11Sep12:39 pmEST

Once Again, the Price Swings ARE the Message

The continued intraday wild price swings across this market are effectively making mincemeat out of just about all traders of late, as one minute bears are celebrating and the next bulls are foaming at the mouth for a squeeze to new highs...only to see the market come right back down and start the whole process over again. As we noted inside the service with Members, wild price swings like this typical presage a larger drop in the broad market, gauging history, especially after a prior multi-quarter bull run melt-up.

This morning's CPI print raises the issue of whether The Fed will disappoint the market next Wednesday by not cutting 50 bps and, instead, opting for a 25 bps cut. I have seen enough of Jerome Powell over the years to know I should not make the mistake again of assuming he will not resort to being extra dovish. Thus, I cannot rule out a 50 bps cut even though I agree it does seem less likely now. After all, we are in the midst of The Fed's "blackout" period until the FOMC next week, which means Fed heads are on hiatus from interviews and sound bites to move market expectations (There is also the issue if The Fed does indeed cut 50 bps, but then the market sells off hard as it reads it as a desperate act as the economy barrels towards recession and the labor market implodes).

Either way, from a purely technical perspective I see weakening daily Nasdaq and leadership charts, even with--or rather because--these wild snapback rallies which come out of nowhere on a seemingly daily basis.

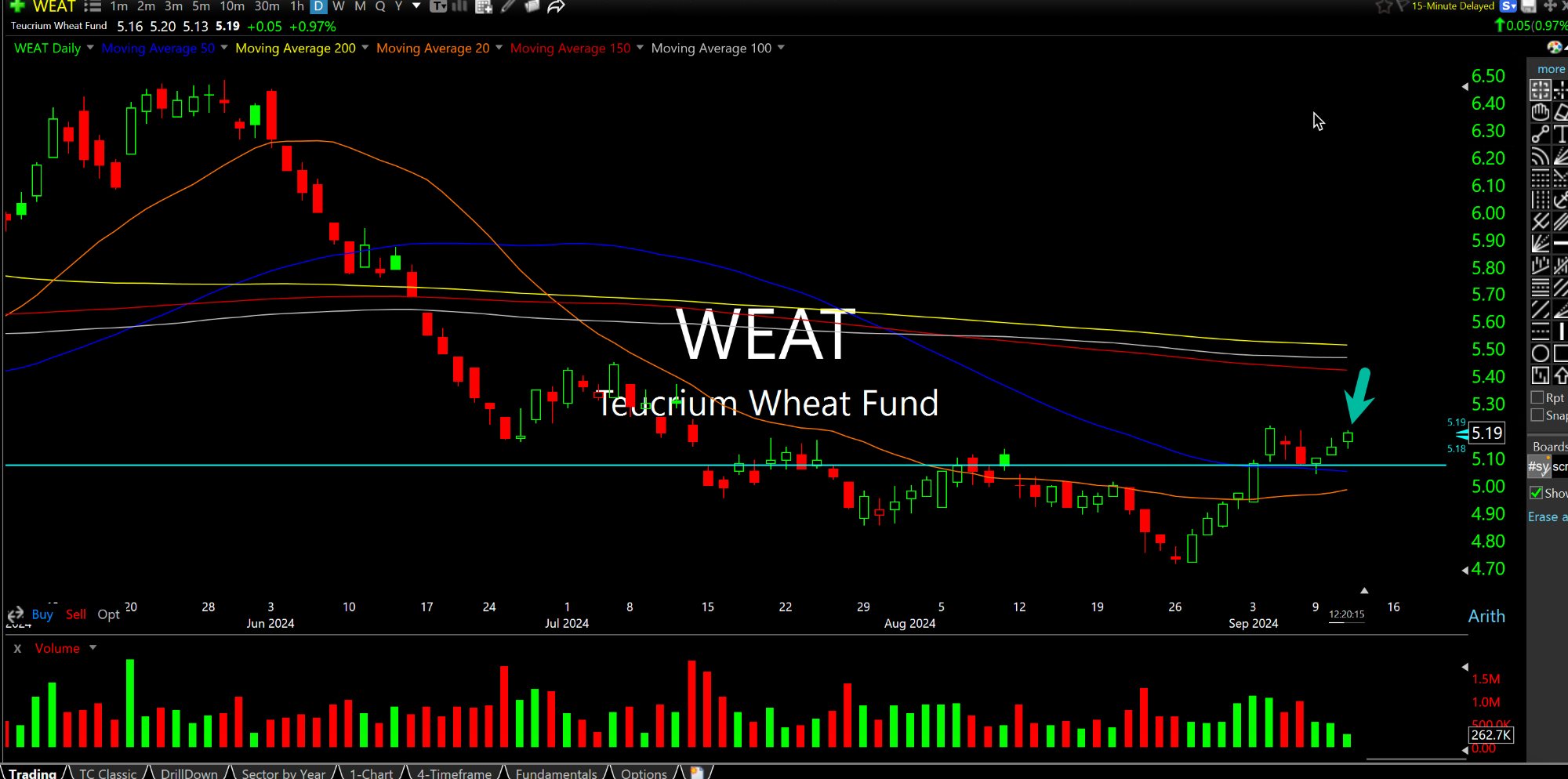

Separately, Wheat is acting better. I remain long the WEAT Fund, below on the daily chart, as it held $5/$5.10 as perhaps newfound support and is turning higher today. Wheat is outpacing corn and beans, too.

Someone is Lying and Needs t... Stock Market Recap 12/29/14 ...