25Sep12:53 pmEST

Leaders Lead in Both Directions

Any pretense of Goldman Sachs being the premier banking house on Wall Street (recall 2008, for example, with Warren Buffett buying perpetual preferred shares to ward off short sellers at the depth of the crisis) has long been disposed of, as JPMorgan Chase and its highly visible CEO Jamie Dimon is clearly on top.

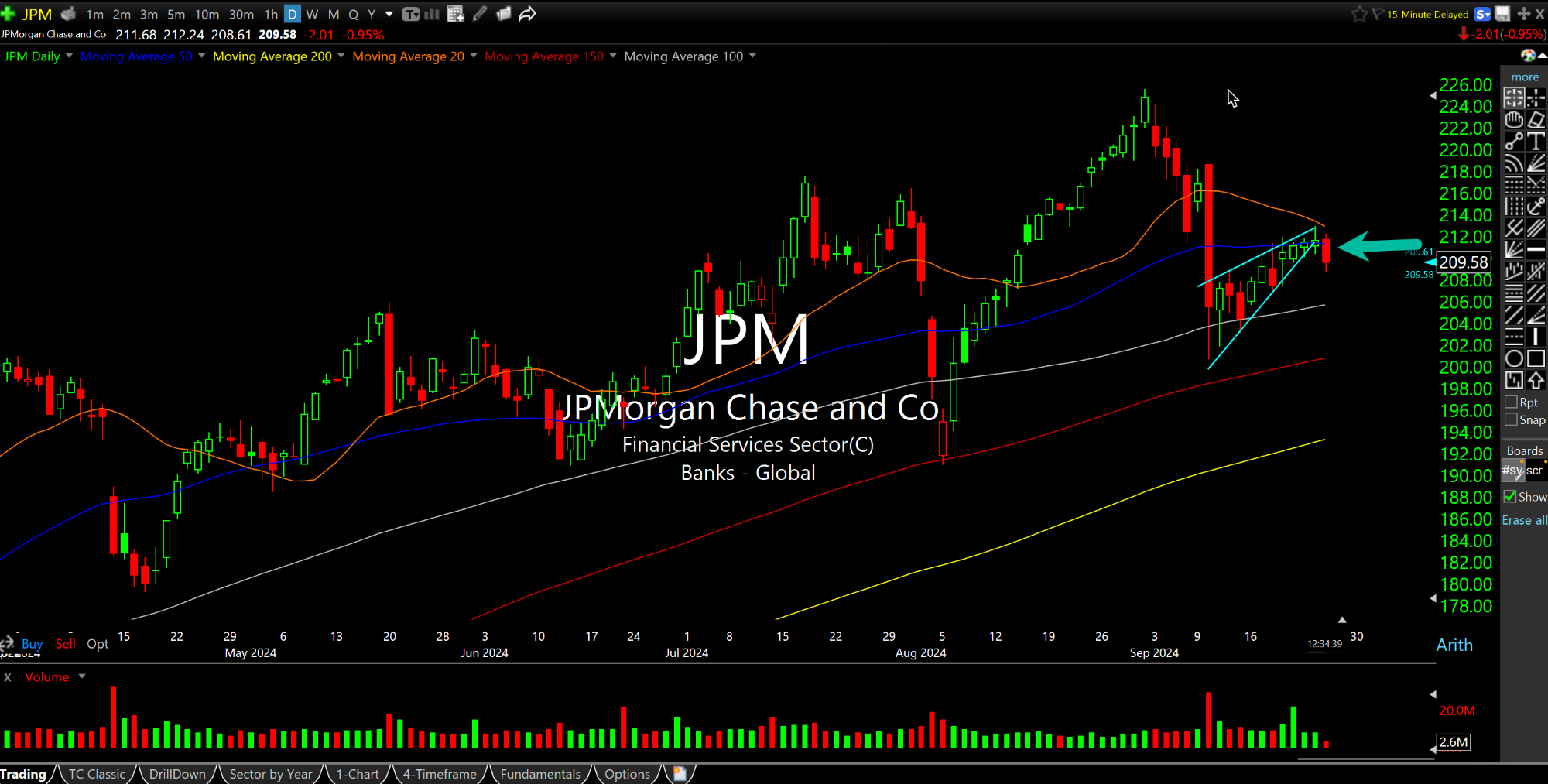

JPM is the largest-weighted market cap name in the XLF ETF, and it is also a Dow component. For the last several quarters the stock has been downright unstoppable at various intervals along the way with only modest dips quickly gobbled up. Bulls have pointed to Chase, time and time again, as Exhibit A as to why the bull market was intact and under no real pressure.

But that changed recently, with the XLF ETF for big banks challenging its August highs (bottom chart, daily timeframe) while JPM (first chart, daily) diverged negatively and failed to retake its 50-day moving average, let alone its August highs.

This bearish divergence is conveniently being ignored like many others, such as the semiconductors still well below their June/July, even August highs.

But late-2007 had one divergence after the next pile up, too.

And even though the macro backdrops are clearly different in some respects (they are actually similar in others, however) the underlying structure of equities is not so dissimilar so as to dismiss these warning signs.