20May11:30 amEST

The Coast May Never Be Clear

Notoriously full of head-fakes and heartbreaks, commodities can be the most ruthless asset class when it comes to trying to time breakouts. For long periods of time commodities essentially lay dormant. But when they do finally wake up, the momentum can be beyond the comprehension of even the most steadfast of bulls.

All we can do is objectively analyze the action, coupled with macro tailwinds, and try to ascertain if the breakouts are actually true this time around.

So far into a bunch of these moves we are seeing just that, all with a Federal Reserve which is clearly remaining stubborn about their "restrictive" stance despite plenty of evidence that inflation is entrenched and even on the move back higher into this summer. The 1970s taught us when we have an easy Fed coupled with inflation on the rise, gold and oil among other commodities are the very best performers among all assets.

And if we apply that to the present, the likes of silver, copper, natural gas, and now even wheat and orange juice are on the march higher. Oil, at present, is off last week's lows but in a bit of a near-term holding pattern.

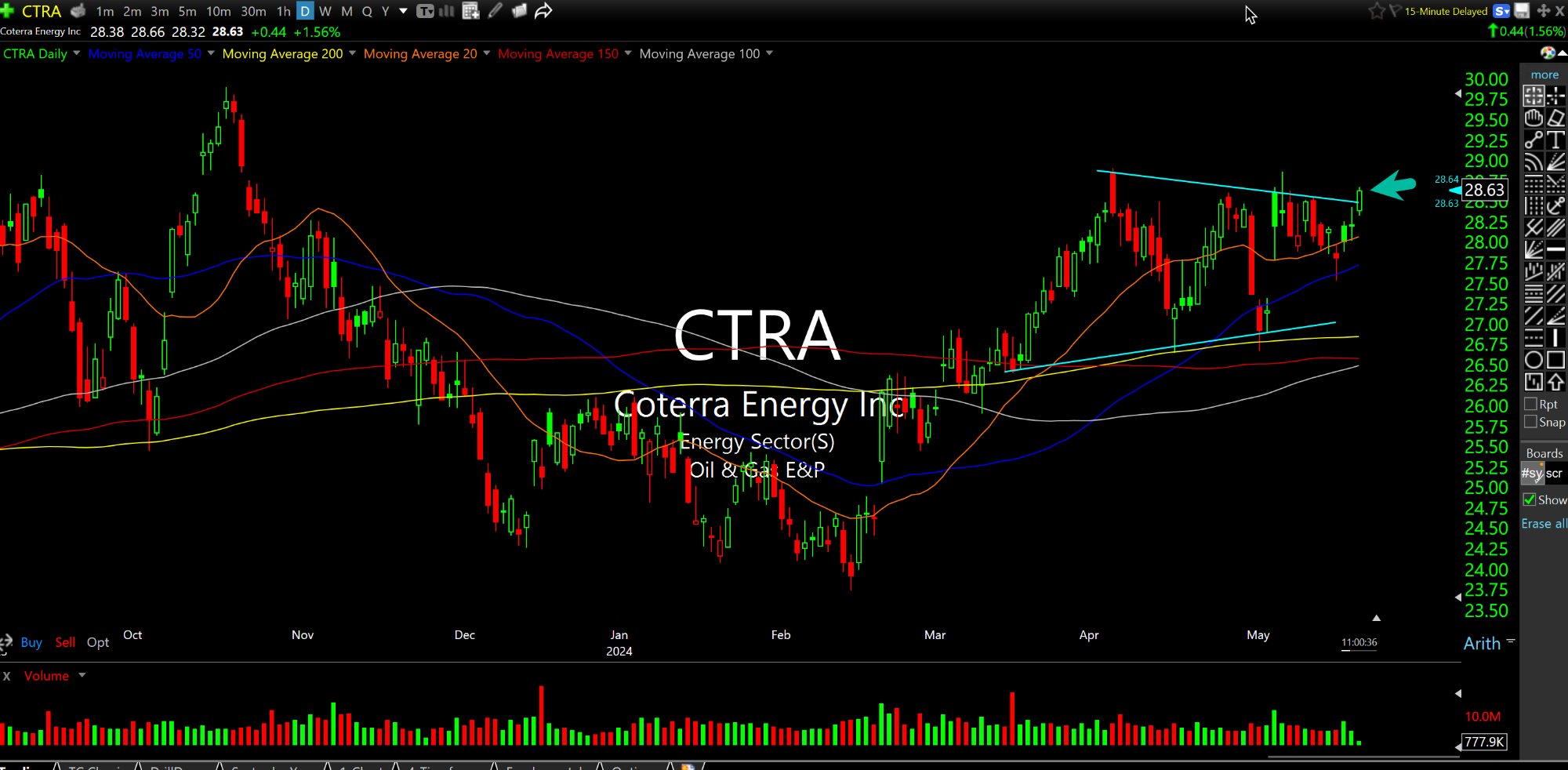

However, some of the best movers this morning in terms of commodity stocks are natural gas-related plays like RRC (also TELL KOS etc.). Thus, I am watching the likes of Coterra, below on the daily chart, to follow suit as it quite coiled and above all moving averages.

Overall, commodities seem to have the green light to continue to rally into the June 12th FOMC (which also marks the next CPI print) as there is no indication The Fed is blinking in the face of any inflationary data.