13Nov10:44 amEST

Emerge or Diverge

Besides the Dollar, to my eye to most compelling divergence to equities we are seeing remains rates remaining stubbornly high. This flies directly in the face of bond bulls declaring an end of the bond bear market, as rates ought to be cratering if The Fed truly were done hiking rates in a disinflationary environment.

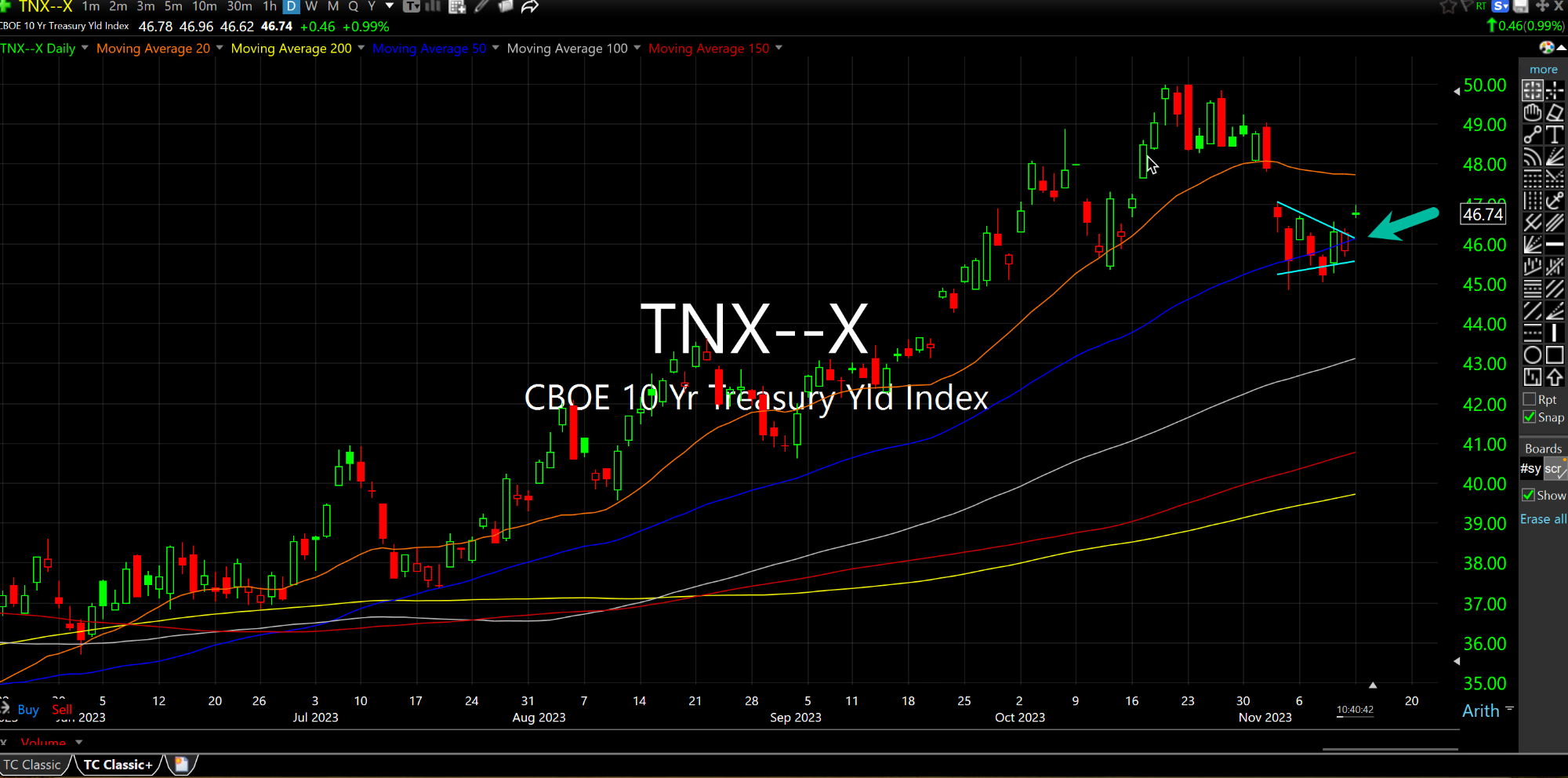

But as you can see on the updated TNX daily chart, which is an Index for Rates on the 10-Year Note (simply put in a decimal point between the first two digits to be a proxy for rates), the recent pullback in rates is now threatening a resumption of the prior strong uptrend.

In a year where the strength in mega cap tech, semis, and some software names certainly has surprised and stumped me, the bond short was certainly one of my more accurate views in 2023. Small caps and ARKK being sold into strength this year has also jived with my views and positioning.

However, in order to truly crush the mega caps and semis I strongly suspect another pop in rates on the 10-year back over 5.0% (or 50 on this chart) would catch bond and stock bulls off guard.

One thing is for sure, with the XBI down another 2.3% today as I write this, we continue to have a narrow, bifurcated market in equities defined by narrow pockets of mega cap tech strength.