09Jul12:04 pmEST

Aftermath of a Memorial Day Massacre

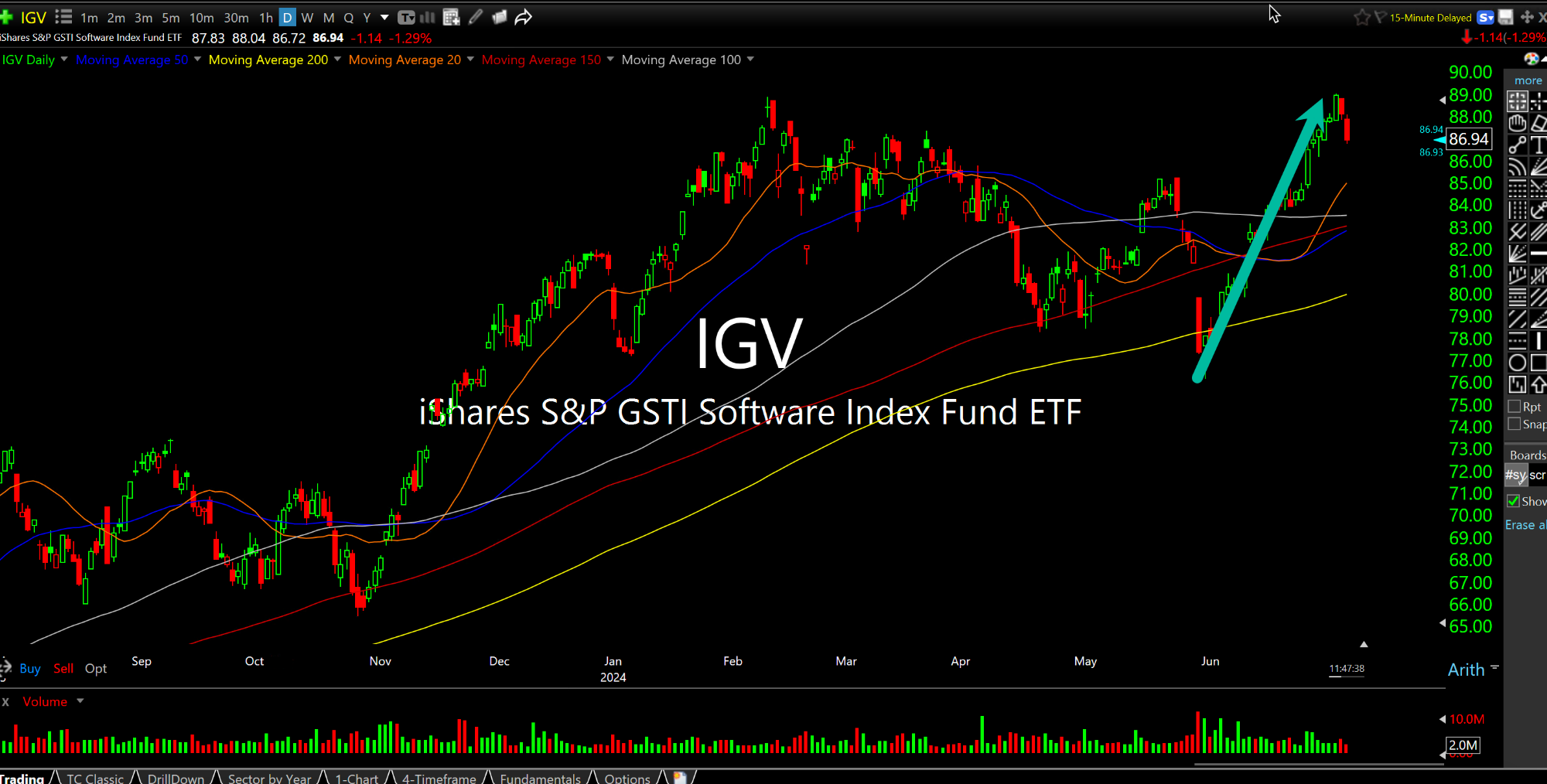

In the wake of Memorial Day this year there can be little doubt that the software stocks staged a massacre of shorts into last Friday's highs, spanning roughly five weeks of nonstop ripping to take the sector back to its early-February highs. The IGV, ETF for the software sector ETF, illustrates as much on the daily chart, first below.

As a result, bulls of course feel even more emboldened about the prospect of continued rotation within tech, perhaps from semis into software, into the back half of the year. In addition, the software move is a kind of case study in what can happen when we do see rotation to a previously-lagging group, which is the bull thesis behind the view that the small caps can shoot higher, for example.

Still, I cannot help but maintain that this is a consensus view, much like the idea that a looming rate cut will either spark a blow-off move higher yet in the Magnificent 7 and semis or, alternatively, offer that much ballyhooed rotation opportunity in small caps, banks, REITs, transports, biotechs, and the like into the end of the year (or both, perhaps).

No, my contrarian view is that a rate cut with inflation still above target will yield an adverse reaction in the bond market, sending rates higher and causing long overdue volatility across assets--This is a scenario I have been pondering for years, seeing the bond market revolt against The Fed's various blunders, bringing back the old bond market vigilantes.

With all of this in mind, Salesforce.com, on the second daily chart, below, looks much more like a short than a long setup after this software rally. The Dow component rallied to its broken 200-day moving average and is now stalling there. The name lagged its peers into the rally, too, as the IGV clearly is in better technical shape than CRM.