12Jun11:08 amEST

Summer Break or Summer Breakdown

Equities are exuberant this morning off a slightly cool CPI print, namely the small caps, Nasdaq, and rate-sensitive sectors. We still have the FOMC at 2pm EST, followed by a Powell press conference, which makes this rally all the more euphoric given the total lack of respect for any risk which may present itself later today.

Still, bulls continue to have their cake and eat it, too.

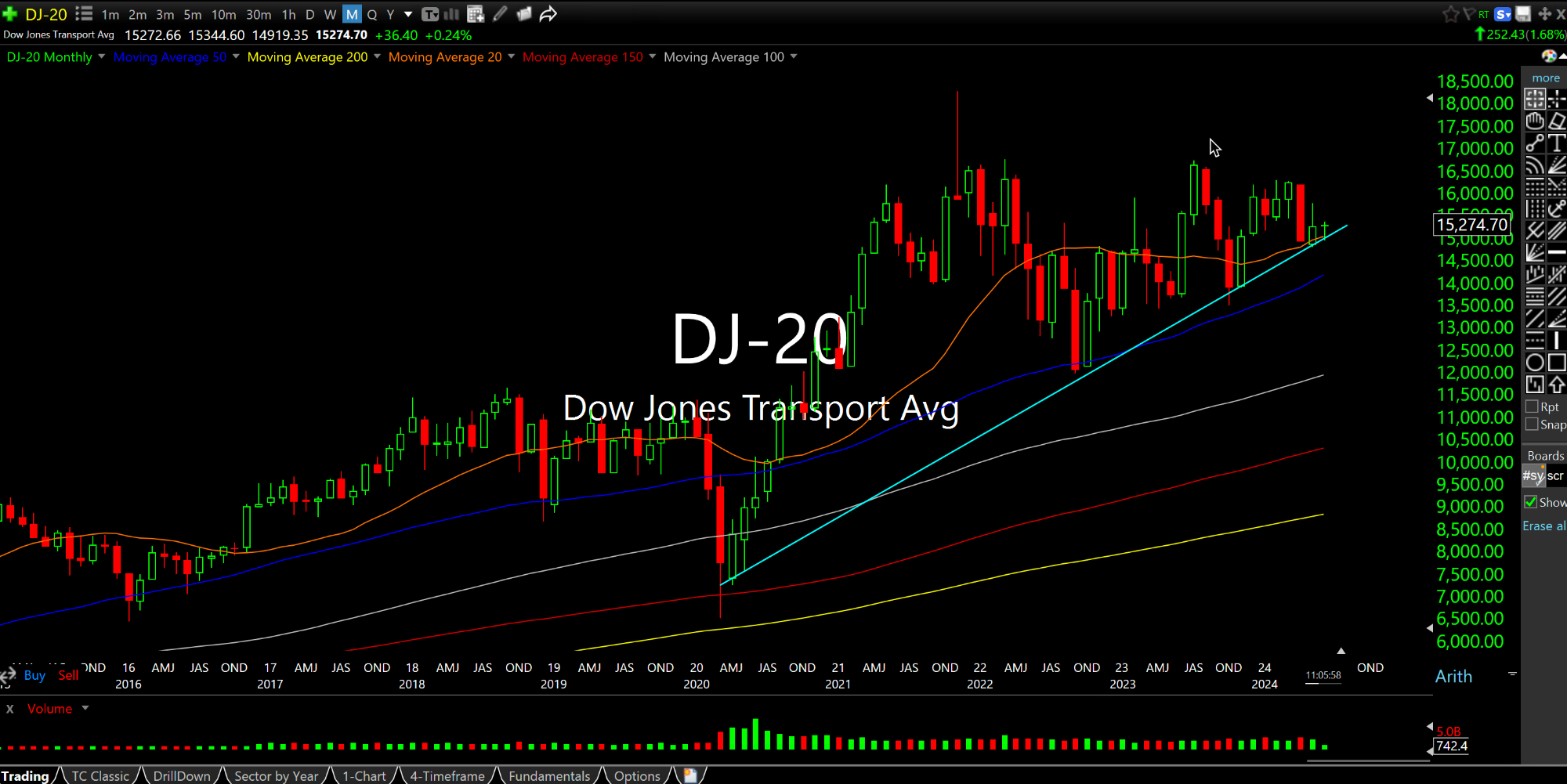

Looking beyond this morning's pop, we have the transports sitting on mostly chart support after lagging for an extended period of time, making no new highs to clearly diverge from the senior indices. The second chart, below of the monthly timeframe illustrates as much.

