10Jan11:27 amEST

Live By the MAGS, Die By the MAGS

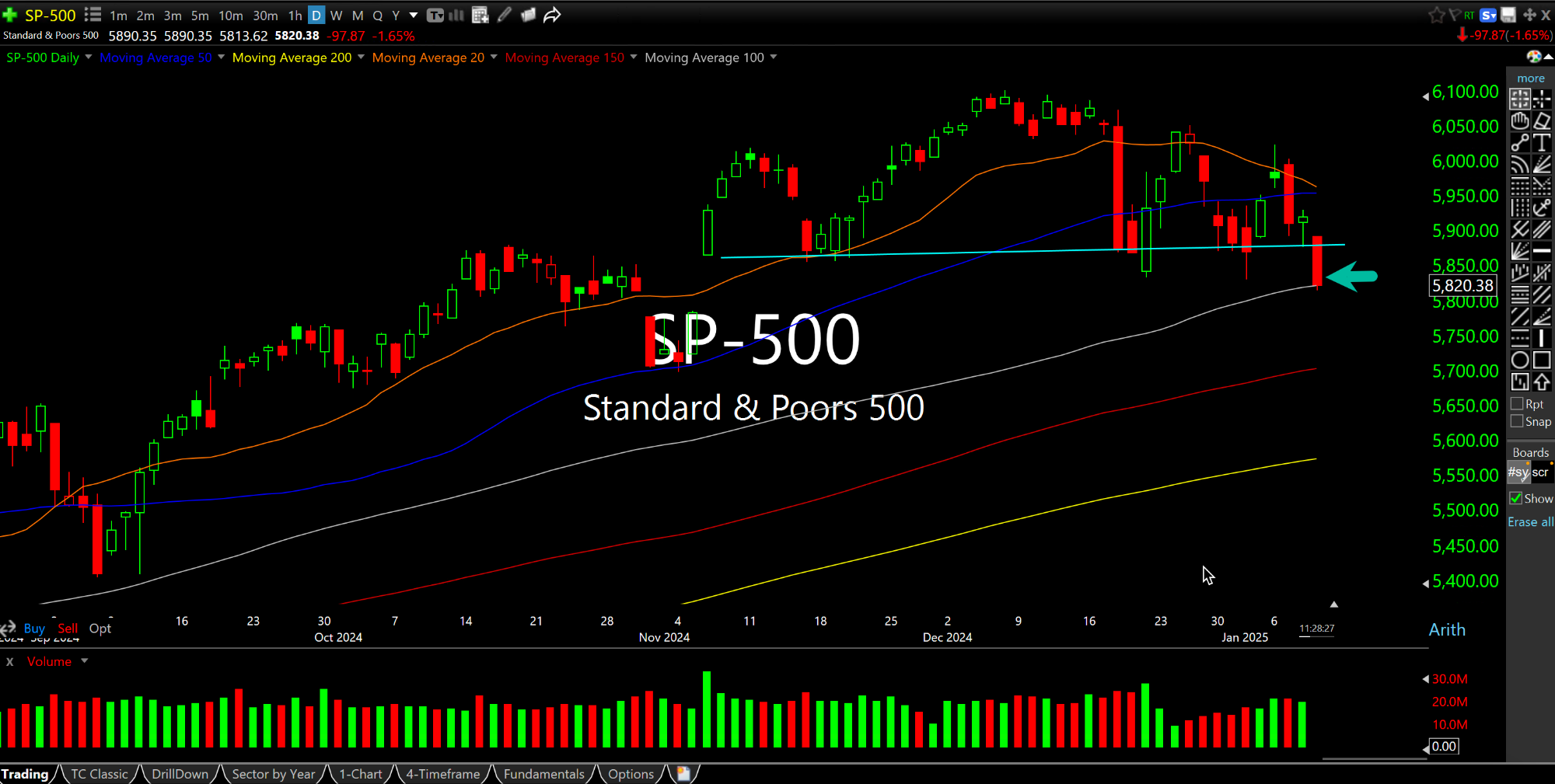

After forming a series of lower highs since mid-December, the Magnificent 7 ETF, first chart below on the daily timeframe, is breaching well-defined support this morning. The second chart, below, for reference is of the S&P 500 Index daily and also shows a support breakdown so far today, indicative of a head and shoulders bearish top threatening to confirm lower, pending today's weekly close.

First and foremost, the fact that there even exists an ETF for an acronym of the few crowded leaders at the top of the market is not the sort of thing you see at stock market bottoms, or even in the middle of the trend. No, it is usually a sign of excess froth in the leaders.

As big as the Mag7 names have become in terms of market cap, there is no evading the issue for bears--The only way to crack this market lower is to decimate the Mag7 names, themselves. Naturally, there is a ton of overlap between Mag7 and the S&P, which is why I presented both charts to you, due to weightings of the Mag7 names clearly affecting the senior indices.

Earnings season for the Mag7 begins in about a week and a half, coinciding with Trump officially taking office.

But the issue today is rates: A strong jobs report means another Fed rate cut is increasingly less likely for the foreseeable future. And that means tons of drama between Trump and Powell the rest of this winter, in all likelihood, with Trump pushing Powell to cut rates just like he did in his first term in a much difference macro climate.

With higher rates comes more pressure on mega cap tech, and most equities overall.

One step at a time, however. And the first step is seeing MAGS and the S&P hold these breakdown levels into next week.