12Aug12:07 pmEST

Here's to Hoping Starbucks Rallies More

...but it's not what bulls ultimately want.

After lagging the broad market and most large consumer names badly for well over a year now it should come as absolutely no surprise to anyone with experience on Wall Street to see activist investor Starboard Value take a stake in Starbucks.

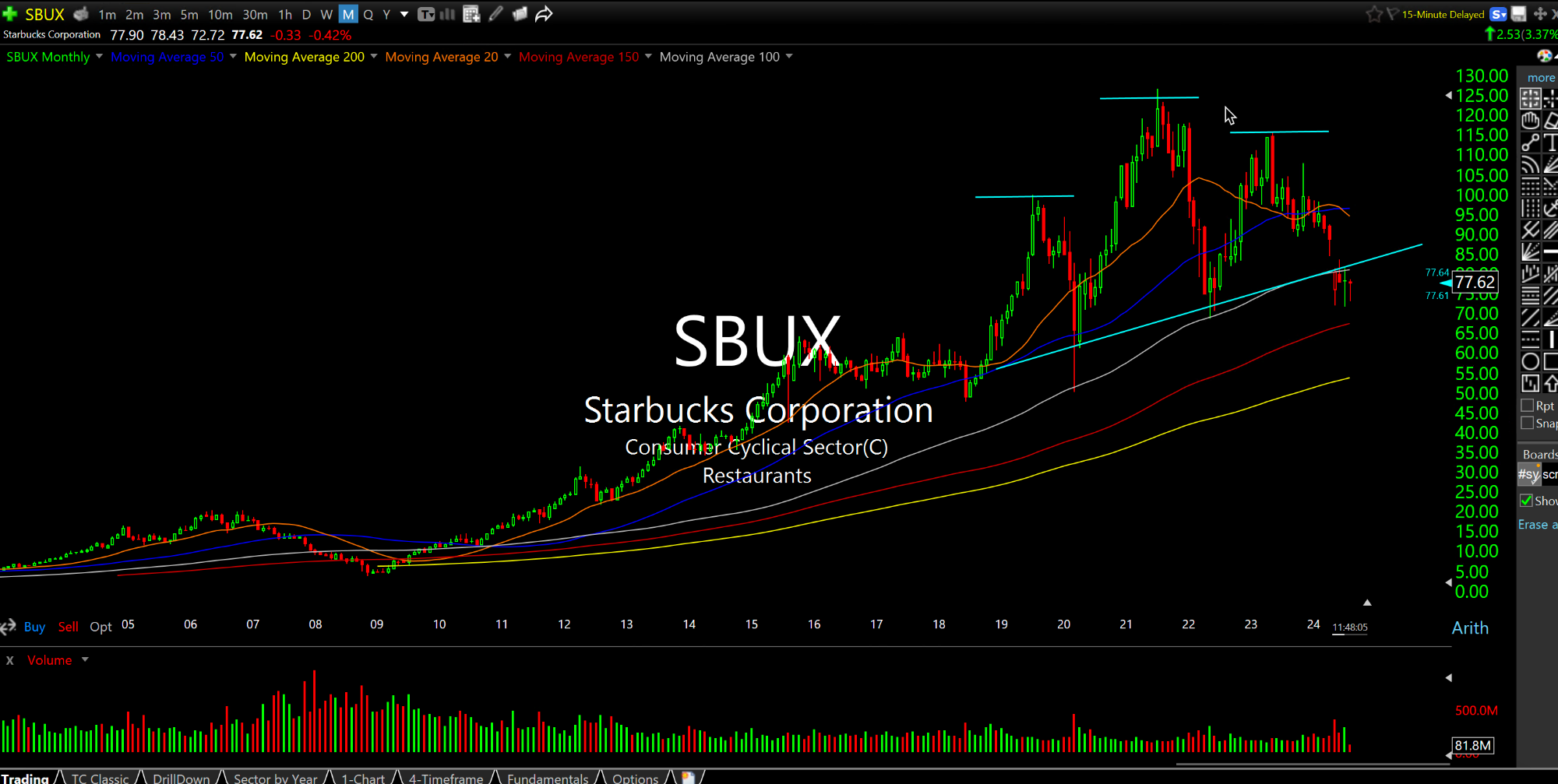

On the monthly chart, updated below, we can see SBUX confirming a cockeyed but valid head and shoulders top spanning several years--The right should can indeed be higher than the left, and oftentimes is the case with the most bearish tops because so many doubt the validity of them with that circumstance in place.

But despite the temptation to time a bottom and assign "deep value" to Starbucks, with activist investors making some moves, the fact remains that the stock is still far from dirt cheap on a valuation basis, despite its multi-quarter slide.

Furthermore, the concept of "brand maturity" seems particularly applicable here.

You are talking about extremely overpriced coffee and sugary beverages which savvy, lower-priced competitors, namely Dunkin' and McDonald's, have done an admirable job of catching up to SBUX in recent years.

With the pandemic stimulus checks long gone and sticky high inflation/rates amid slowing economic growth, consumers are simply not in a position to splash money around at Starbucks anymore--Old timers like myself will recall back in 2008 that it was a huge faux pas to bring a SBUX cup into a corporate office setting amid layoffs and cost-cutting measures--Many employees would actually buy SBUX and dump the drink into a Dunkin' mug or the like, for example.

This time around, it may not so much be about a corporate faux pas so much as consumers genuinely being unable to afford SBUX anymore.

Beyond that, Howard Schultz founded SBUX with the idea of it being a "third place," for people to meet and hang out, beyond bars or church, and spend more money if they were hanging out at a SBUX for hours on end.

Fast-forward to today, however, and you will notice just about all SBUX locations have replaced couches with uncomfortable chairs (and fewer of them), not unlike MCD always did, in order to generate higher turnover and discourage loitering from paying and nonpaying customers alike.

Overall, it would not surprise me to see SBUX enjoy a reprieve into autumn or even the end of 2024. However, into 2025 I am convinced that the name is setting up for more excellent downside from a risk/reward ratio. The idea that consumers will come roaring back into Starbucks at this particularly juncture seems highly improbable, espeicially when even convenience stores like Wawa are beginning to catch up to SBUX themselves.

In many ways, SBUX, given its unique attachment to daily American consumption, was a creature of an extended American period of low rates and easy money. But if you agree with my thinking that that era is finished, then SBUX becomes the ultimate candidate to sell rallies on a going forward basis.