07May1:08 pmEST

Chasing the Mystery

Much debate is currently swirling about whether we are, in fact, seeing another wave higher of inflation or, instead, inflation is either flat-lining or even receding. There seem to be intelligent, well-studied folks on both sides of that debate. Housing and rents figure to be the tiebreaker. And as we know, real estate can be inherently local in nature. Hence, depending on which market you are looking at it is too easy to find data which fits your bias.

But when it comes to commodities, the "Cantillon Effect," something we noted with Members in recent months, still seems to be in play. In other words, inflation does not hit all assets all at once. Instead, we see it play out over time with rotation amongst commodities.

Today, we have various chemicals plays like FMC and IFF, which are hosted in the XLB ETF alongside many other chemicals, rocketing higher.

The XLB has always been one of those overlooked ETFs. However, with exposure to ags and chemicals mostly, alongside some other commodity-related plays, it is instructive oftentimes as a gauge of where the commodities space truly is, overall, instead of just looking at the price of crude or gold in a vacuum.

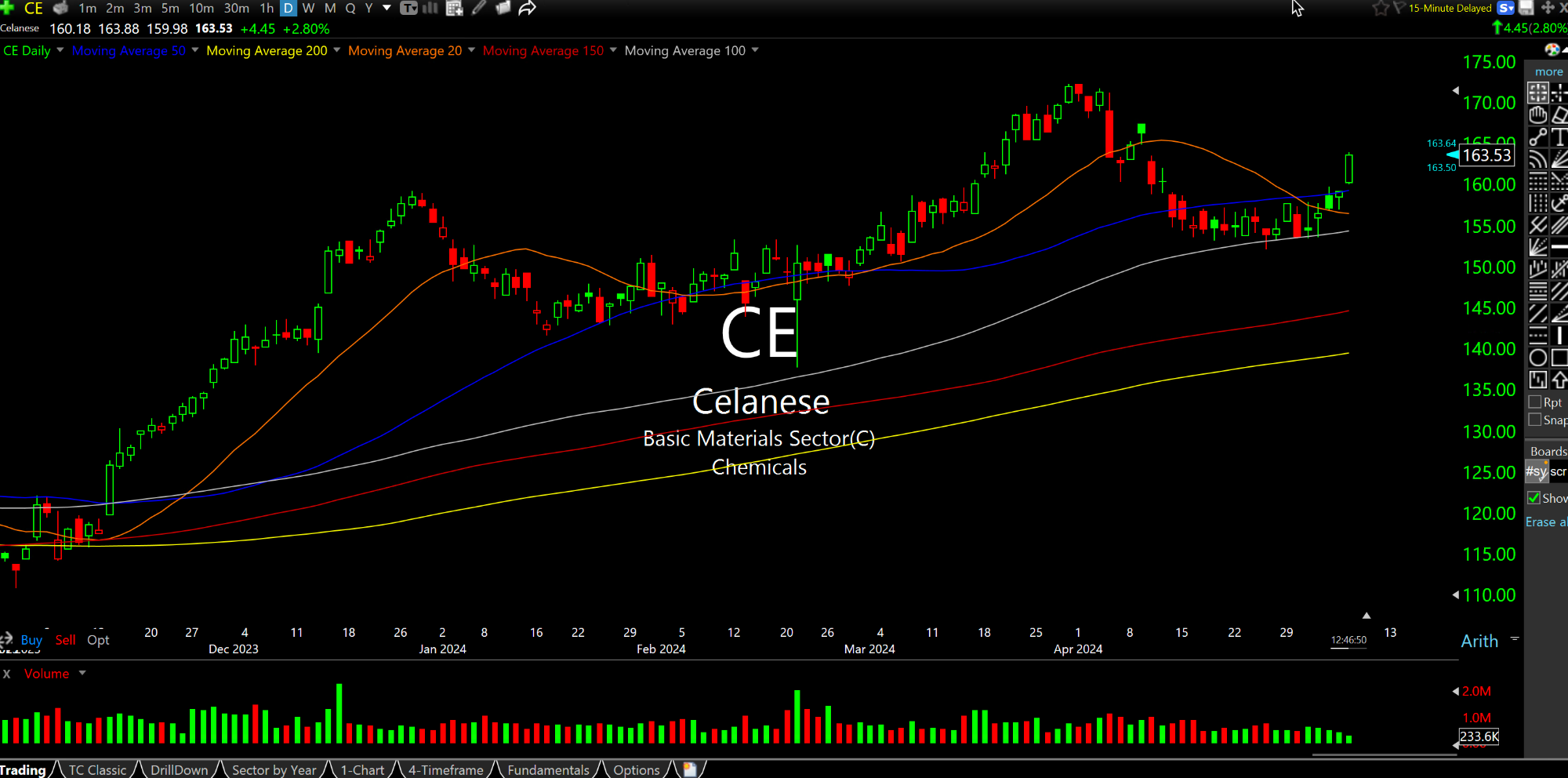

On the second daily chart, below, chemicals plays CE has my eye, although I believe they report this week. Still, I will be looking for a potential trade after the report.

And on the short side Boeing still cannot improve much at all. On the first daily chart we can see as much, with a bear flag setup threatening to roll back over as we speak.

The Time is Now for Commodit... You Cannot Anime Your Way to...