18Sep3:18 pmEST

The Bond Traders Speaketh

Stocks are whipping around, having faded well off session highs amid a volatile 50-bps cut Fed Day. However, we still have the final hour to get through and tomorrow's action after a night for markets to sleep on the surprising decision.

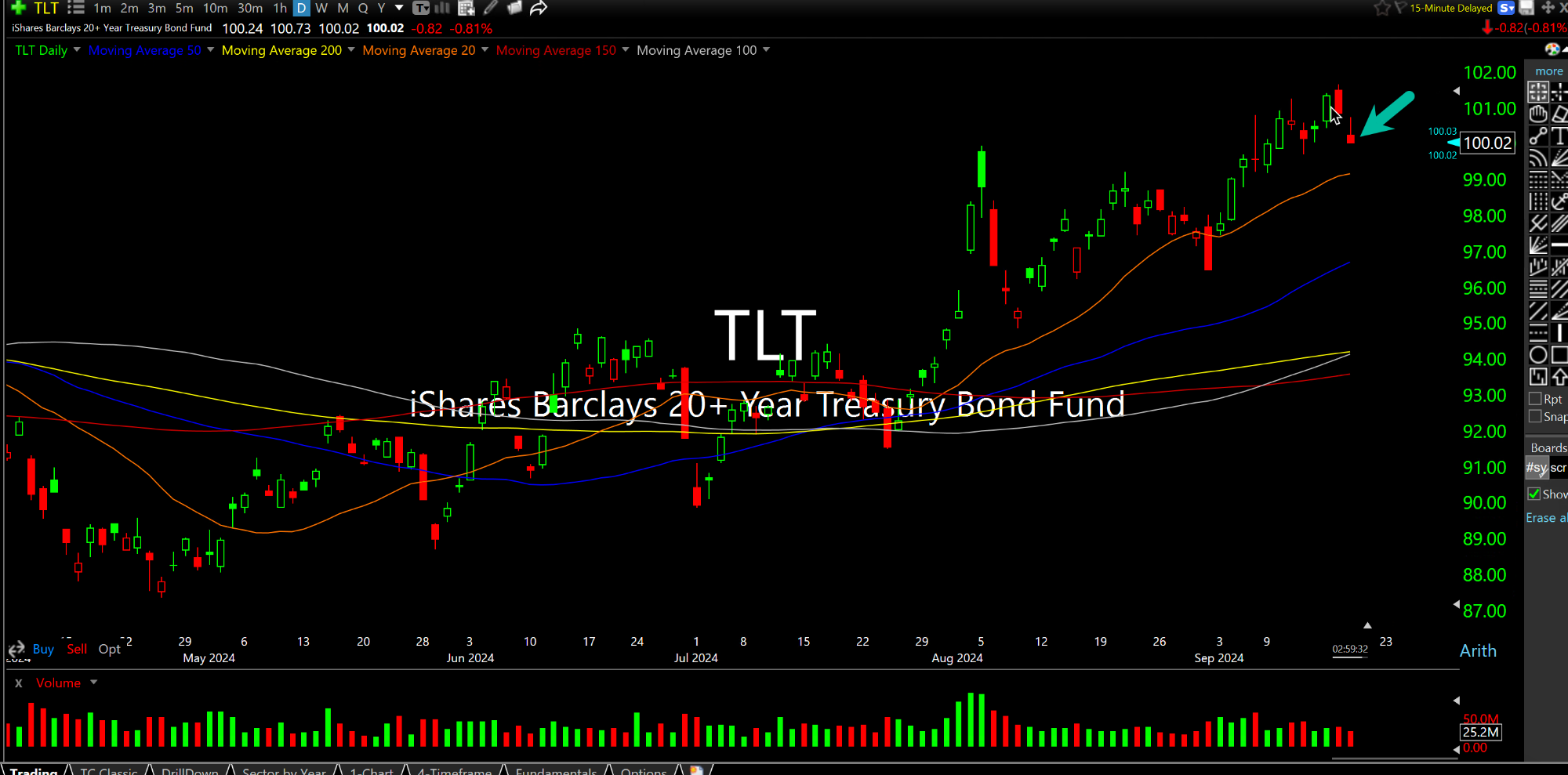

In the meantime, Treasuries are selling the news, seen below on the TLT ETF daily chart. I have been out of my TLT short since July and, as noted with Members, am actively looking to get back involved but not in a rush to do so, either.

The bond market, at least, is saying that the front-loaded jumbo cut was priced in, given the steep rally by Treasuries since the end of July.

Bond traders have a long-standing reputation for being the most perspicacious market players on Wall Street. Recently, however, much doubt has been cast on their acumen as stock bulls argue the economy is just fine and no recession is imminent. Longer-term I still see inflation and rates roaring back to new highs (using rates on the 10-Year as a baseline). But in the near-term bond traders are pointing towards a clear recession.

Now we see if the same holds true for stocks, as the dust settles from today's big cut.