17Jun12:45 pmEST

The Curious Case of Bifurcation

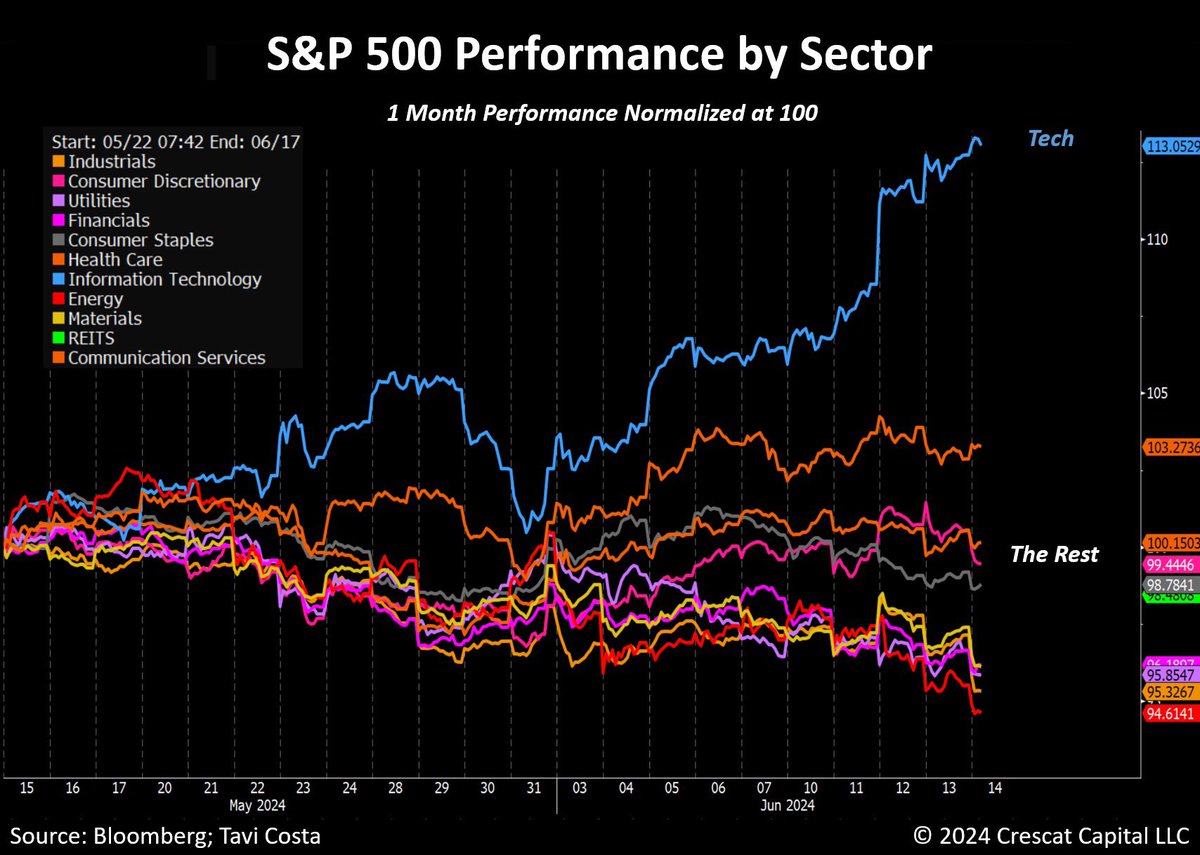

Great visual, below, of just how bifurcated this market has become.

Bifurcation is a concept that we have noted with Members in more depth. Simply put, it refers to the market losing its discipline beyond the standard "winners versus losers" you often see in capitalism.

Instead, when the winners (tech, the blue line) become narrow and crowded to such an exaggerated extent that valuation, stretched technicals, bad news, possible frauds, are all not only ignored but scoffed at, all the while the laggards are left for dead with an arrow through their chest on the side of the road despite how cheap they have become (ahem, energy stocks, the red line), the net result is a bifurcated market.

Historically, bifurcation ends extremely bearishly but, again I recognize many folks are declaring this time to be different for a variety of reasons: Fed, Yellen, debt, retail participation, overseas money coming to America, passive flows, etc.. From my perch, those are classic excuses for why this time is different...until it is not.

Whichever side you come out on, we can agree that the chart below illustrates the uniquely wide spread between tech and the laggards like energy.

Afternoon Update 06/14/24 {V... Amid the Daily Melt-Up, Home...