24Jul12:25 pmEST

We've Got Evidence Now, Pal

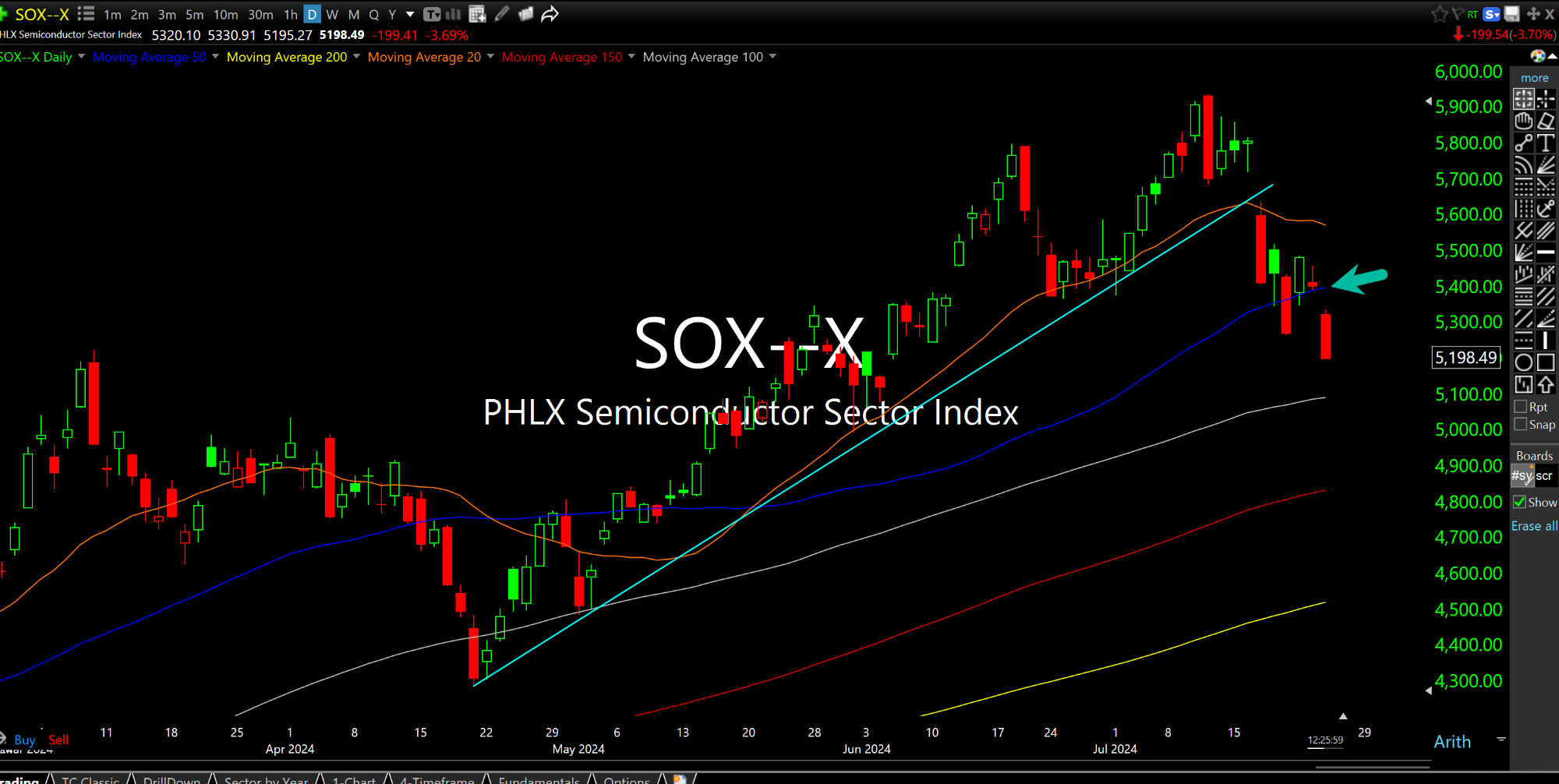

A higher low in the VIX; A lower high by the semiconductors (below on the updated daily chart for the SOX Index) as the 50-day moving average for that sector has now been clearly lost.

These are pieces of strong evidence that some type of regime change is underway in equities, as dip-buyers previously feasted with easy on any and all pullbacks, all the while crushing the VIX to new lows.

While many are quick to dismiss today's action as merely being an overreaction to TSLA down 10%, the reality is that the Nasdaq is seeing widespread selling beyond Tesla, which previously traded in its own world anyway.

Others are quick to attribute this action to politics. But it is still July and we have not even had the Democrat National Convention. It is hard to see markets pricing in too much politically until after Labor Day, and history supports that view.

My view continues to be that semiconductors as a sector alongside the "Mag7" (previously "FAANG") leaders led us up and therefore we feel compelled to monitor them to lead us down. I recognize the small caps have received a nice rotation of late. But the sheer size of the leaders substantially outweighs even the thousands of stocks in the Russell.

Furthermore, with evidence of a slowing consumer (see Visa) and slowing economy it is a stretch to get behind the economic boom thesis of the small caps having a sustained path higher from here.

My Way of Playing Oil to Sta... In the Company of Adult Trad...