24Sep1:21 pmEST

Sweet and Sour Stimulus

.jpg)

Overnight we saw that China announced its most significant stimulus package since pandemic. In response, China stocks traded as ADRs in America, such as BABA BIDU JD NTES PDD, just to name a few, are all gapping up hard as many shorts are likely caught offsides on top of the usual momentum chasers piling on the long side.

While I disagree with the view that this stimulus package will act as a panacea for China's economic issues, it may very well serve as an excellent ploy in a cold economic war to reignite inflation in the western economies.

Specifically, you will note non-precious miners, such as copper play Freeport-McMoran, gapping up hard as well today on the back of this stimulus news.

In fact, FCX is the very best overall performer in the S&P 500 Index as I write this on the session.

In addition, note that the gold miner ETFs printed bearish reversal candles yesterday which are failing to follow-through lower today, illustrative of the powerful upside momentum gold is enjoying right now.

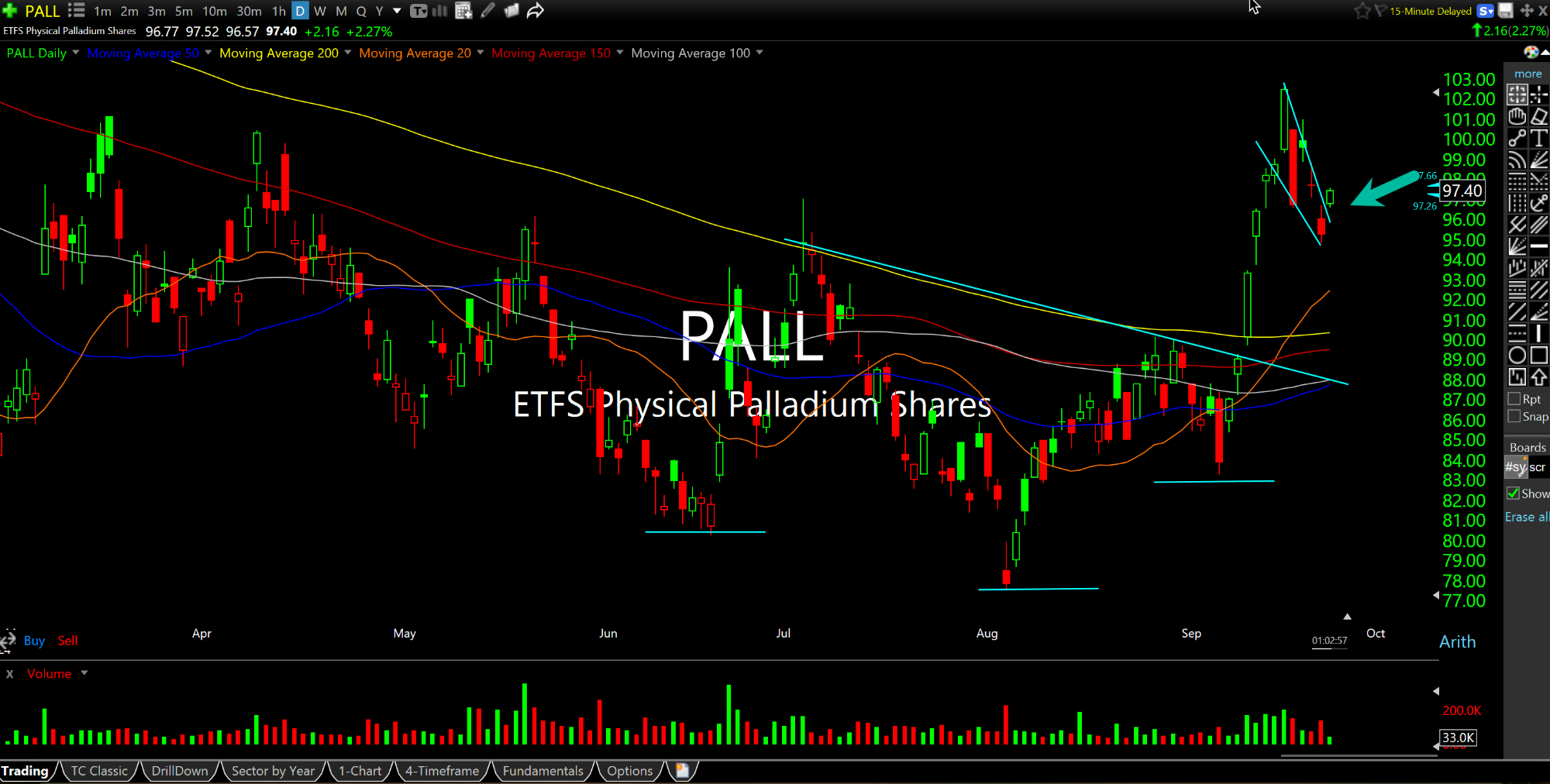

Finally, the other two precious metals besides gold and silver are palladium and platinum, respectively below on their proxy daily charts. Palladium's ETF, PALL, is threatening a bull flag breakout to resume higher, while the Platinum Group may be completing an inverse head and shoulders bottom.

Overall, as the jobs market weakens, the worst possible scenario would be to see cost-push inflation rear its ugly head again to make cash-strapped consumers all the more vulnerable.

We have no control over the policies here with The Fed and with China. But we can look for signs commodities are pointing to stagflation.

Shorts Don't Want to Land on... Leaders Lead in Both Directi...