23Oct1:57 pmEST

Hey Jensen, Want to Autograph My Jenga?

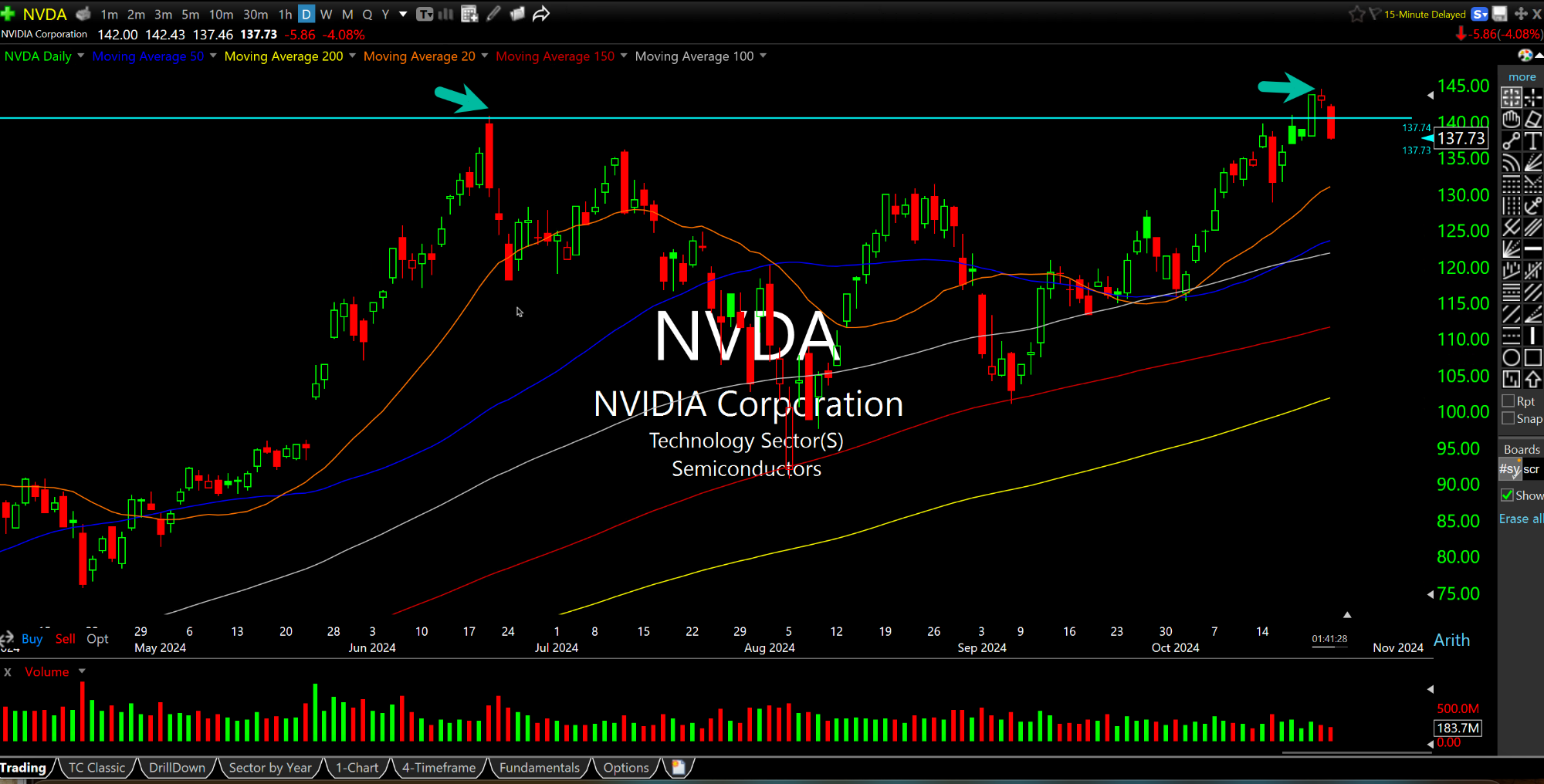

Trading at roughly $3.4 trillion (with the "T") market cap and a forward PE over 33, NVIDIA's technicals also remain historically steep on long-term timeframes, almost analogous to the Dutch Tulip Mania and South Sea Bubble when viewing the quarterly chart parabolas.

But we have known that for a good while now.

Thus, the pertinent issue right here, right now, is whether NVDA, after printing a fresh all-time high yesterday on this latest autumn rally, just put in a false high/bull trap. With today's sharp weakness, the question is at least somewhat viable, though bears need far more weakness to even think about confirming the double-top.

Specifically, NVDA would need a weekly close below the early-August $90.69 lows to confirm said double top. In the meantime, we have just under a month under NVDA reports its next earnings on November 19th.

So why even both raising this issue, if much more weakness is need to confirm and the marquee stock may be on hold until next earnings, with plenty of other earnings before then plus the election?

It is an excellent question, the answer to which, of course, is that NVDA has been piggybacking the Magnificent 7 of late, as well as the entire semiconductor space as the sector at-large, gauging the SMH ETF and SOX Index, both floundered. Going one step further, you can argue NVDA piggybacked the Nasdaq and S&P of late, too.

And that is even more the case today, as the SOX breaks to multi-week lows.

In essence, NVDA may be the key piece of the "Jenga" board which should topple the entire market once it is pulled.

They Threw the Baby Out with... Tesla Jumps, But Small Caps ...