16Oct11:50 amEST

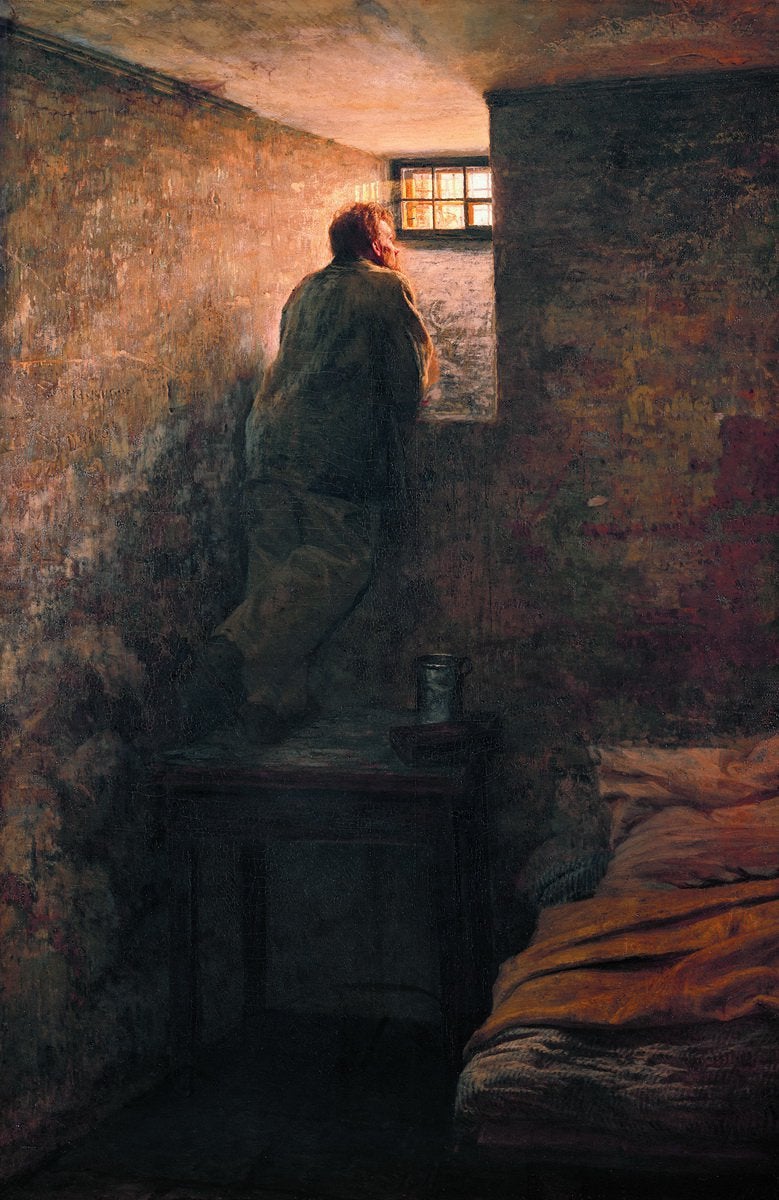

Trapped in a Prison Market

Imagine, if you would, that you had taken a nap in July 2018.

You did not wake up until this morning to read this blog post. During that nap, the IWM (ETF for small cap stocks in the Russell 2000 Index) has made no net, or overall, progress and is trading at the same levels it was some five years and three months ago.

On a shorter-term timeframe, we can see the S&P 500 (daily chart, below) bumping its proverbial head (arrow) up against prior support which may or may not still be converting into newfound resistance.

Either way, this has been one of the more extended periods of consolidation for many parts of the market.

That said, a basic tenet of technical analysis is that from periods of price compression often come explosions--It is reflection of life in general, in many aspects. You toil for years and years, endure the grind, some setbacks, etc.. And then the breakthrough occurs. Or, unfortunately, the breakdown occurs, too.

In front of a uniquely busy week of Fed speakers chirping away, including Powell at the Economic Club of New York Luncheon in New York on Thursday, plus NFLX TSLA earnings, stocks are higher due to a lack of WWIII full-blown escalation. Even with rates higher, as the 10-year shoots back over 4.7%, equities remain inclined to hold support even if they have not come close to breaching upside resistance.

The net result is a kind of an imprisoned market, held captive by its own delusions of bullishness while resistant to the increasingly bearish reality. Wall Street has an extensive history of ruthlessly repricing risk assets lower once the epiphany occurs, but this cycle clearly continues to play out a pedestrian pace.

A few notable laggards so far today: Apple, high yield corporate credit (HYG JNK), and especially investment grade LQD.

Special Edition: Full-Length... Not Such Golden Slacks This ...