08Dec11:15 amEST

The Great Mispricing

I have not added back to my bond short (via long TBT, a bearish ETF derived from TLT as a way to bet on higher rates), just yet. However, I am chomping at the bit to do so, as TBT was easily my largest position by size for most of 2023 up until a little over a month ago when I sold most of it.

That said, the chasm between the market pricing in multiple rate cuts in 2024 and the realities of entrenched long-term inflation boggle the mind at this point.

After this morning's strong jobs report, the FOMC next Wednesday will be the last Fed meeting until January 31st, 2024, which means even if Powell does not give us a surprise rate hike he had better speak in a manner which does not lead to the market mocking him like it did last Friday.

Specifically, Powell gave some allegedly hawkish comments last Friday at a fireside chart, and all the market did was price in more rate cuts amid a sharp rally in risk assets. That sort of open disrespect ought to be irking him day and might, compelling him to get tough, or at least tougher than he has been.

Yes, 2024 is an election year. But so was 2008. And 2000.

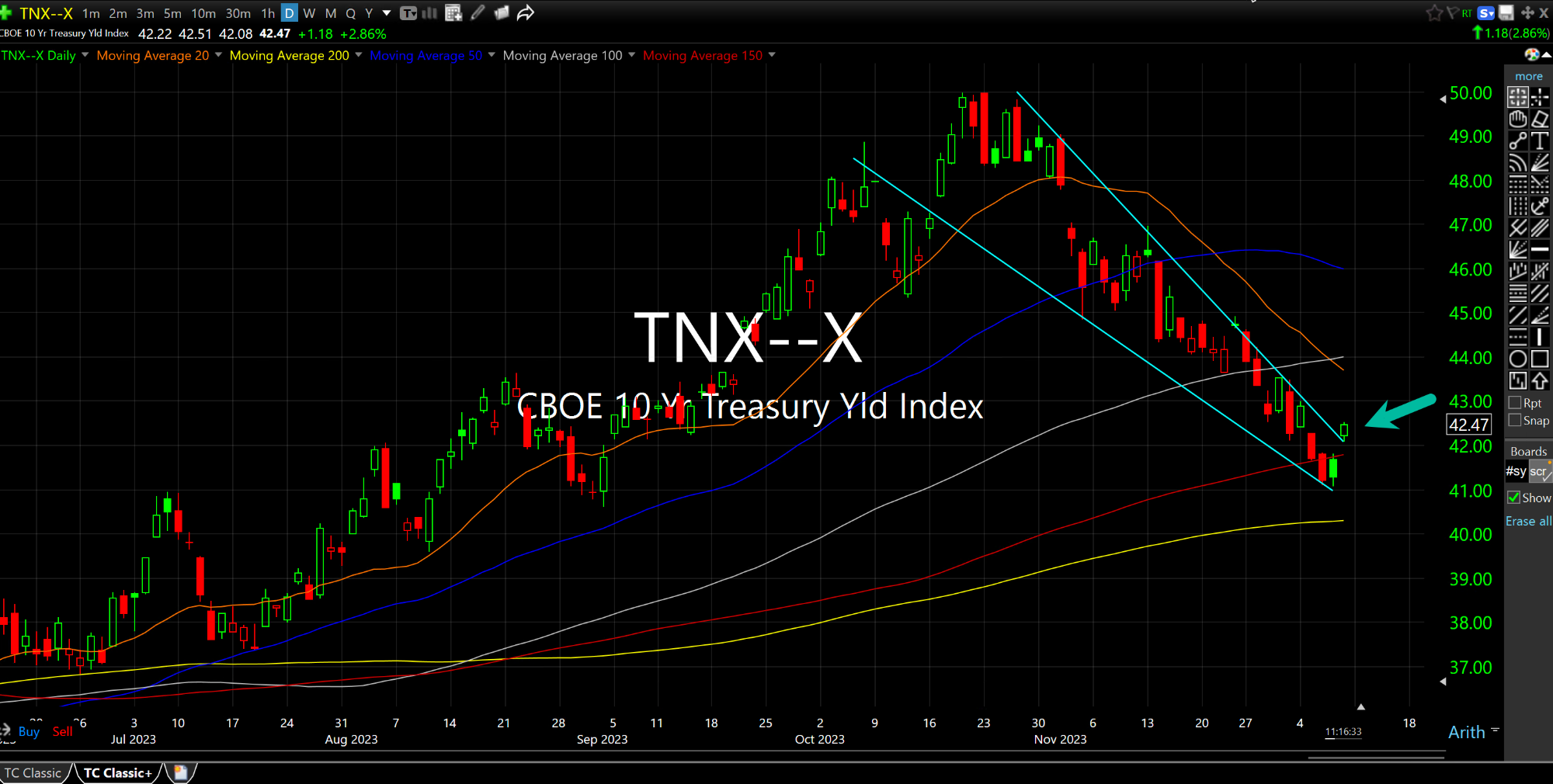

Whether or not equities get the message anytime soon remains to be seen. But my focus for now is on identifying the turn back higher in rates which should stupefy the majority who assumed rates have topped for good.

And with today's reaction to the jobs report, seen below for the Index for Rates on the 10-Year Note, it is a good start.

Things Are Happening in Braz... Weekend Overview and Analysi...