04Jun11:27 amEST

Tough to Make This Connection

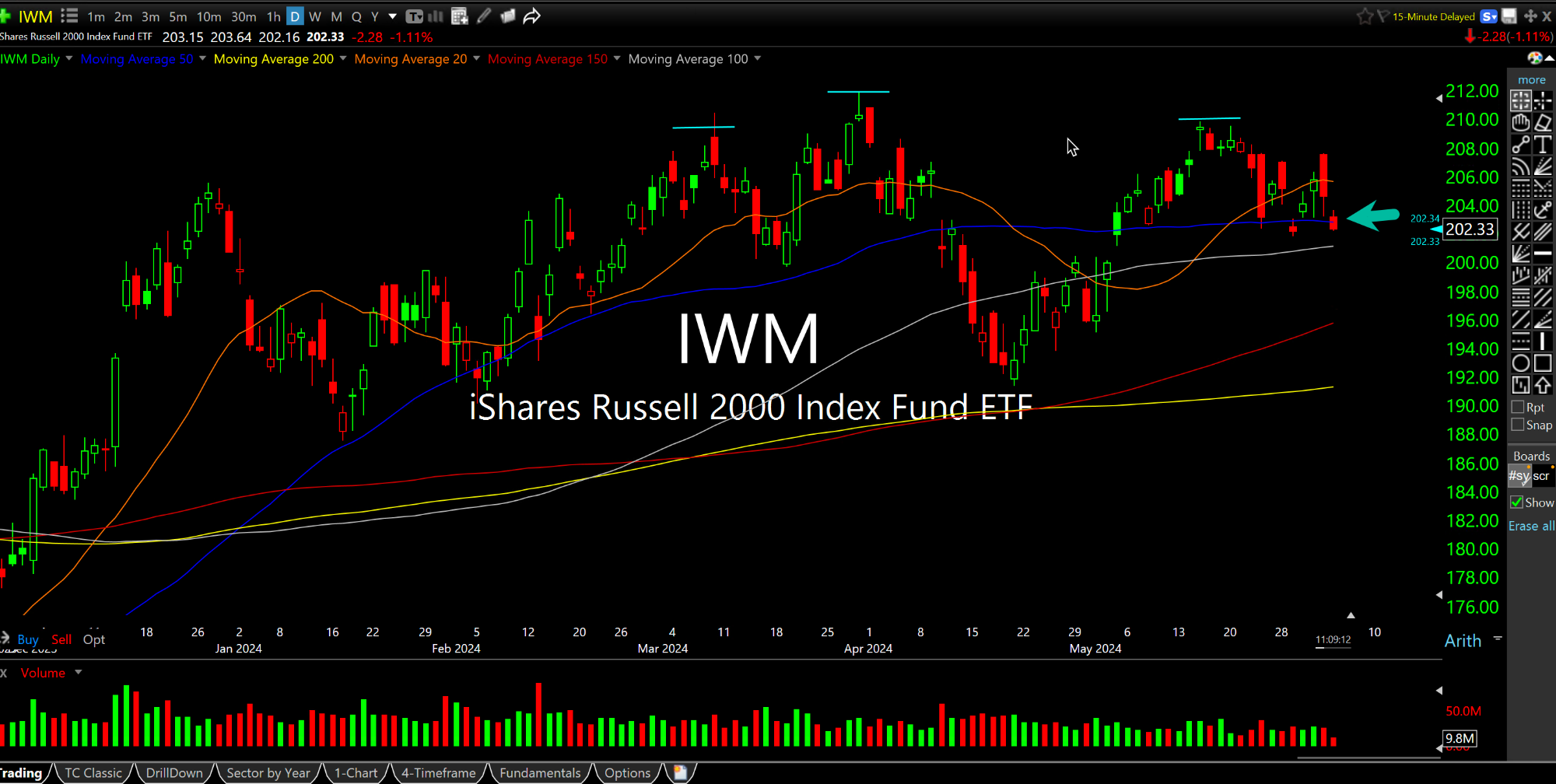

You may be surprised to learn that the IWM, ETF for the small cap-led Russell 2000 Index, is currently trading at levels it traded at back in December 2020.

For all of the talk about the epic NVDA bull run, the Magnificent 7 names, as well as the likes of COST building a kind of Tower of Babel off the charts into the sky being equated with most or all equities given their weightings on the senior indices, the thousands of small cap stocks cannot get out of their own way.

On the updated IWM daily chart, below, the near-term timeframe shows a (highlighted) potentially bearish head and shoulders rolling top to dovetail with the weakness today, probing the 50-day moving average (dark blue line, arrow).

Many, many people have pounded the table on a bullish IWM call for a key rotation to sustain the melt-up in equities. However, thus far it has not materialized.

Furthermore, each passing day the IWM fails to take the rotation baton and catapult higher it places even more pressure on NVDA and the Magnificent 7 names to continue to defy gravity. Unless this time truly is different, history says that defiance will prove insufficient.

Elsewhere, I am looking for gold miners to find some buyers into today's thrashing. I still view it as a shakeout after a multi-month rally.