05Jun11:04 amEST

I. Was. Front-Running!

In many respects this particular stock market has turned into one, massive, front-running machine. While I understand many will counter that equities have always been a discounting mechanism, which I tend to largely agree with, this regime has featured a nonstop effort to price in any and all bullish outcomes to the extreme max.

Not only have bulls been actively pricing in the elusive "rate cuts," which originally were thought to number at least six in 2024, but now we have NVIDIA melting up again in front of its 10-1 stock split effective this Friday, June 7th.

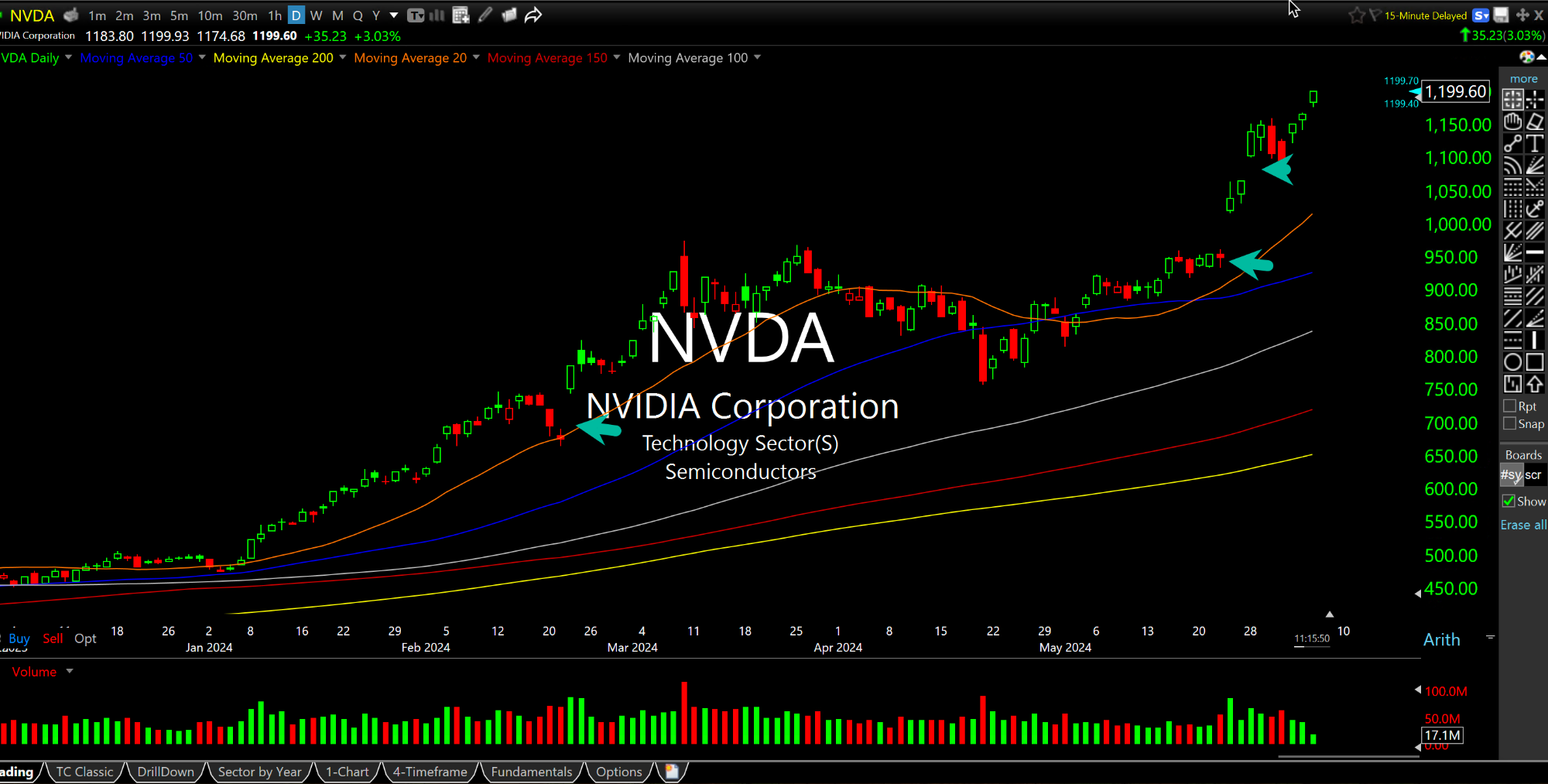

On the updated NVDA daily chart, below, we can see how many open gaps loom if the stock ever does reverse down hard (and there are many, many more open gaps not even seen on this chart, too). Unlike yesterday, today's NVDA rally is dragging up the rest of the semis the Nasdaq, overall, with it.

Beyond that, NVDA is closing in on both AAPL and MSFT for the largest market caps of publicly-traded firms in the world. At this point it is hard not to see a token moment where NVDA becomes the largest firm in the world, as the CEO signs his autograph on adoring female body parts, yet another in a long line of classic contrarian top signals. Of course, the only thing missing now is the actual reversal lower, which is the most important part of the equation.

Overall, this coming Friday though the middle of next week, with the jobs report first and the NVDA split, followed by the CPI and the FOMC next week, ought to provide insight as to where this market wants to go into summer since it is highly likely the big shots on Wall Street will be taking off for after next week's events pass.