04Nov3:15 pmEST

A Big Hurdle to Clear, But Well Worth It

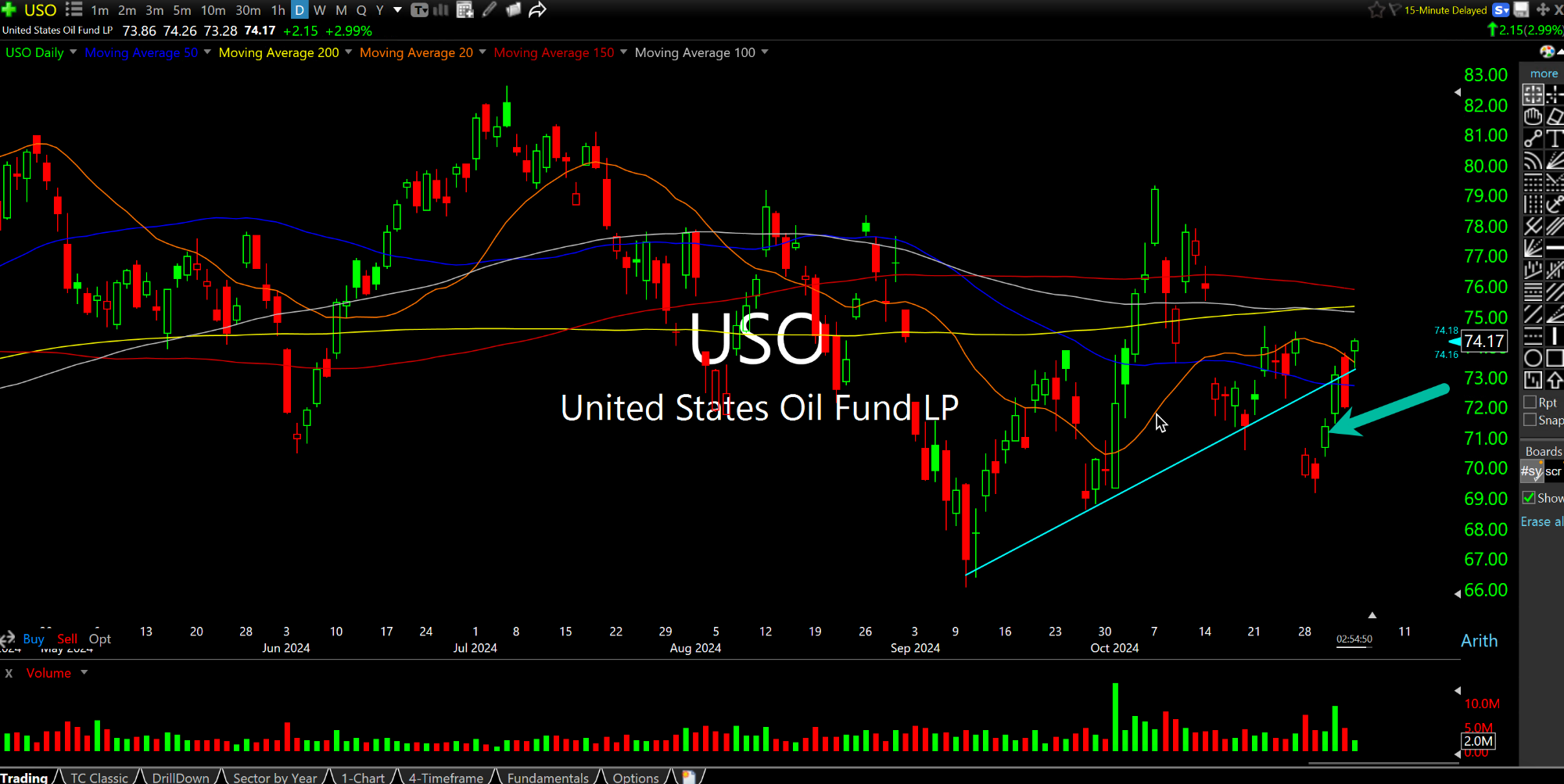

With everything going on this week it is going to be easy to overlook potential false breakdowns in both oil and natural gas, respectively below on their ETF's daily charts.

As you can see both oil and natty have been abysmal in recent weeks. But today natty is rallying nicely while oil is continuing to climb since finding buyers late last week. In both cases, the charts are reclaiming prior broken support, which I have highlighted for you--Doing so is typically the first sign of a bear trap (a trap to lure in bears) on a potential false breakdown.

The caveat, of course, is that reclaiming a prior broken support trend-line must hold, with no ifs ands or buts, since if buyers run out of steam again then we know the air is out of the tires, so to speak.

But given the run that gold has seen over the last three months I am inclined to given oil and natty the benefit of the doubt for a commodity rotation.

So while most will focus on the election, FOMC, and everything else going on this week it may very well be the perfect cover for oil to keep improving while natty finds a good low.