16Nov1:00 pmEST

Walmart Doesn't See Such a Soft Landing

Of all the firms to ignore regarding the pulse of working class consumer, WMT seems like it should be last on that last.

And, yet, despite the firm cautioning in front of the holidays, the broad market is not exactly crashing despite flashing red as I write this.

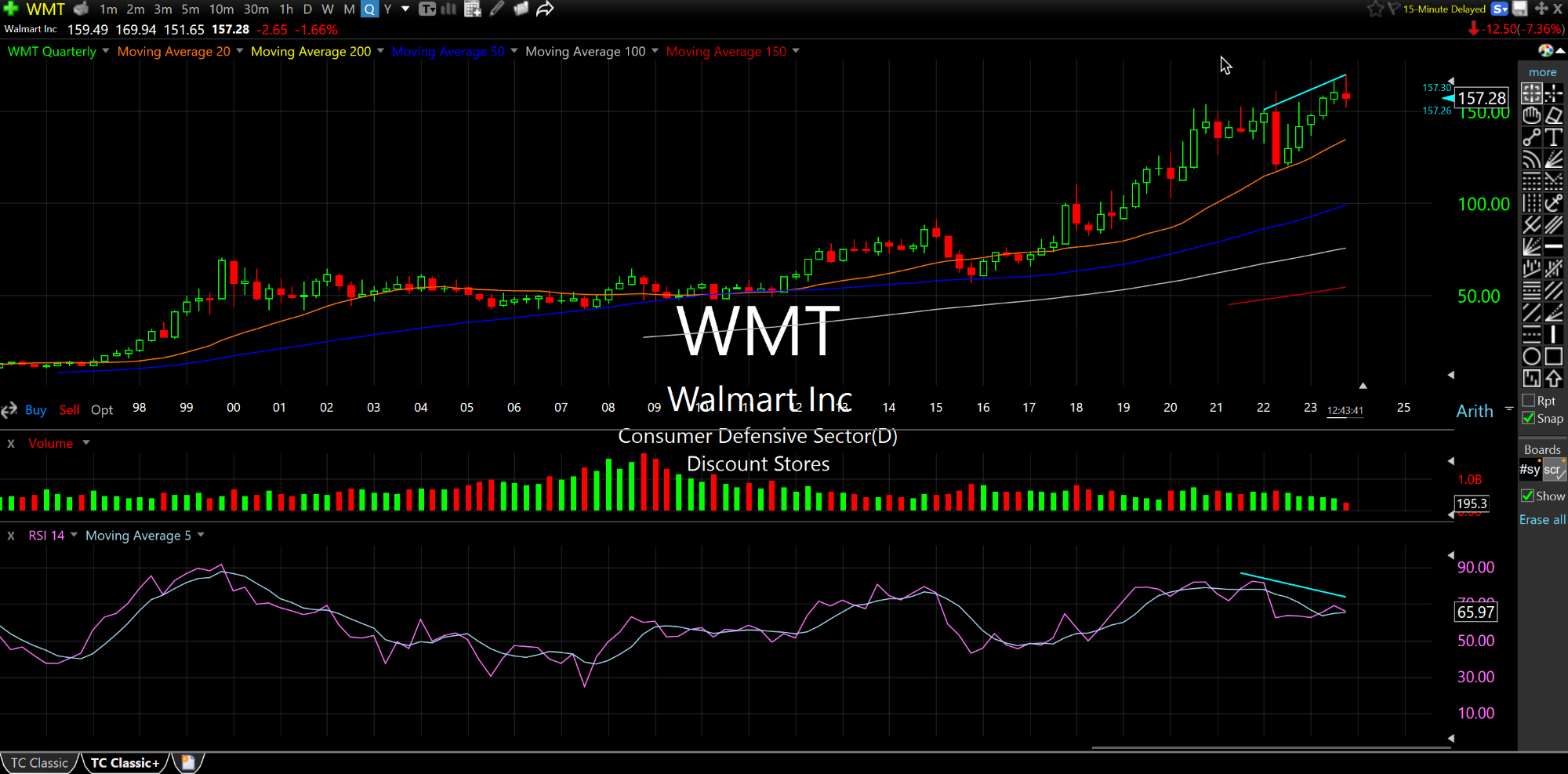

On the quarterly chart for WMT, below, the long-running bearish RSI divergence (bottom pane) to price is kicking in on the back of the earnings selloff. Overall, I skewed risks to the downside versus upside reward for Walmart over the coming quarters.

That said, the takeaway for me from the report and call was that the ubiquitous "soft landing" victory declarations on behalf of Powell and The Fed continues to strike me as premature, setting up a delayed-but-not-cancelled downturn in stocks.

Elsewhere, uranium and coal plays seems like the two best commodity performers and overall charts in what has clearly been a mixed space.

Weekend Overview and Analysi... A New Regime Means ARKK is a...