19Apr2:35 pmEST

War Was Never Part of My Bear Case

While it may be tempting to play geopolitical expert and go play-by-play all night with headlines out of the Middle East, I believe it is a mistake for bears to hang their hats on WWIII as a critical part of their case.

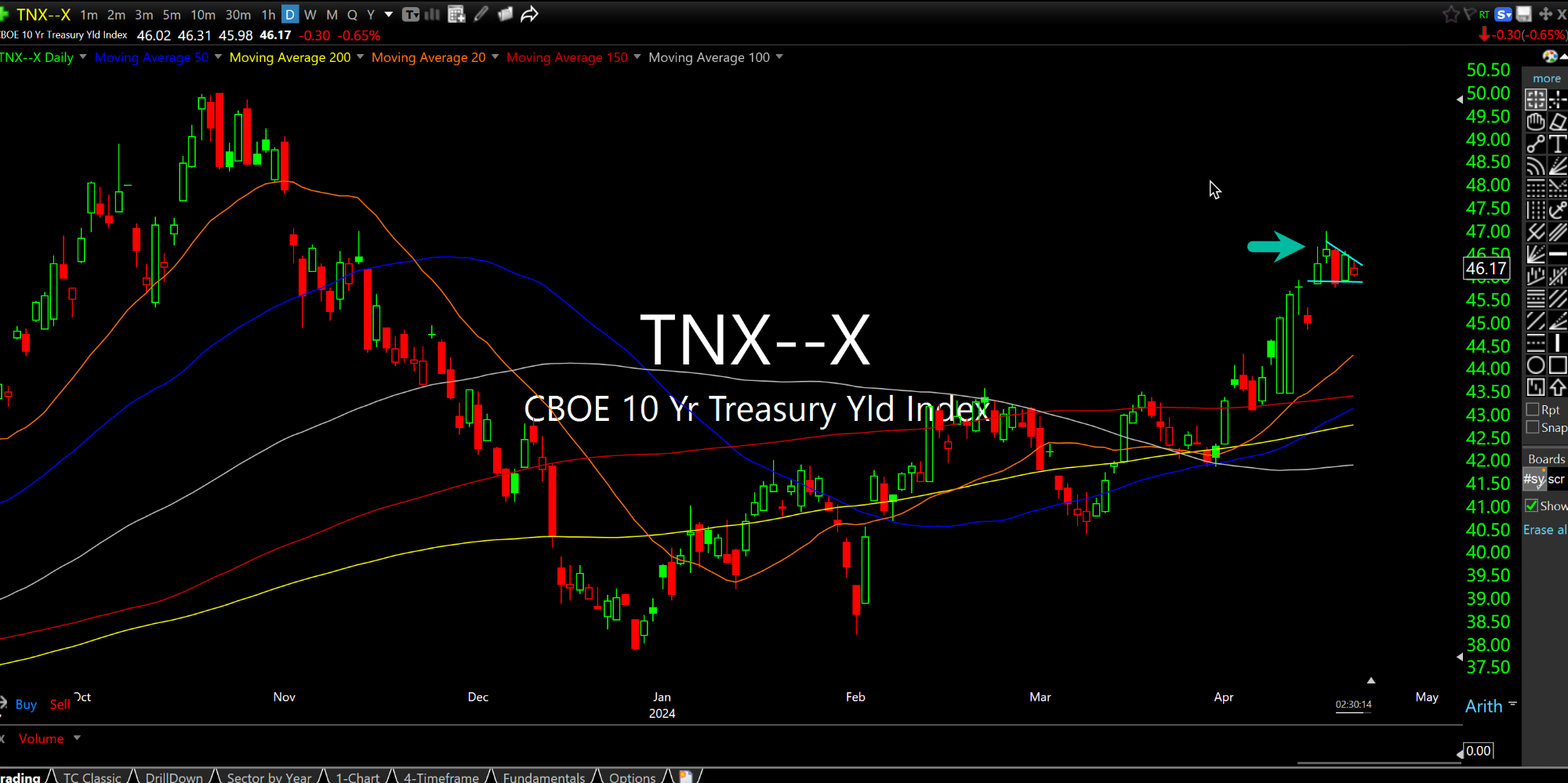

From my perch the more market-relevant development has been the rally and sticktoitiveness of rates, especially on the 10-Year Note. Even last year and earlier this year during the most exuberant parts of the rally in equities, what kept me thinking it was the final blow-off in a liquidity-fueled historical bubble was the stickiness of rates, despite how so many were boldly claiming a soft landing has been achieved.

Heck, even last December Jerome Powell himself began to take a victory lap on the matter.

And here we are now, headed into summer with rates on the 10-Year becoming acclimated above 4.5%, even finding support today at 4.6%.

With rates sticky high, much of the underlying assumptions built into tech/growth/Mag7 names begin to crumble, as will, unfortunately, much of the great American consumer with the exception of the ultra-high net worth 1% of folks who will spend just enough to likely keep prices high, and ironically, keep most Americans barely able to make ends meet, if at all.

While I obviously did not expect him to read me, I did indeed give plenty of warnings last year and earlier this year if Powell did have a few minutes to scroll on by regarding the foolish idea of placating rates doves and equity bulls as a way to couch any hawkish utterance he made--The very notion of him doing so served no purpose other than to ease financial conditions via a rally and reignite inflation, undermining the entire battle.

Going forward, World War III is of course a legitimate risk. However, rates remaining high and even pushing higher yet towards 5% in short order remains the most tangible and troublesome scenario for markets, since much of the jubilation in recent years we have seen has come on the back of pricing in a kind of permanent goldilocks, where Mag7 names enjoy infinite earnings growth, priced to perfection, and growth stocks from the QE/ZIRP era would soon enjoy lower rates and a soft landing.

In reality, both of those scenarios were pie-in-the-sky and fueled an epic bubble, which means the weakness in semiconductors this week is much more likely a prelude of what is to come rather than a buyable dip.

Now We See How Much of a Lea... Weekend Overview and Analysi...