10Sep12:48 pmEST

Dimons Are Not Forever

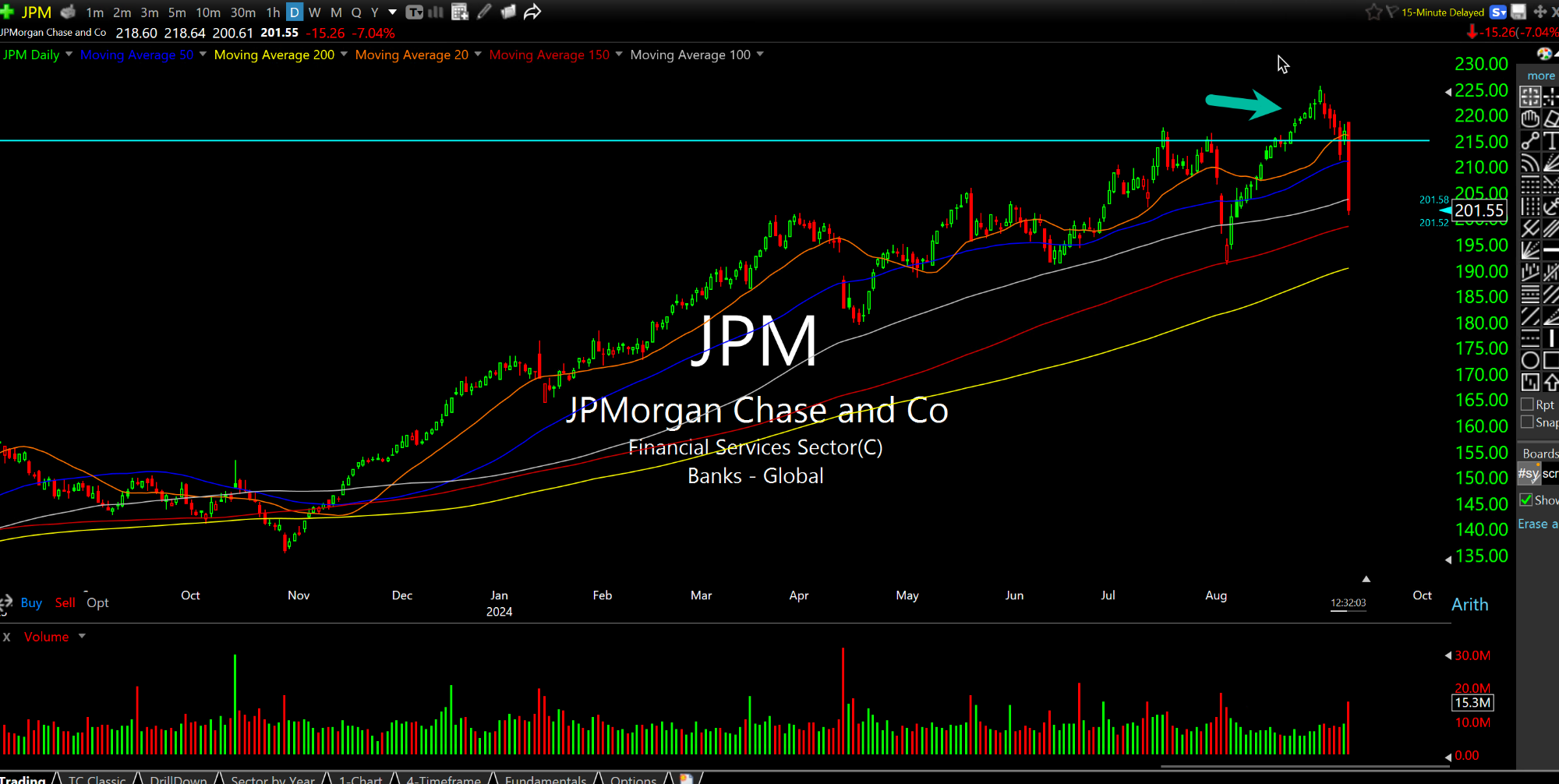

On the back of rate cuts hopes we have seen banks melting up since the August 5th lows even more than other sectors did in that time. JPMorgan, in particular, with its highly visible CEO Jamie Dimon, was right at the forefront.

In fact, inside the service with Members we noted that the $215 level on JPM's chart seemed like a good spot to see if the latest breakout had legs, as bulls were and are adamant about, as opposed to a classic "bull trap" before diving lower.

Today we have the bank's President and COO, Daniel Pinto, throwing cold water on the outlook for net interest income (NII). According to Reuters, Pinto stated that market expectations around NII have been "very high."

As I write this, I see JPM is down more than 7% as the XLF (ETF for larger banks) is down 2%.

Now, the issue is whether Pinto's comments were an actual catalyst for a selloff or, instead, merely an excuse. I defer to the latter, as the August melt-up likely got out of line and was dominated by retail buying into the market rather than the large institutions.

Hence, on the updated JPM daily chart, below, we can clearly see $215 suddenly lost on this sharp downside move. The bull trap view, which is literally a trap which lures in bulls, is alive and well for JPM and banks at-large, even with a likely rate cut coming next week.

I expect banks to, finally, be good shorts into bounces going forward, and am looking for significant downside in the coming quarters as the multi-year JPM bull run reverses course. SKF and FAZ are two bear ETFs of note.