24Oct2:53 pmEST

Tesla Jumps, But Small Caps Should Be Rallying Too

As Tesla stages an impressive 20% pop after earnings today it is interesting to see the small caps in the Russell 2000 Index red as I write this, into the late-afternoon portion of the session.

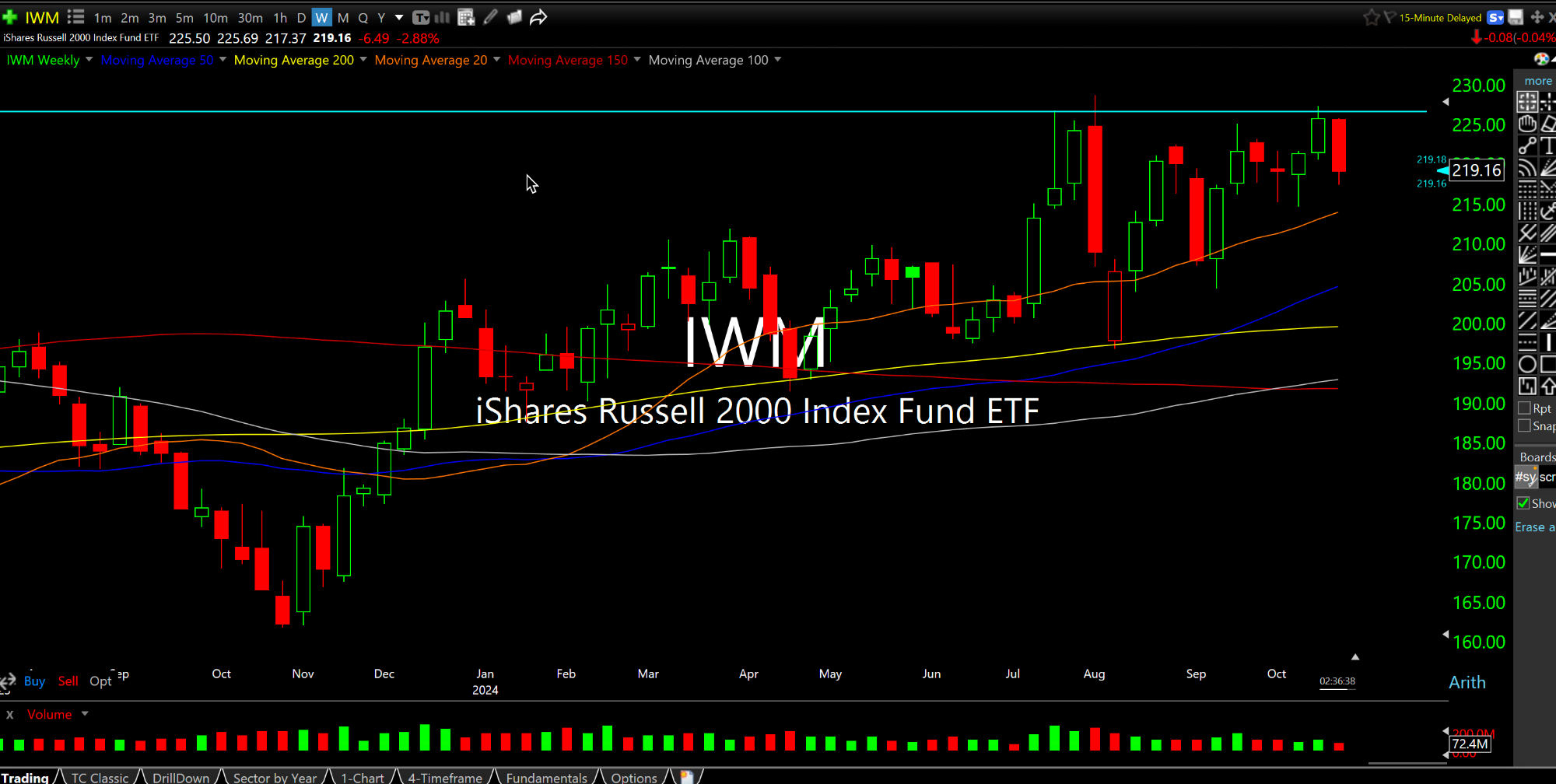

Given that rates on the 10-Year are dipping a touch below 4.2% today, on top of the momentum players galvanized with TSLA, one would think that the IWM would have the green light to run free. But that is just not the case, with $220, a level we noted with Members yesterday, inflicting resistance today.

On the updated IWM weekly timeframe, below, we can plainly see the late-July/early-August highs bringing out sellers in recent weeks. Even with many presuming a Trump win, small caps still cannot rally even though they ought to if the Trump predictions prove true.

While it is still premature to declare a double top on this IWM chart (much like NVDA, we would need a close below the summer lows to confirm), the underperformance during a time when they *should* be getting rotation remains the take-home message.

Elsewhere, palladium and platinum are having remarkable session, as they remain the two overlooked precious metals, even amongst many commodities traders. It is hard not to think that several asset classes are pushing back on The Fed continuing along the rate cut path for the November FOMC and beyond.

Hey Jensen, Want to Autograp... Afternoon Update 10/25/24 {V...