27Dec3:22 pmEST

I Feel Sorry for Your Latte

Starbucks continues to act poorly into the final days of 2023, a surefire sign that fund managers have little interest in having the name on their books. For a good while now, we have noted the SBUX relative weakness both here and with Members.

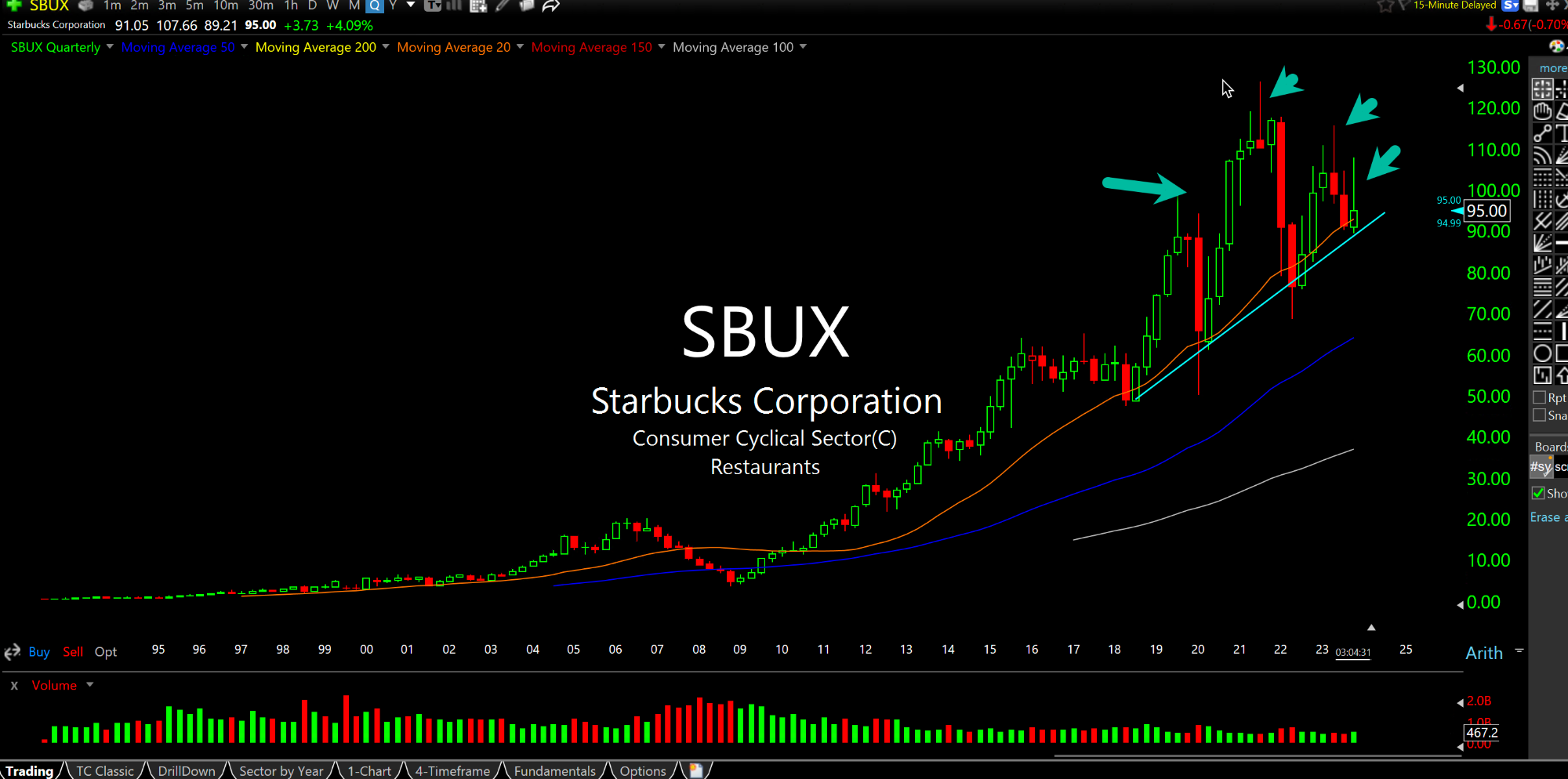

Despite that, on the long-term SBUX quarterly chart, updated below, the major uptrend for years is (barely) hanging on by a thread into 2024.

However, I also want to draw your attention to the arrows highlighting several quarterly candle "shadows" or substantial fades from those respective quarterly highs.

In other words, over the last few years there has been clear selling strength for SBUX. I attribute the various attempts to break and sustain higher moves as a function of all the excess liquidity in the system, post-pandemic.

But as you can see the market still did not hold those moves, as fundamentals are slowly but surely winning out.

Into next year, I expect that phenomenon to be all the more pronounced, as the excess liquidity continues to slowly get mopped up. Other names are quarters behind SBUX in this regard, but given the unique American consumption icon that Starbucks became, especially after 2009, I expect it to be leading the rest of the gang lower.

And, as the quarterly candle fades suggest, it is a poster child for excess liquidity eventually being swallowed by the system, a long overdue but inevitable fate.