21Mar2:37 pmEST

Metals and the Bond Market Can Stop This March Madness

Sure, we can discuss oil.

But from my perch the bond market, shooting rates higher, and the precious metals with their derivative miners, are the two main forces which can push back on The Fed's likely mistake of focusing on rate cuts and ignoring the possibility of inflation igniting for another wave higher.

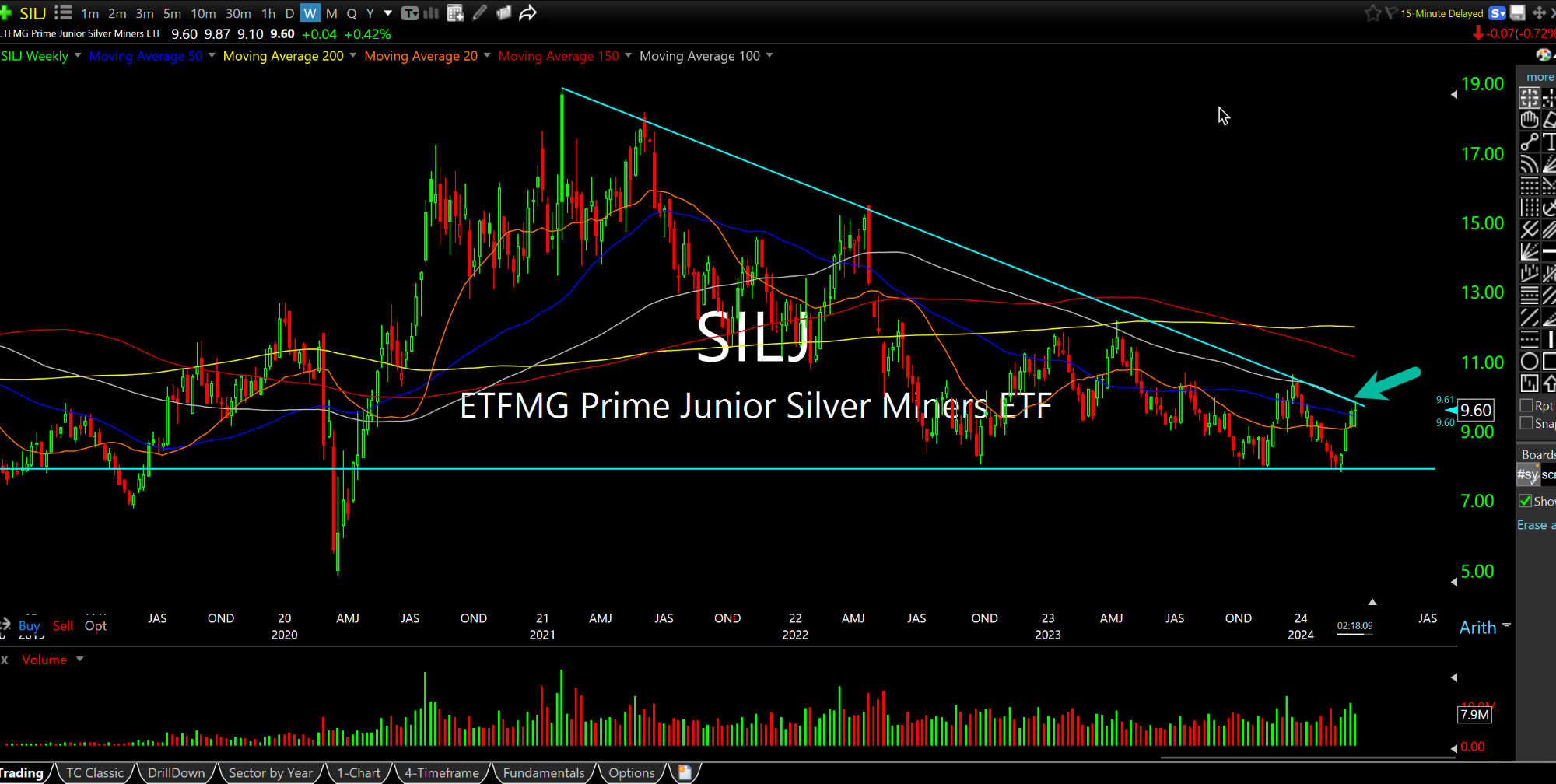

On the junior silver miner ETF weekly chart, below, which I went long yesterday, we have a modest pause today. In the context of yesterday's big rally, though, this is perfectly fine. The larger issue is whether SILJ can breach the highlighted and obvious long-term resistance trend-line just above to cement a more meaningful breakout and fresh move underway.

You note that resistance trend dates back more than three years at this point.

Should a precious metals/mining bull advance, alongside rates moving higher, we would certainly have a scenario The Fed is not expecting--One where asset classes are saying, loud and clear, that inflation remains a serious issue and that rate cuts would be a glaring blunder.

After yesterday's performance during the press conference, Powell is certainly hunkered in to his view at this point that the recent hot CPI and PPI prints were merely "bumps" along the way towards lower overall inflation. As you might imagine, I disagree.

In the coming weeks, however, I will let the bond market and precious metals decide who is correct and who is out of line. Equities, as usual, are the last to get the message but always the most abrupt to reprice.

Jerome Powell Starring as Ba... Afternoon Update 03/22/24 {V...