06Nov2:27 pmEST

I Bet You Wish You Had a Whirlpool Now

We have tons of violent moves across asset classes today on the back of the Trump victory overnight.

However, I maintain my view that the bond market selloff, especially on the long end of the curve, will only prove more significant (and more menacing) over time--Case in point, we have the IYR getting pounded today amid the explosive overall rally in equities due to the rate-sensitive nature of the commercial real estate stocks, suggesting that the soft landing narrative was overhyped from jump street.

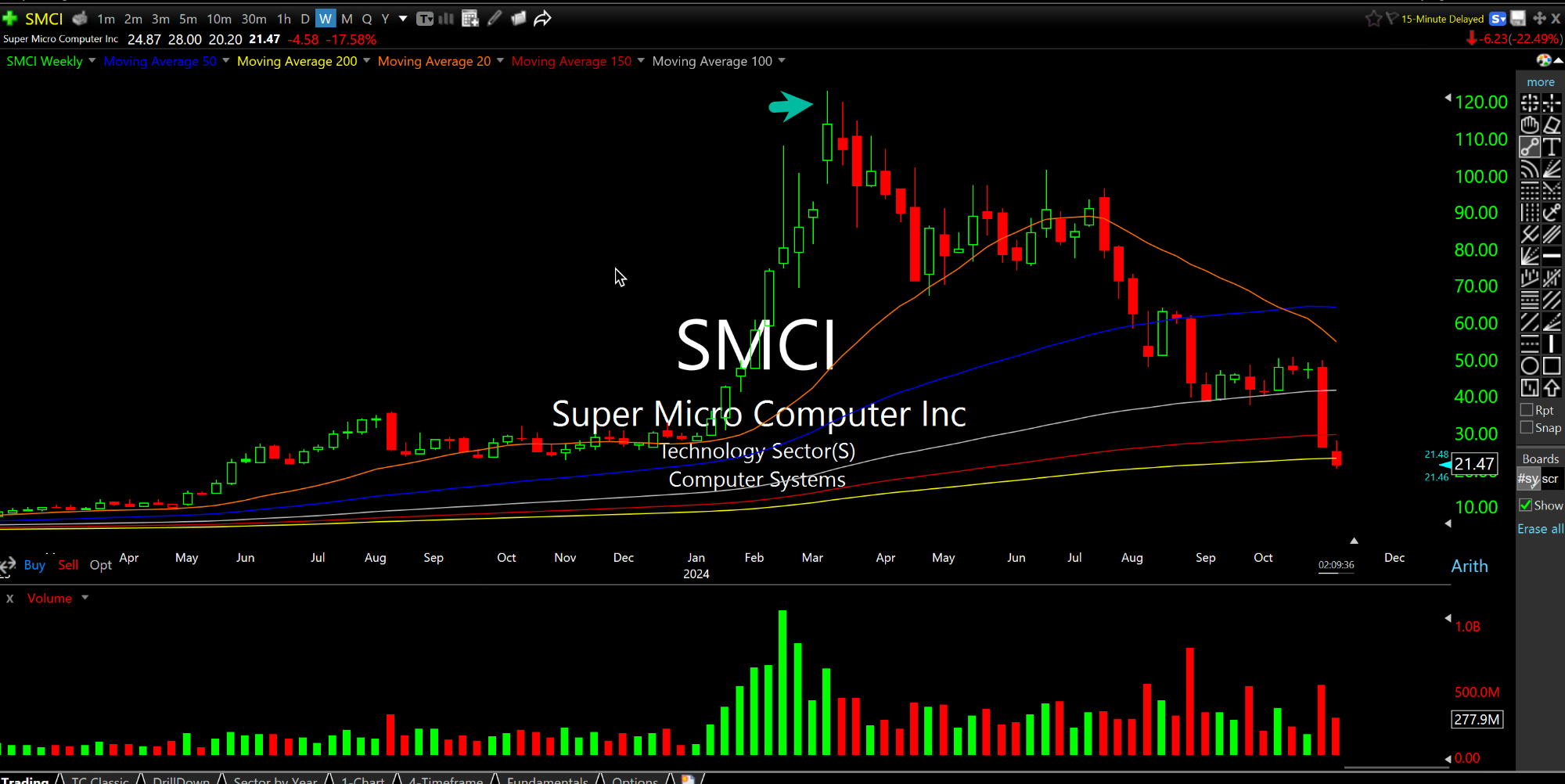

In addition, with everything going on it is too easy to overlook the SMCI quagmire. Super Micro reported "earnings" last evening and is down a cool 22% as I write this, on top of the recent harsh selloff on its lead auditor resigning. NVDA has somehow remained unperturbed, but I believe that bury-one's-head-in-the-sand mindset by the market to have an expiration date, too.

It is also worth noting that SMCI replaced Whirlpool in the S&P 500 last March, and now there are some rumblings SMCI could be delisted if the selloff persists and the accounting issues snowball, which would clearly be a dramatic fall from grace and the stuff out of which Wall Street infamy is made. The obvious parallel to draw is NVDA being added to the Dow in a few days, which could be the ultimate turn of events if accounting issues are discovered (or, perhaps, revealed) in the monster AI leader as well.

Overall, the initial ebullience over the Trump victory is likely to give way to a reality check about the move in rates. The Fed is under pressure to cut again tomorrow, but they would be directly opposing the bond market action since their previous jumbo rate cut in September.

If they choose to stand pat and not cut they may be viewed as anti-Trump and politically-motivated, which means Jerome Powell ought to get comfortable in the bed he made over the last few years.