10Oct12:15 pmEST

At the End of the Day

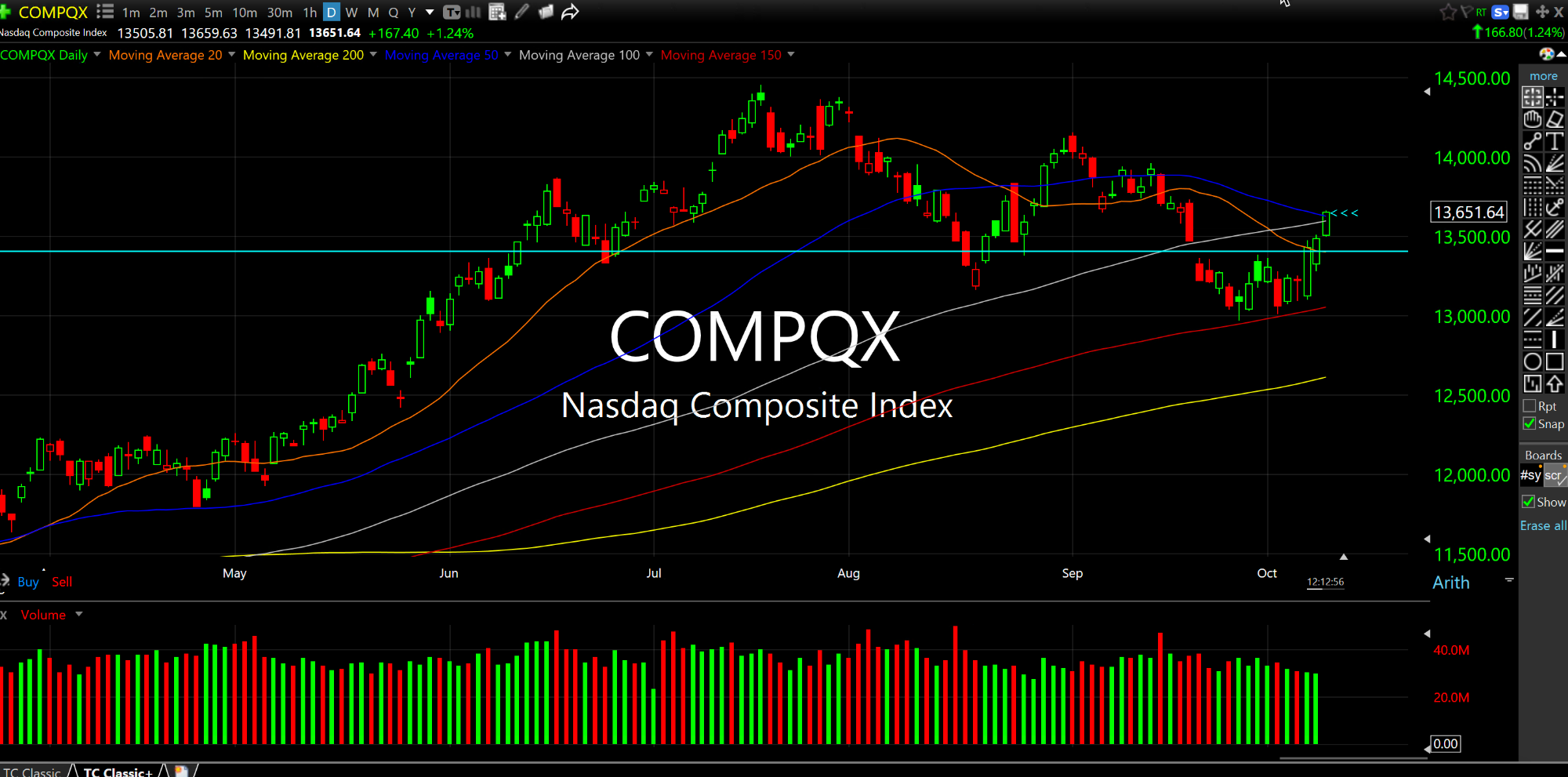

The S&P 500 and Nasdaq, respectively below on their daily charts, have easily been the two strongest indices of late, as virtually all other indices are below their own 200-day moving averages.

But not the S&P and Nasdaq.

Hence, instead of cherry-picking the weaklings, let us focus on these two.

Simply put, at the end of the day (or perhaps this week, with plenty of macro and micro data to come) we should get a better gauge on whether the "necklines" of prior broken support will not function as resistance.

Although we have the squeeze on again today, this market is not trending either way in the near-term. Since the summer months we have seen nonstop backing, filling, checking back, and fading on the S&P and Nasdaq.

And, again, these two are the strongest of the indices.

As you might imagine, my bias is to look for a fade by week's end into the heart of earnings the rest of the month.

Isn't That Just Like a Commo... Shaken and Stirred, Yet Unpe...