08Oct1:31 pmEST

Judging That First Real Dip

Amid renewed political will in America for nuclear energy to help power AI, on top of continuous Middle East escalations, we have seen uranium stocks enjoy an impressive early-autumn trading period as a group.

In the last few sessions we finally got some dips to judge, insofar as whether the sector's notorious reputation for unforgiving volatility and nasty shakeouts persists or, instead, we see more bullish type of action in the form of benign dips which are aggressively gobbled up to propel the group for a new leg higher.

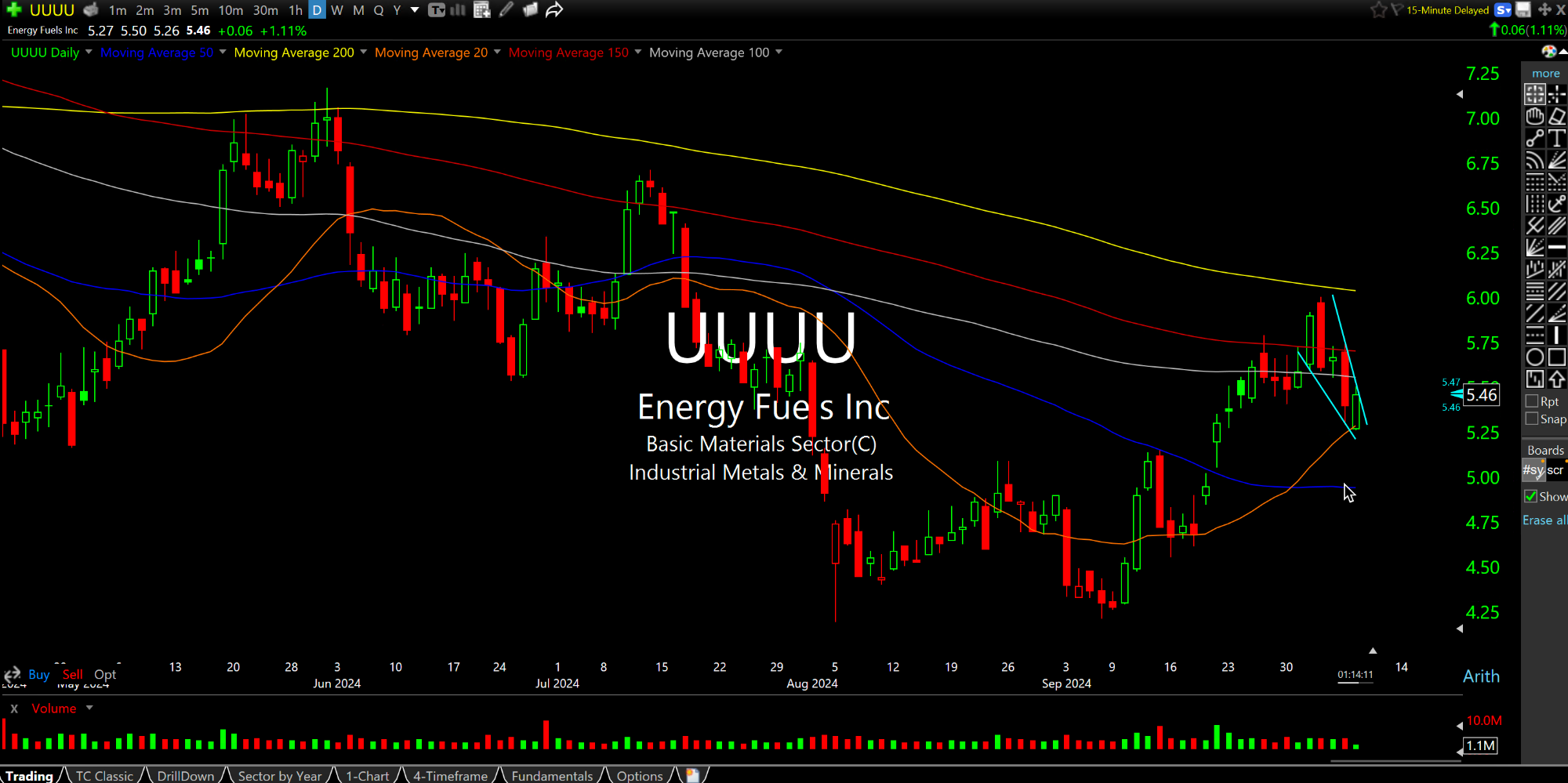

UEC and UUUU, respectively below on their daily charts, are two prime examples of dips which are, thus far, relatively benign for this high beta sector. Also watch CCJ DNN SMR for tells.

As for the market overall today, the Nasdaq got out of the gate hot to offset overnight carnage in China and China ADRs here in America today. With rates on the 10-Year still hovering right above 4%, however, I suspect Thursday morning's CPI suddenly carries more significance than the last few CPIs.

Excuse Me, I Believe You Hav... A Wounded Wolf is Especially...