08Mar1:51 pmEST

Reversal of Fortune

In last evening's full recap video for Members we discussed the idea that most State of the Union Addresses do not move markets very much, if at all. In fact, it is often something of a red herrings for trading to try to trade off it, despite all of the coverage and analysis surrounding the event.

However, the jobs report this morning was a different matter altogether.

We saw the unemployment rate tick higher, and the last report's payrolls were revised down. Both of those circumstances gave rise to another pump in the futures pre-market with the red-hot semiconductors leading the way on the back of rate cut hopes by a meek Jerome Powell Fed.

As a few of our Members astutely noted in real-time, however, the chips saw abnormal abrupt rug pull just after 11am EST, led by SMCI and NVDA sharply heading down.

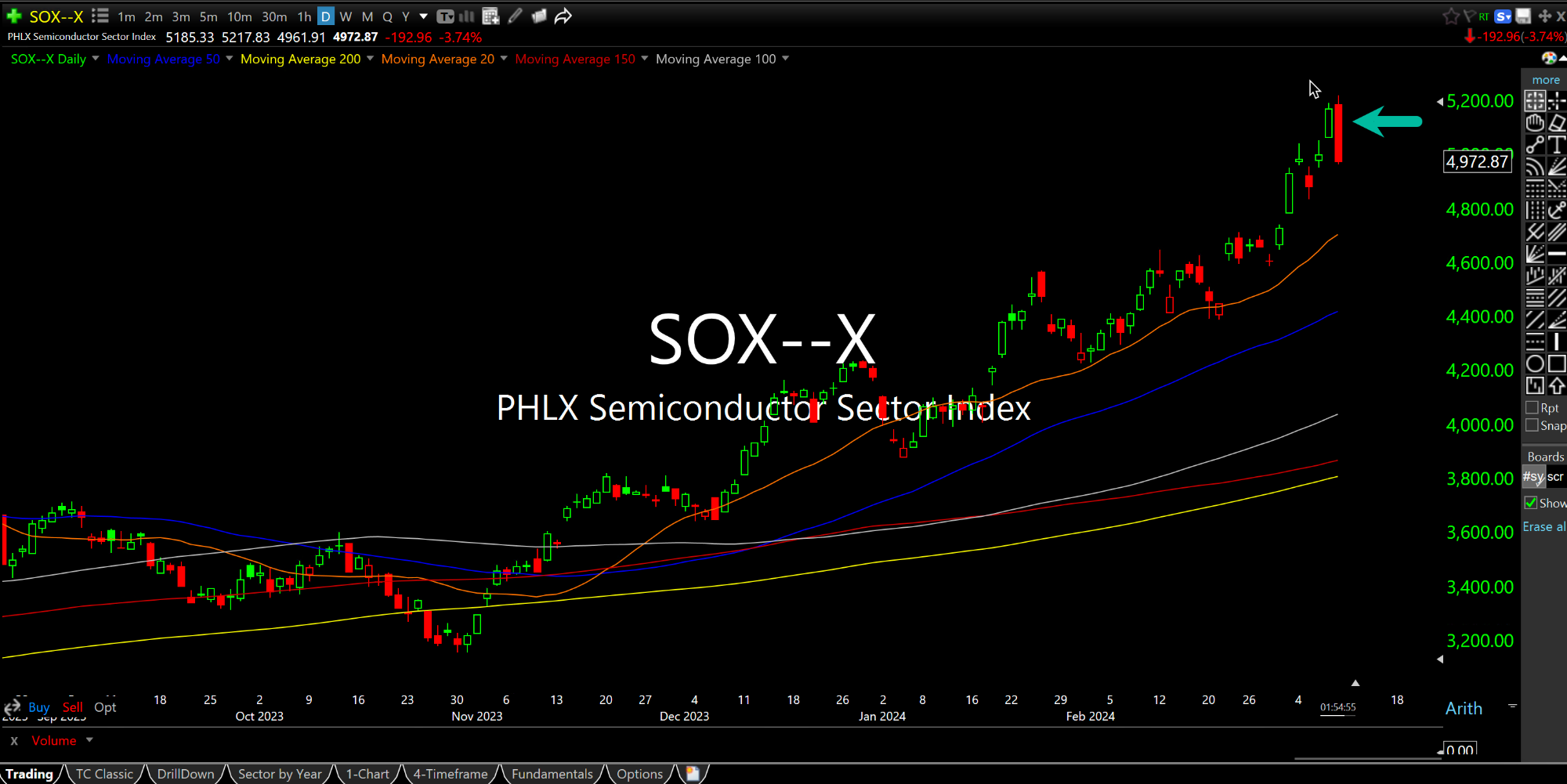

On the SOX daily chart, updated below, for the Philadelphia Semiconductor Index, we have yet another classic reversal candle headed into the weekend, pending the close.

While I fully understand bulls will laugh off this candle as yet another false flag in an ongoing melt-up, the Berkshire Hathaway we flagged from two weeks ago is still playing out in favor of bears.

In other words, as I wrote yesterday this week feels like the exact inverse of early-March 2009--A major market inflection point just when it feels idiotic to fade a longstanding and crowded one-way tape.