14Nov10:19 amEST

It's All Good, Man

With virtually every bit of news and development being construed by markets as good news, it is highly likely I will be taking off at least some bearish bets today if we do not see a fade into the closing bell.

Even with this morning's shellacking in rates, they are still considerably higher than where they started the year, which was my main focus headed into 2023--It's just that I thought equities would buckle under the pressure of sticky higher rates. That has yet to happen, however, as each pullback has been met with a furious scramble back into stocks and an eventual squeeze.

So, while I have been correct on rates (and trimmed an overweight position in TBT over the last month), the move in equities, especially the Nasdaq, continue to stoop me.

Once again, bulls are feeling their oats; Cocky, emboldened, assuming clear skies from here. I still suspect the cool CPI print this morning is a bit of a head-fake to the downside in inflation.

In other words, this is not the last that we have heard from this inflation.

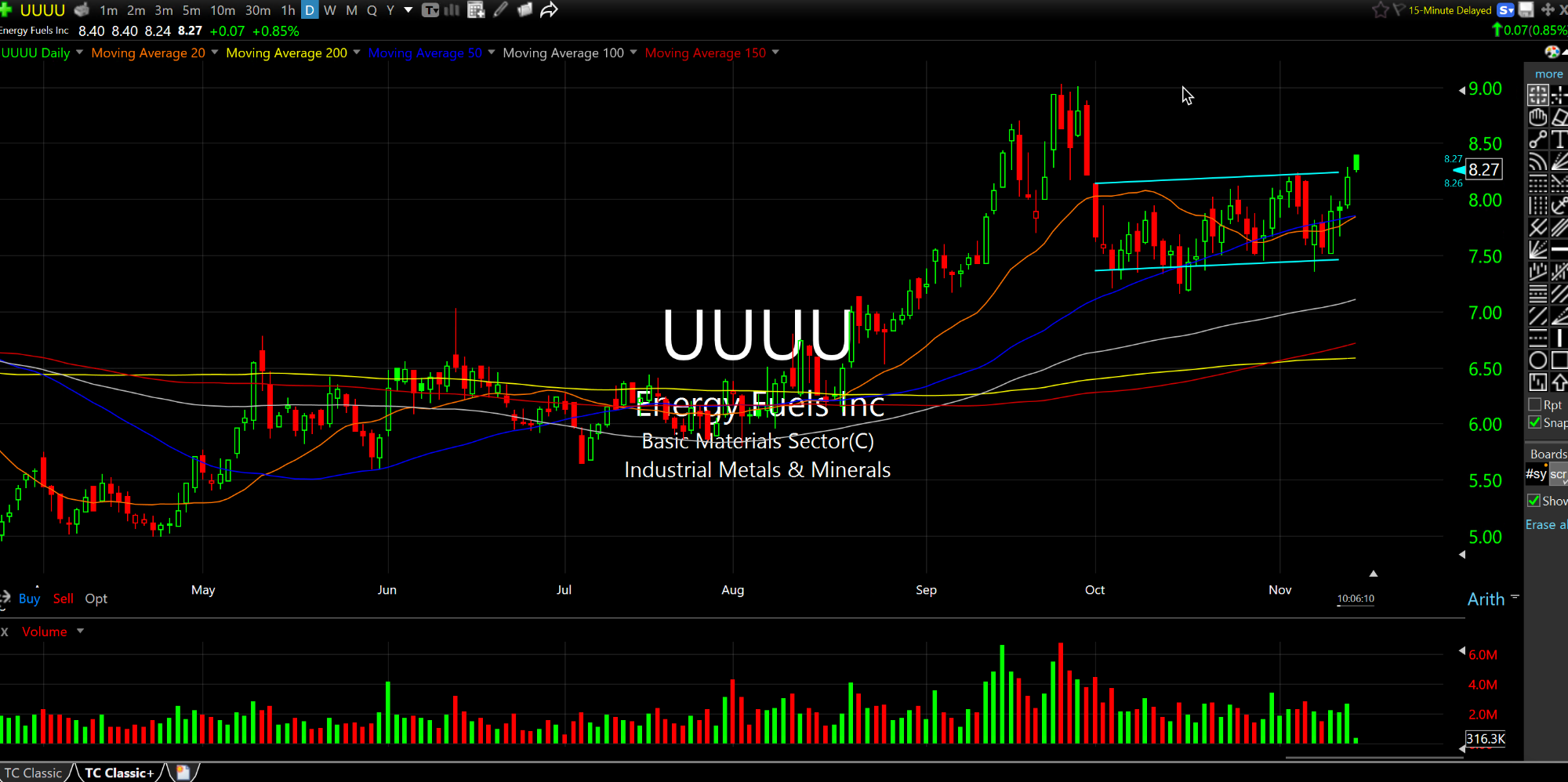

One sector which has my eye on the long side continues to be uranium, with URA being the sector ETF.

UUUU is one prime example of a stock in an uptrend (above daily chart rising moving averages), basing well and trying to move up and out of the base. Clearly, major wars around the world is one bullish factor for the group.