08Apr12:25 pmEST

Cutting it High and Tight

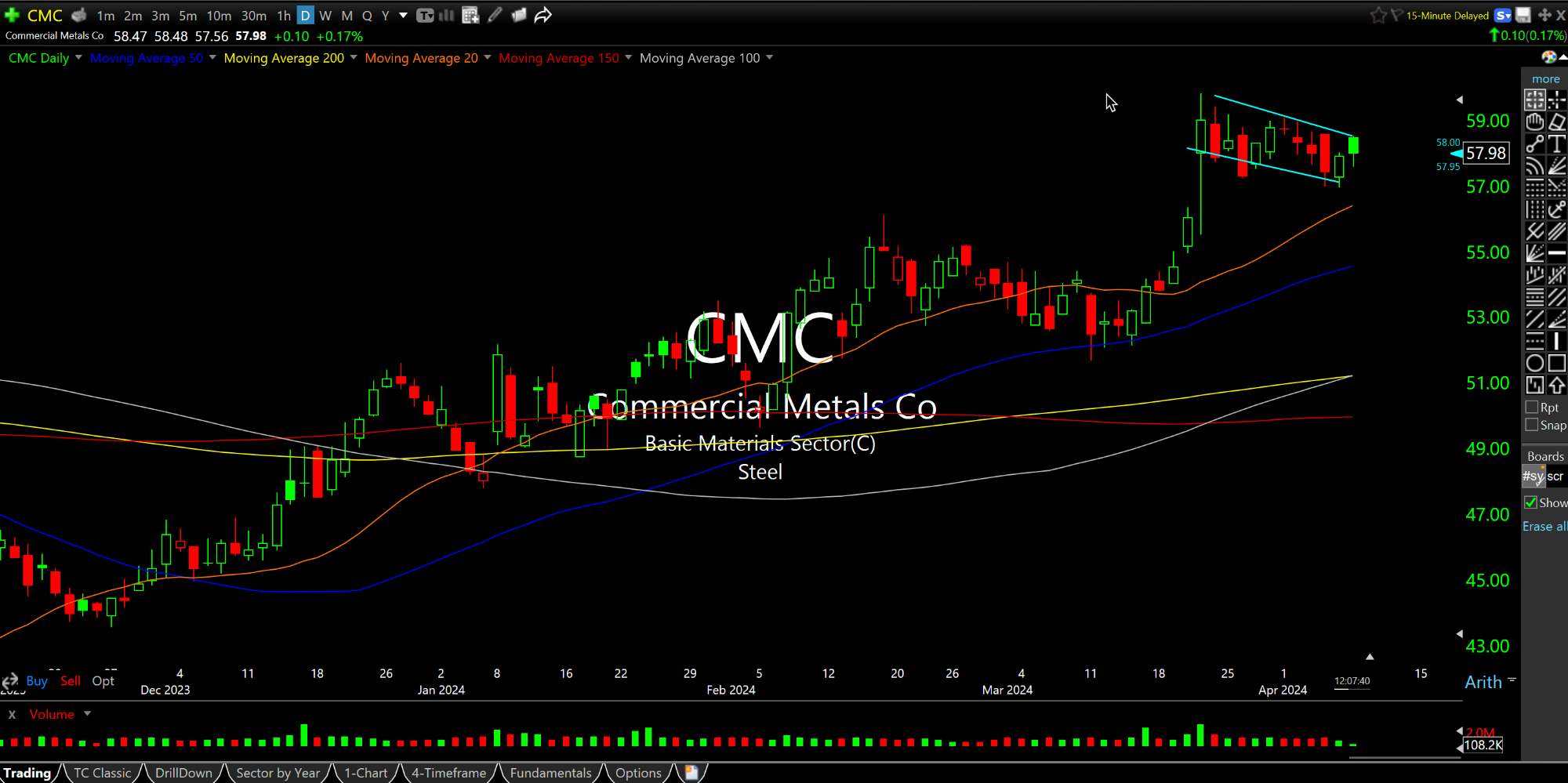

On the updated daily charts below, for CLF and CMC respectively, note how the stocks are flagging "high and tight" after prior run-ups above all moving averages.

For these two commodity stocks, this is solid price action and puts us on watch for another move higher especially if the commodity complex at-large continues to enjoy rotation.

To be clear I remain wildly bullish on commodities on a long-term basis (looking out the rest of the decade and beyond). However, given how monstrous the leading tech names are in terms of trillion dollar market caps and weightings on the indices and ETFs, I remain open-minded to a broad market swoon brining everything down into summer.

But the point remains that I am convinced even into that scenario commodity stocks will emerge as the new leaders off those lows.

As for the action today we have a flattish, oscillating tape. The CPI print on Wednesday morning likely looms as the big event of the week and we may not get much direction until then.

Afternoon Update 04/05/24 {V... Here's the Thing About Rip V...