12Feb12:40 pmEST

Smooth Seas Forever

“A smooth sea never made a skilled sailor." -Franklin D. Roosevelt

In front of tomorrow morning's Consumer Price Index print we have stocks higher.

In particular, the rotation attempt down to small caps is taking hold. Even the oil stocks are finally waking up a bit, mostly the oil services names in the OIH ETF (look at RIG) and the exploration plays in the XOP ETF.

On the surface, it also seems like as business as usual for bulls, as some AI plays/semiconductors are being absolutely ramped higher again, namely ARM SMCI, among others.

So is this the new perpetual normal?

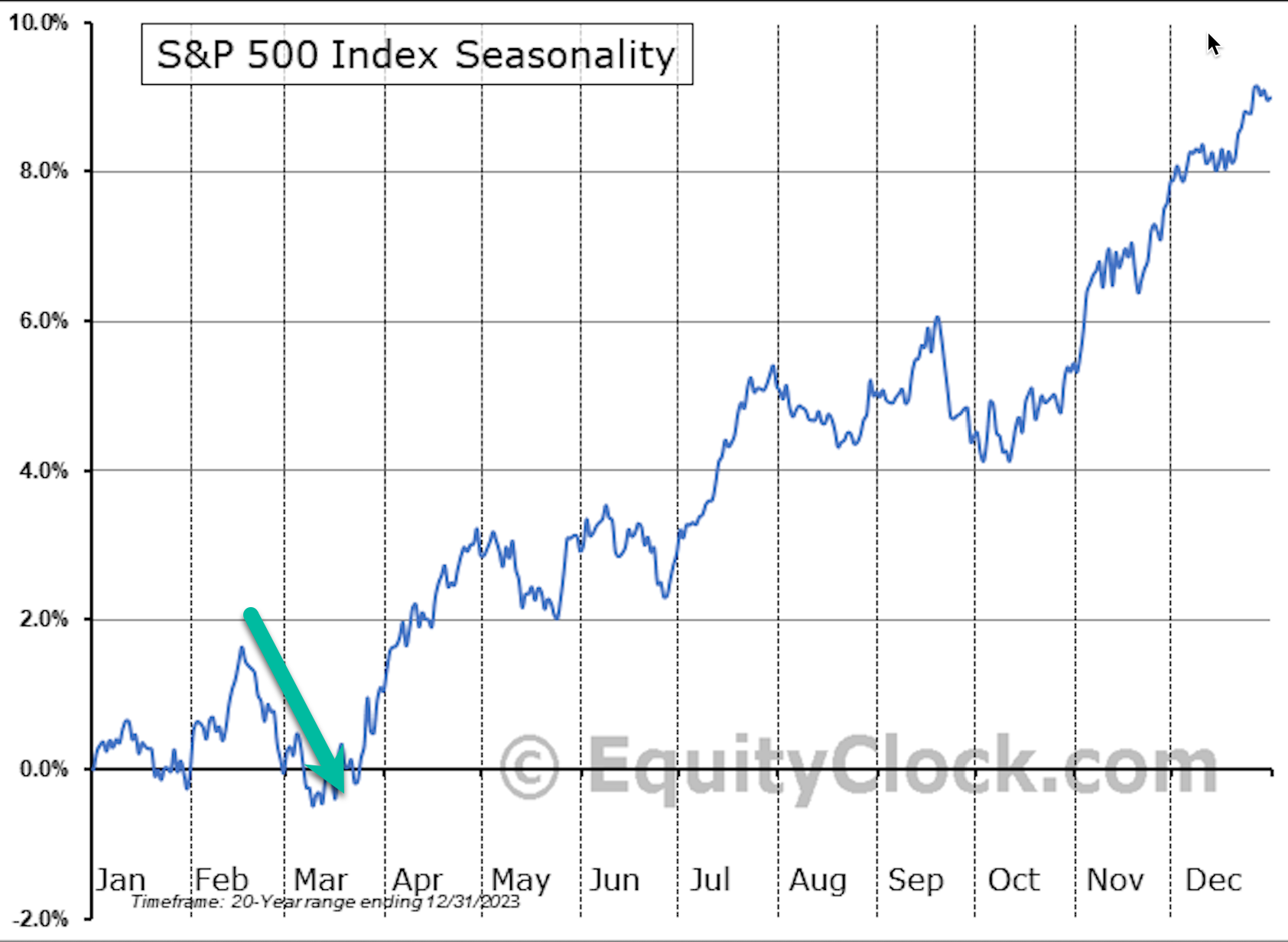

Even though any inkling of bearish seasonality for mid/late-January was a complete dud and totally wrong this year, I am still going to point out that this week, especially around Wednesday, marks the beginning of one of the most bearish periods of the year over the last twenty years for the S&P 500 Index.

On the first seasonality chart, below, the arrow I have drawn shows mid-February until March options expiration has the potential to surprise lower. We also have the VIX gapping up today, even with stocks higher, which could easily be a Monday effect coupled with event risk for the CPI tomorrow.

Still, I am not going to say that this time is different and that the market has reached a permanently high plateau of prices. If you are looking for tangible data to support a view that the mania and bubble action in chips may be near reversing, the upcoming seasonality, the VIX being bid, and a general lack of respect for risk in front of events like the CPI (again, see ARM SMCI as well as META still going after earnings), are enough to at least look for the rug-pull in growth stocks.

On the long side, oil tankers and coals seem like the best charts on the board that I see, as the oil stocks are oversold but broken technically.

Weekend Overview and Analysi... We're Just Sweeping Dirty Di...