21Jan12:29 pmEST

Hedonistic Nihilism

Hedonism is the belief that pleasure is the most important thing in life, while nihilism is the belief that life has no meaning or value. A combination of the two is called hedonistic nihilism.

Given the shenanigans of the meme coins ($TRUMP and $MELANIA coins, for example, not to mention the estimable $FART coin) over the long weekend now, more than ever, seems like a moment in markets where many traders are convinced that "animal spirits" will last well into Trump's second term in office. Of course, there are other factors--Perceived pro-business policies from Trump, upbeat sentiment from business owners, etc..

But all of that ignores the fact that markets are already at or near the highs, with valuations sky-high in many spots, especially amongst the market leaders set the report earnings in the next few weeks (with Netflix tonight, for example).

In other words, all of the comparisons to Reagan's first term seem absurd, at least from a market perspective.

When Ronald Reagan first took office, for example, there were magazine headlines bemoaning, "The Death of Equities" after years of horrendous price action and multiple shrinking among sticky high inflation eating into profit margins. The Nifty Fifty had topped out many years before Reagan even set foot in the White House as President.

And during the market malaise of the 1970s, leading up to Reagan's first term in January 1981 (markets did not bottom until August of 1982), the best performing asset was gold bullion. That was no coincidence, as it is during times of hedonist nihilism that many investors seek comfort in gold, an asset which has outlasted thousands of years of seeing advanced civilizations come and go---Especially those civilizations which had become so arrogant as to assume they would thrive even when moving as far away from their founding principles as possible.

Thus, with central bankers (See: Waller's remarks last week) and politicians bold enough to think they can simply bully inflation lower with words alone even with wildly inflationary policies, gold continues to signal it may render all the hot air to be just that.

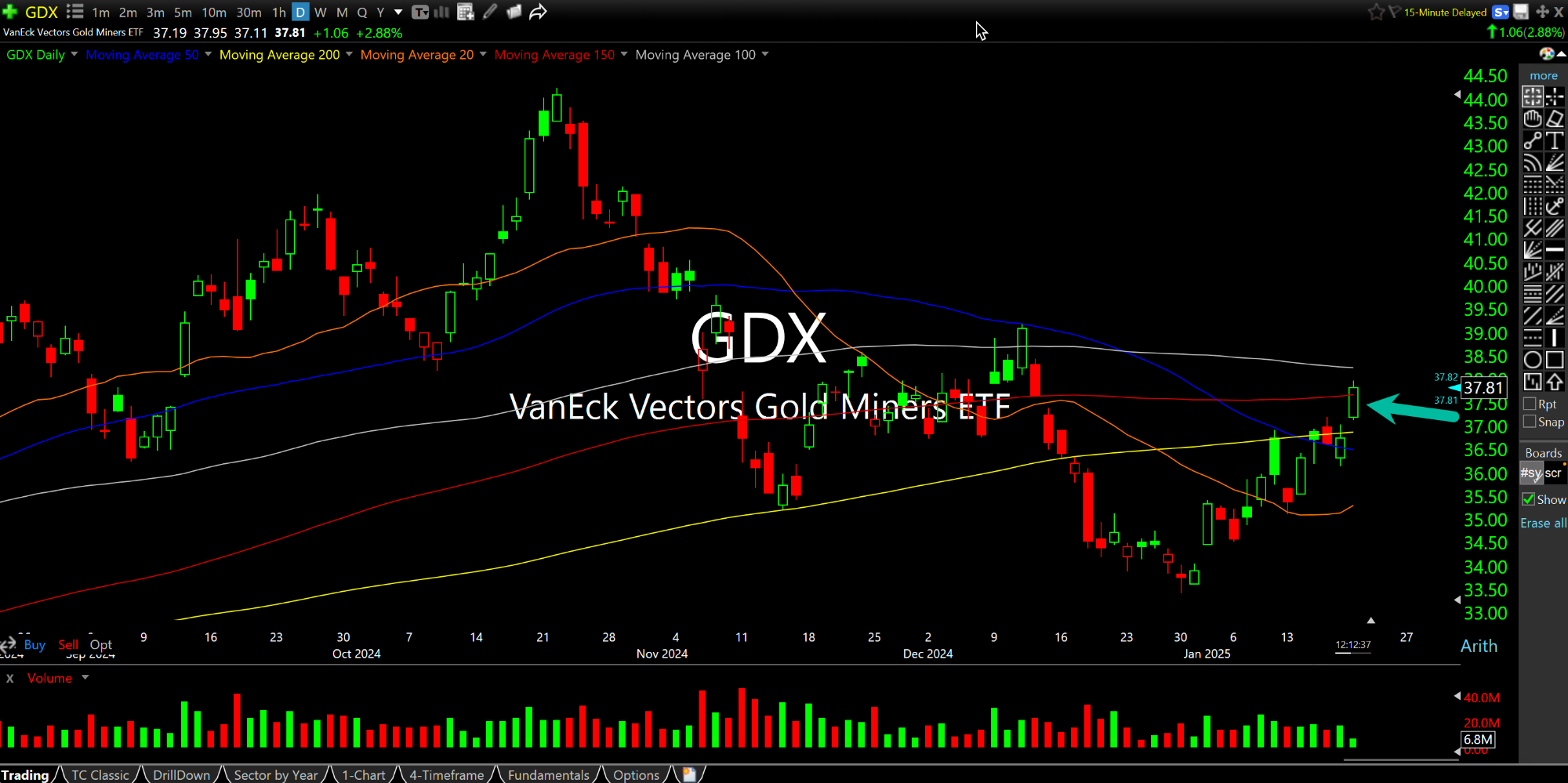

On the first monthly chart, below, the GLD ETF (for the gold metal itself) continues to flash a tight, explosive-looking bull flag with good strength today. And now gold miners, on the second daily chart, below, for the GDX ETF, are following suit back above their 200-day moving average.

The bond market is certainly one major entity which can instill genuine fear (which we have not yet seen) in both investors and politicians, but gold running away into the sky can also upset the apple cart in D.C..

Afternoon Update 01/17/25 {V... This is Not the Golden Age o...