We know the SPR remains historically low amid sticky, high inflationary pressures. Once again, equity bulls and monetary doves want to have their cake and eat it, too--Arguing that rates are high due to a strong economy but not acknowledging that could go much higher alongside oil, to boot.

Eventually, however, sticky high oil prices and sticky high rates will have too many deleterious effects on the consumer and corporate profit margins for the economy to remain unperturbed to an acceptable degree.

As for USO technically, we want to see the $76 area (50-day moving average) now hold as support into any dips for this move to have legs. Also keep an eye on the UGA (gasoline futures ETG) to see how the war in the Middle East affects gas prices for Americans in the coming weeks.