29Feb11:44 amEST

It's Called Stealth for a Reason

The Nasdaq just faded to red as I am writing this. However, bears clearly need much more gusto than that to the downside in order to cement any kind of top.

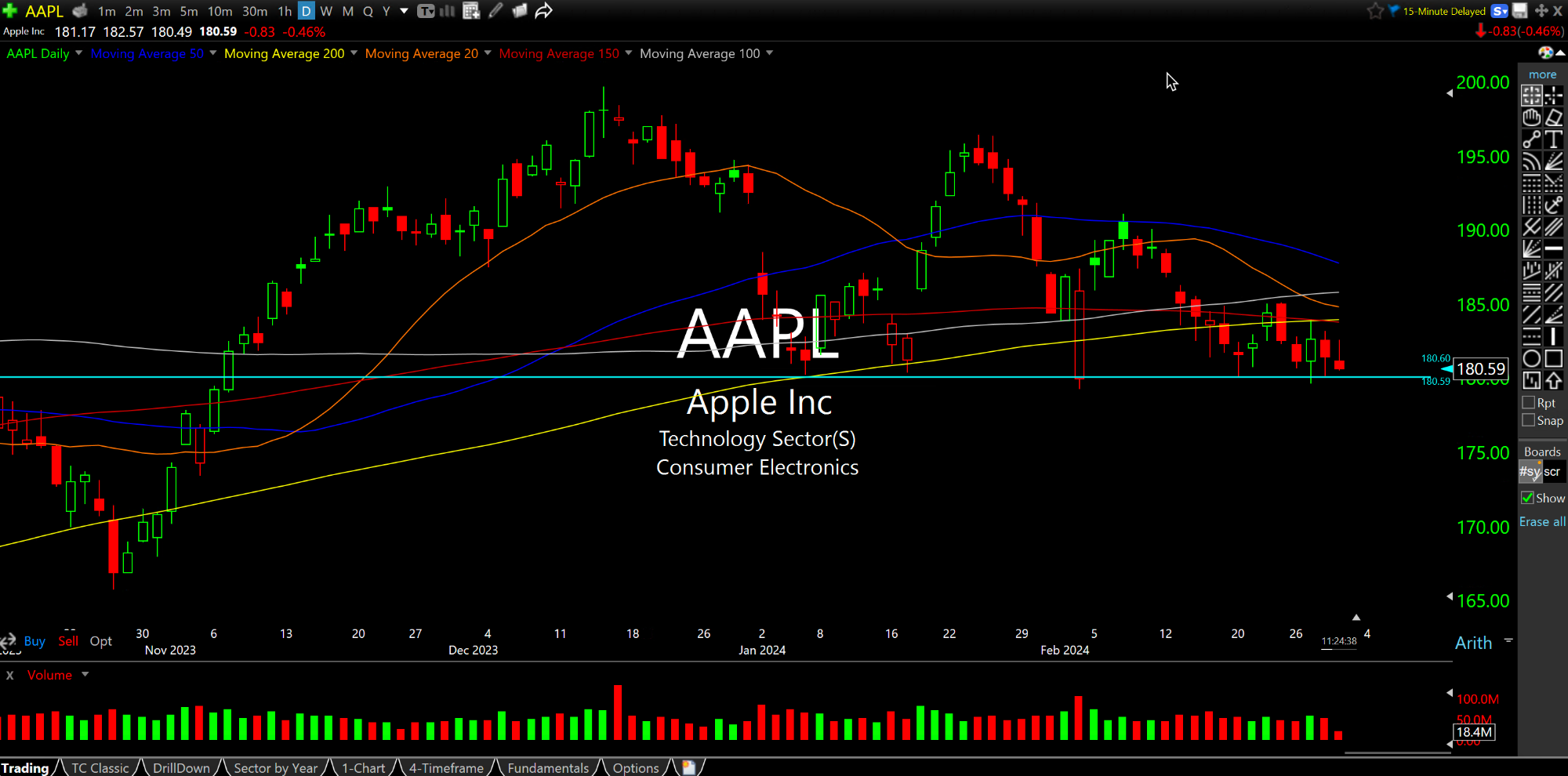

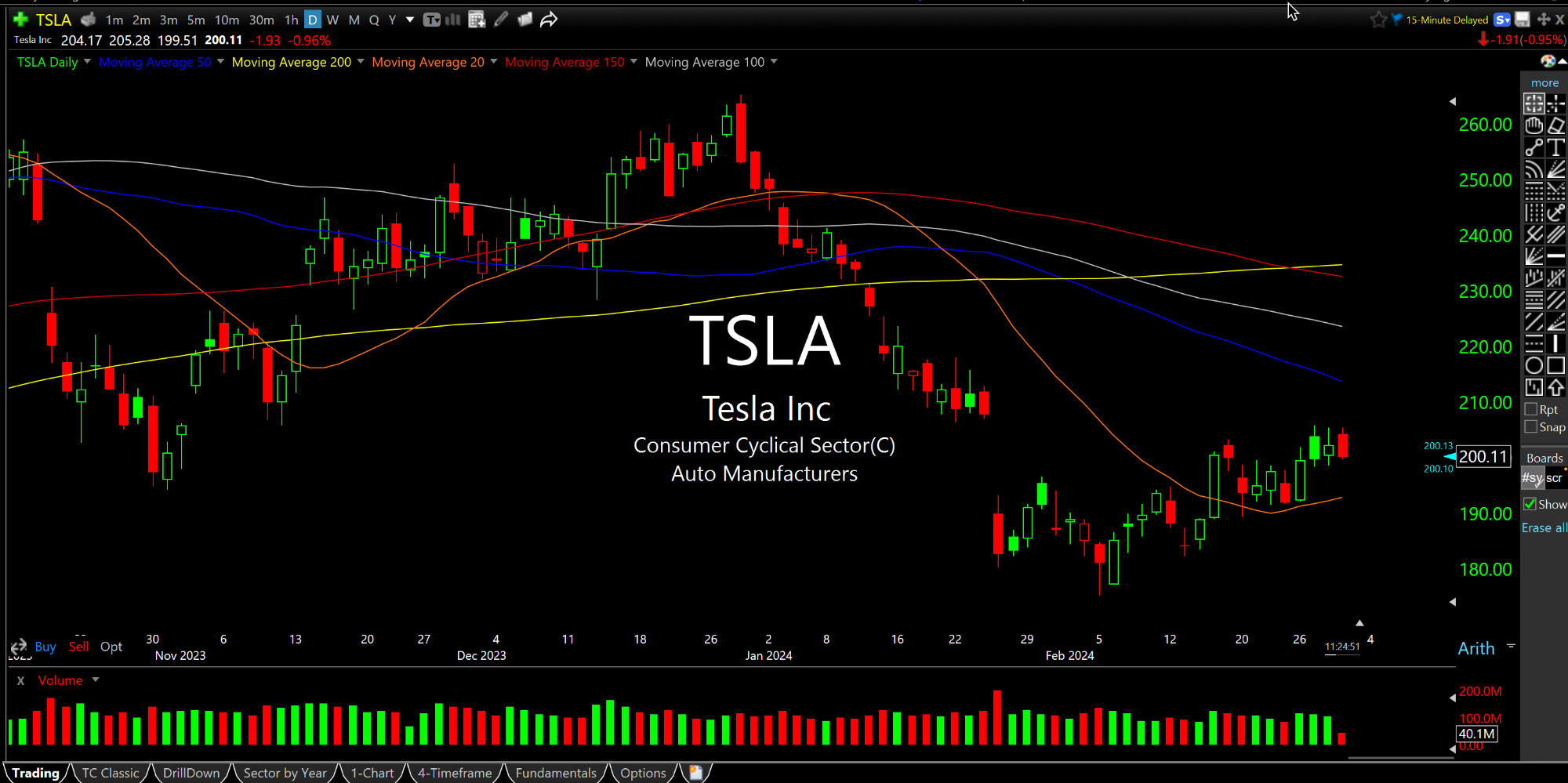

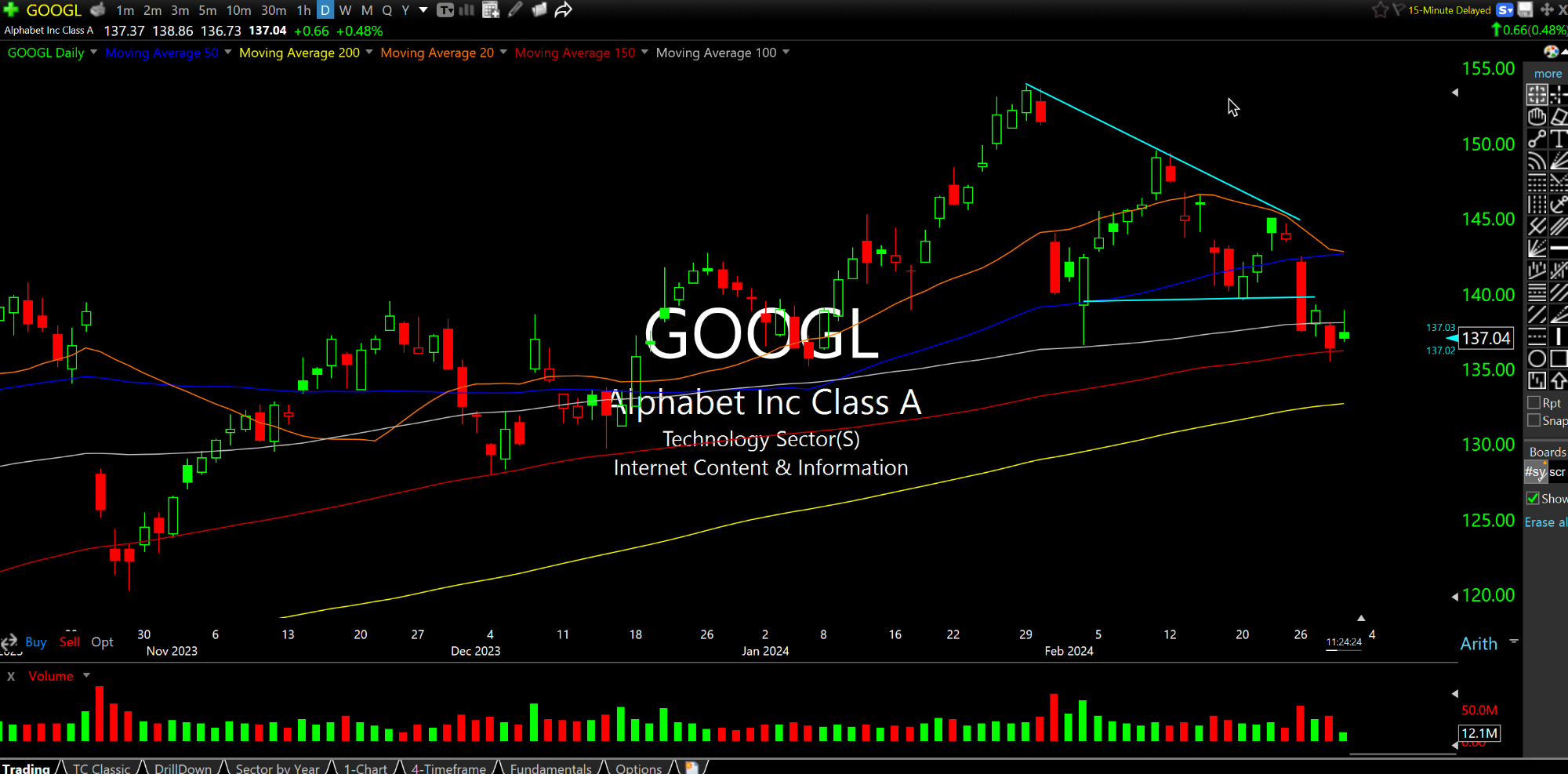

That said, I expect the stealth distribution in "Magnificent 7" names AAPL TSLA and now GOOGL to prove to be a leading indicator of where this market is headed in March, and perhaps beyond.

On the AAPL TSLA GOOGL daily charts, respectively below, these three clearly at odds with AMZN MSFT META NVDA strength, as well as chips like AMD.

Hence the issue is whether the big money selling out of AAPL TSLA GOOGL are the early movers before the rest of the gang follows suit. But seeing AAPL and TSLA, two of the most owned and loved names of the last decade, struggling to bounce below their own 200-day moving averages ought to be a red blinking light for risk.

Instead, in a sign of the times of how complacent this market is, that circumstance is merely being brushed aside, at least for now.

Floating the Idea of a Berks... Here's What the Powers That ...