14Feb12:20 pmEST

Too Many Kisses on Valentine's Day

Even though Apple has been relatively quiet of late, especially compared to the AI/chips as well as other "Magnificent 7" stocks, there is no getting around the fact that the firm still has a market cap of $2.82 trillion, as we speak.

Hence, the sheer size and weightings in the various indices and ETFs render AAPL incredibly relevant at all times.

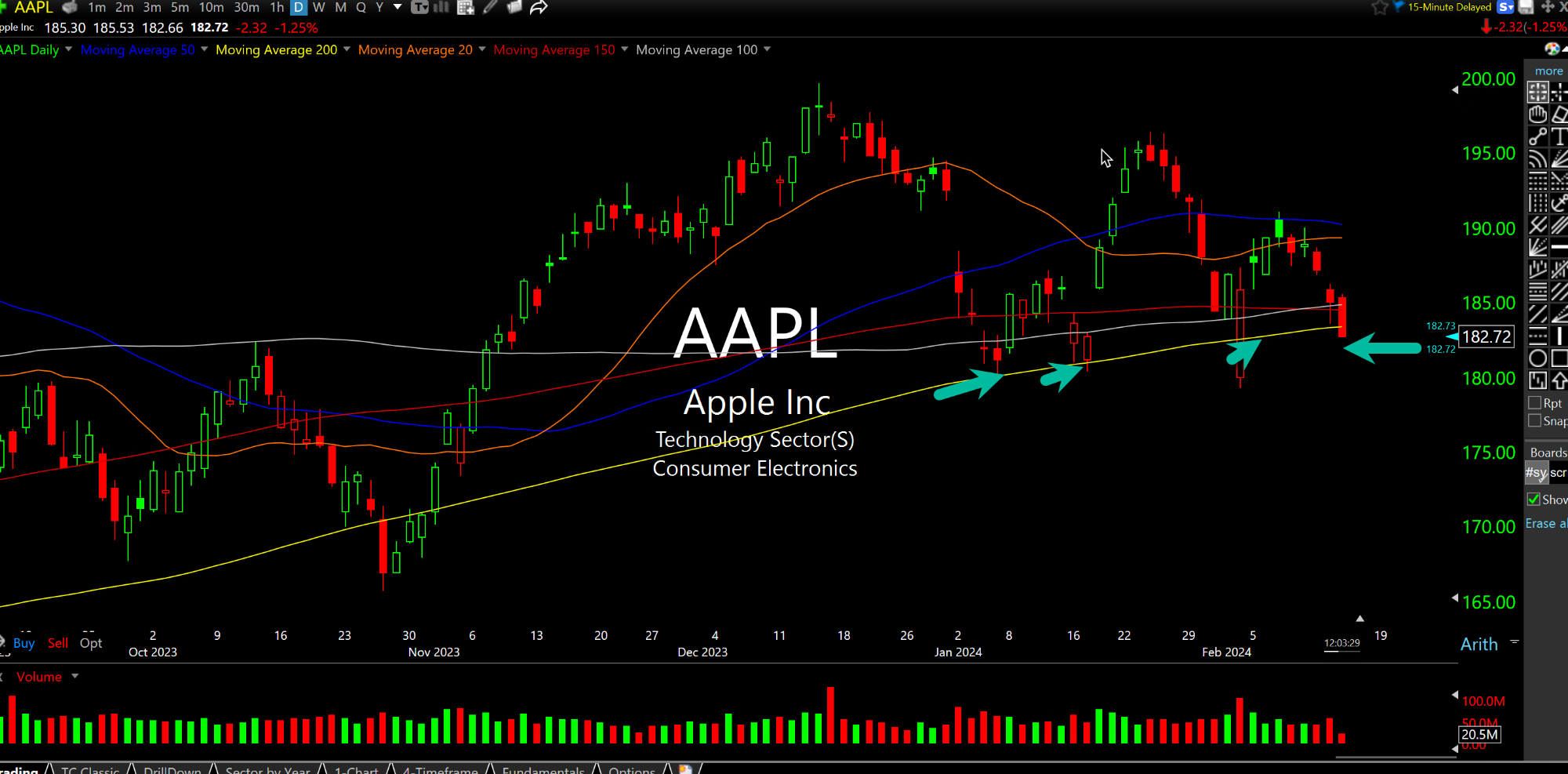

On the AAPL daily chart, updated below, we can see the stock once again testing (or kissing) its 200-day moving average (yellow line) and noticeably lagging the broad market in today's session. As they say, the more an obvious support area is tested, the more likely it is to eventually give way with no sustained rally off it due to the law of diminishing returns for buyers who take the plunge at the 200-day.

With earnings out of the way, going forward you can be sure I will be watching AAPL versus its 200-day closely--Losing it here ought to have negative ramifications for all senior indices as well as various pin action in tech. A few kisses are good, but AAPL is simply overdoing it here with this amount of 200-day tests and a (surprising) general lack of underlying appetite among buyers.

We're Just Sweeping Dirty Di... Keeping it Actionable When t...