25Jul12:04 pmEST

This is What a High(er) VIX Means

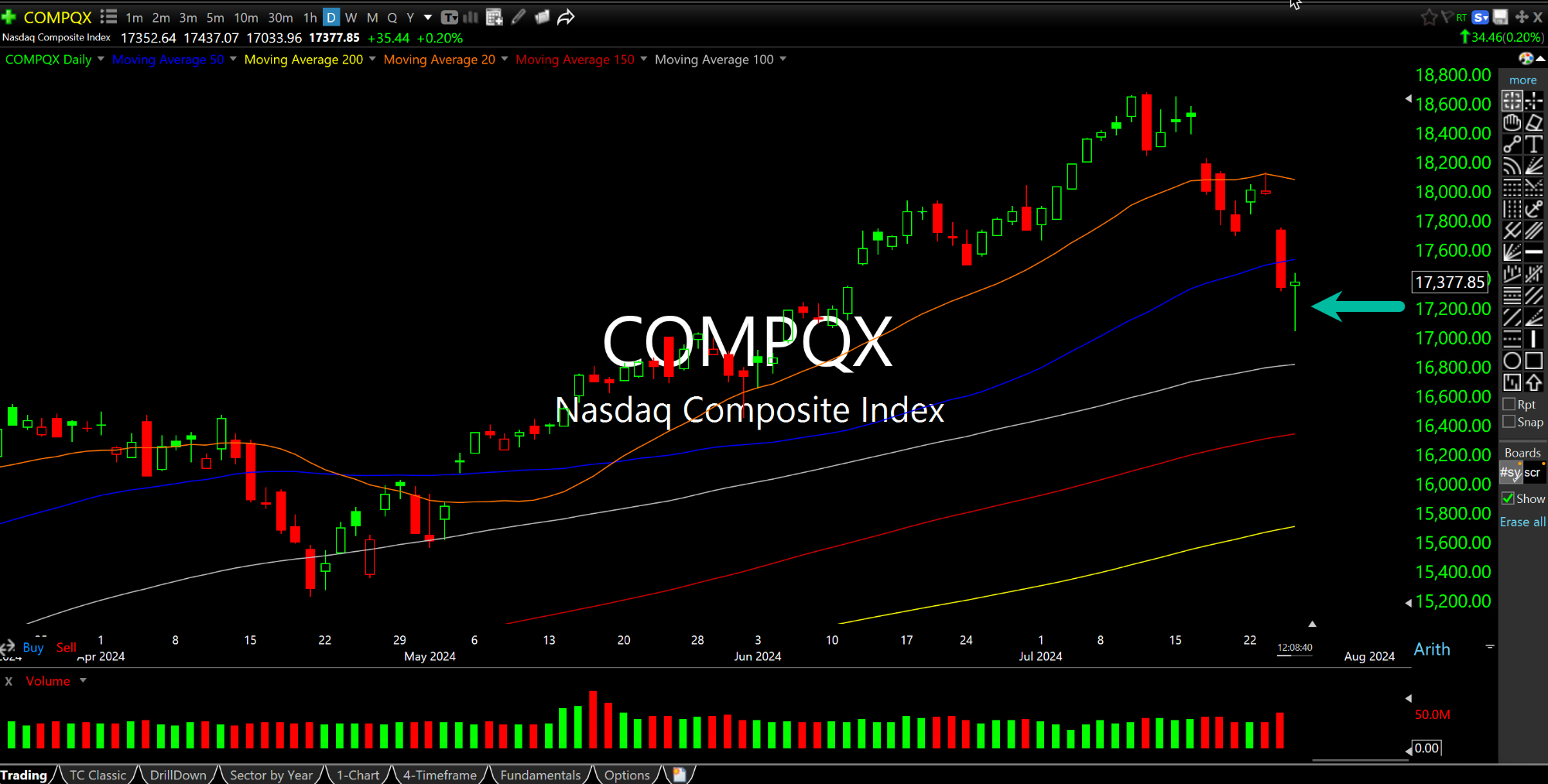

While certainly not at historically elevated extremes, the VIX (or Volatility Index) is higher than the sleepwalking levels it spent most of this spring and summer, heretofore. This morning, NVDA, semis, and most tech at-large opened sizably lower before reversing back to green/flat as I write this.

Bulls are cheering this move as a kind of washout bottom. And while we were indeed near-term oversold, this move also smacks of what happens when the VIX becomes more elevated on a relative basis--Price swings naturally intensify in both frequency and intensity. Indeed, that is the essence of a higher VIX.

Thus, we ought to expect such moves, especially with the mixed macro we saw this morning: GDP was strong, durable goods were rather weak. Tomorrow we have the PCE, a Fed-favorite inflation indicator, before more major earnings reports next week and, of course, the FOMC on Wednesday.

In my experience the sheer size of today's candlestick (with several hours to go, nonetheless, in today's session) is a bit too big to be a reliable "hammer" reversal, despite how exhilarating it feels. Again, for a very near-term (hours, maybe a day or two) oversold bounce bulls may be correct.

But the larger point to me, which ironically gets lost on most in the heat of the reversal, is the increasing size of the price swings themselves and how it is a clear departure from what we saw compared to the last few quarters, even years.