18Mar12:28 pmEST

How Could it Be OK if it is Askew?

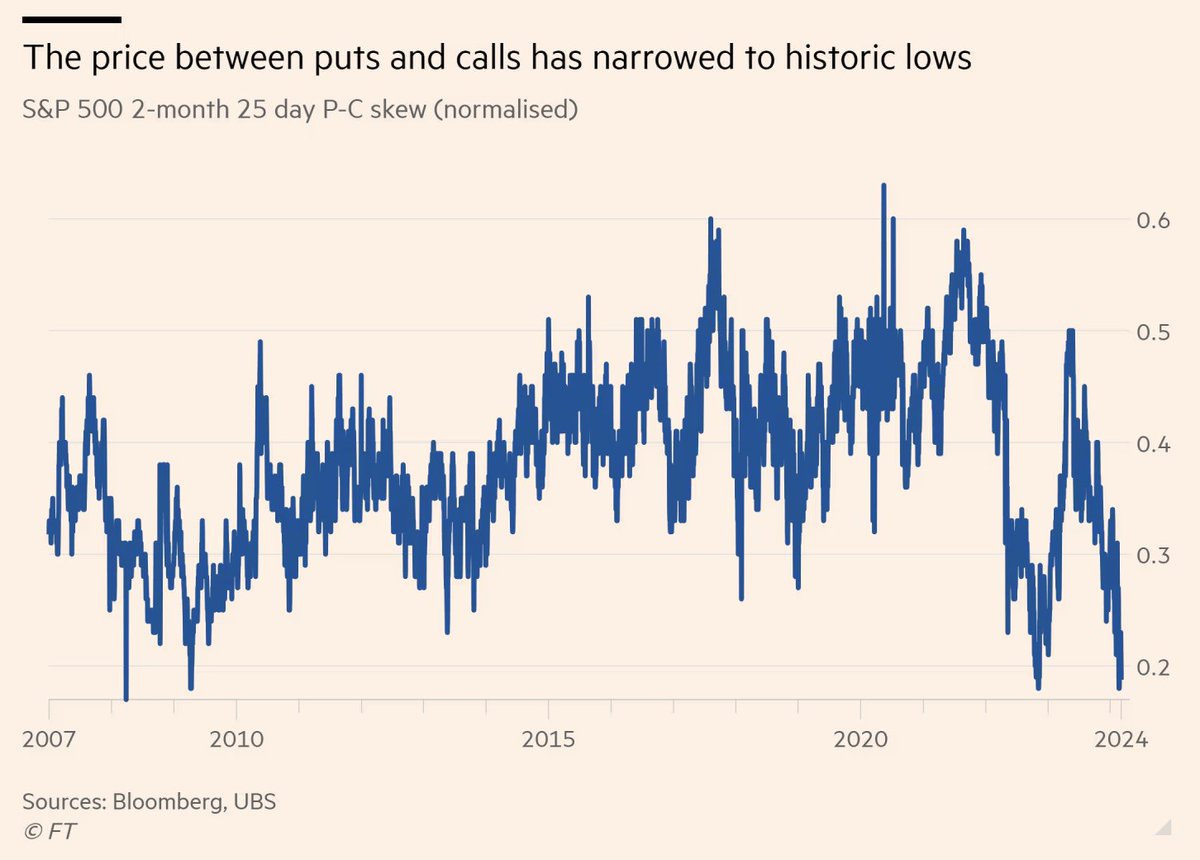

An historically low "SKEW," seen below, typically correlates with a calm equities market, where market players are far more concerned about capturing upside reward than worried about downside risks. And that is what we have taking place here, albeit to an extreme.

Interestingly, alongside the rally in Japanese stocks overnight, this is happening in front of some major central bank meetings this week, the Bank of Japan tonight and then our beloved Fed on Wednesday--Rates and gasoline prices (as well as cocoa's epic spike) are rising again in front of it.

Once again, though, when it comes to equities we are looking at clear signs of complacency and an overall lack of respect for risk, as traders could not wait to pile into the GOOGL/AI news with AAPL this morning, as well as play an overload bounce in TSLA. That said, NVDA's bounce mostly faded with its conference.

Still, something is askew, with small caps red and pinned below the IWM's 20-day moving average as well as a plethora of other bearish action under the hood of the car today.

Don't Just Stand Still and L... Sift Through the Summer Drif...