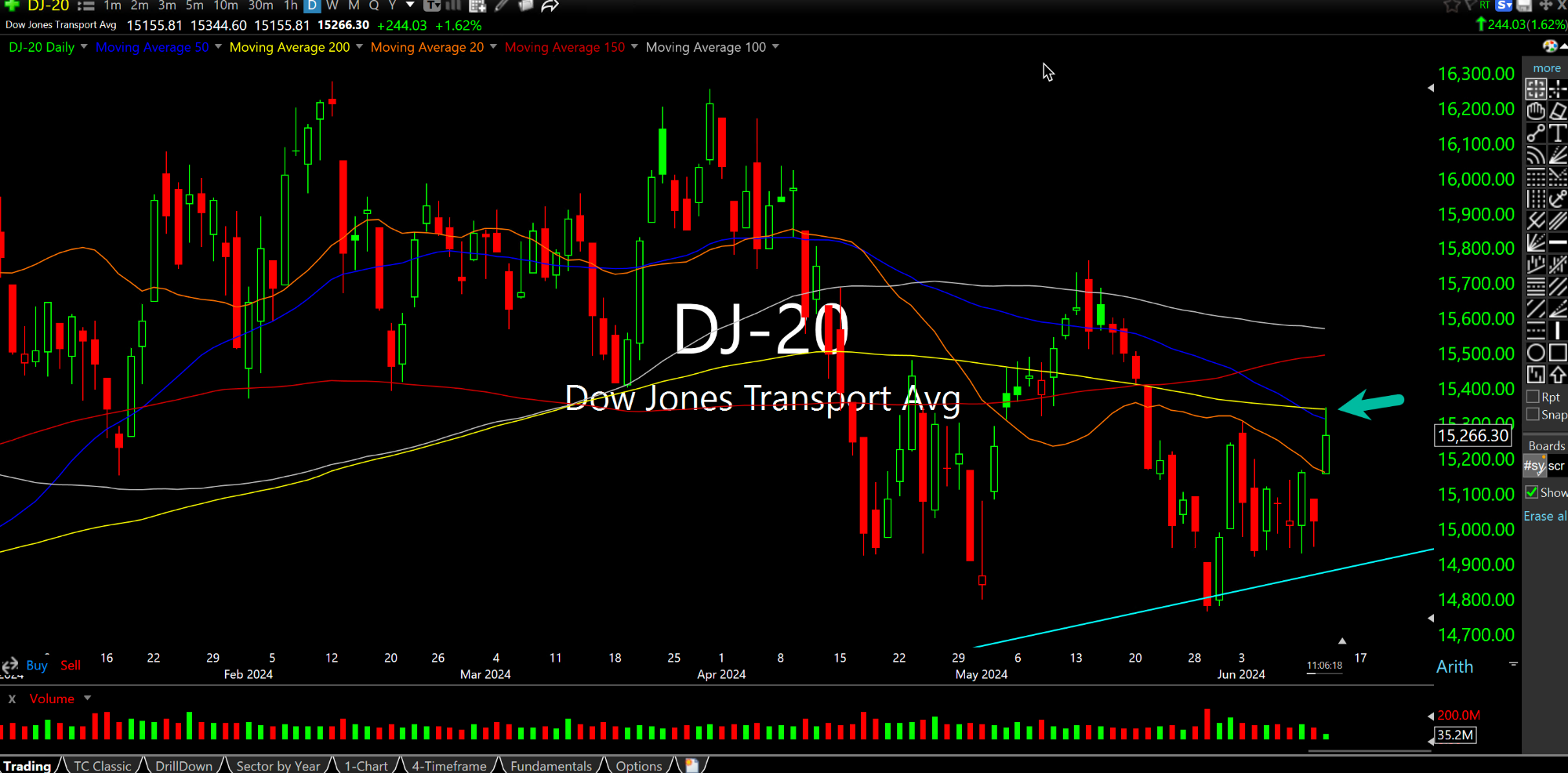

And the first chart below of the daily shows this morning's pop "kissing" the 200-day moving average (arrow, yellow line) from the underside. Also note that 200-day is clearly declining, giving the presumption rallies will fail.

Overall, I still maintain the market has priced in a moderation of inflation. And, frankly, the decline in the rate of inflation seems transitory more than anything, especially if energy continues to bounce back with rents in the back half of 2024. While the market is pricing in a soft landing, it is still unlikely we get it--And at this point it is largely baked in, anyway. Indeed, the oil rally this week has been met with some nervous reception of folks who assumed crude has topped for the year.

Let's see what the FOMC brings.

It Ain't Just the Regional B... Two Firms Getting Their Lunc...