29Jan10:47 amEST

Cutting? Seriously, Cutting?

At the risk of launching a Jim Mora rant, I will simply flag the DBA ETF (for a basket of soft commodities) weekly chart, second below, challenging ten-year highs from December 2024 here as softs stage a resurgence in early-2025.

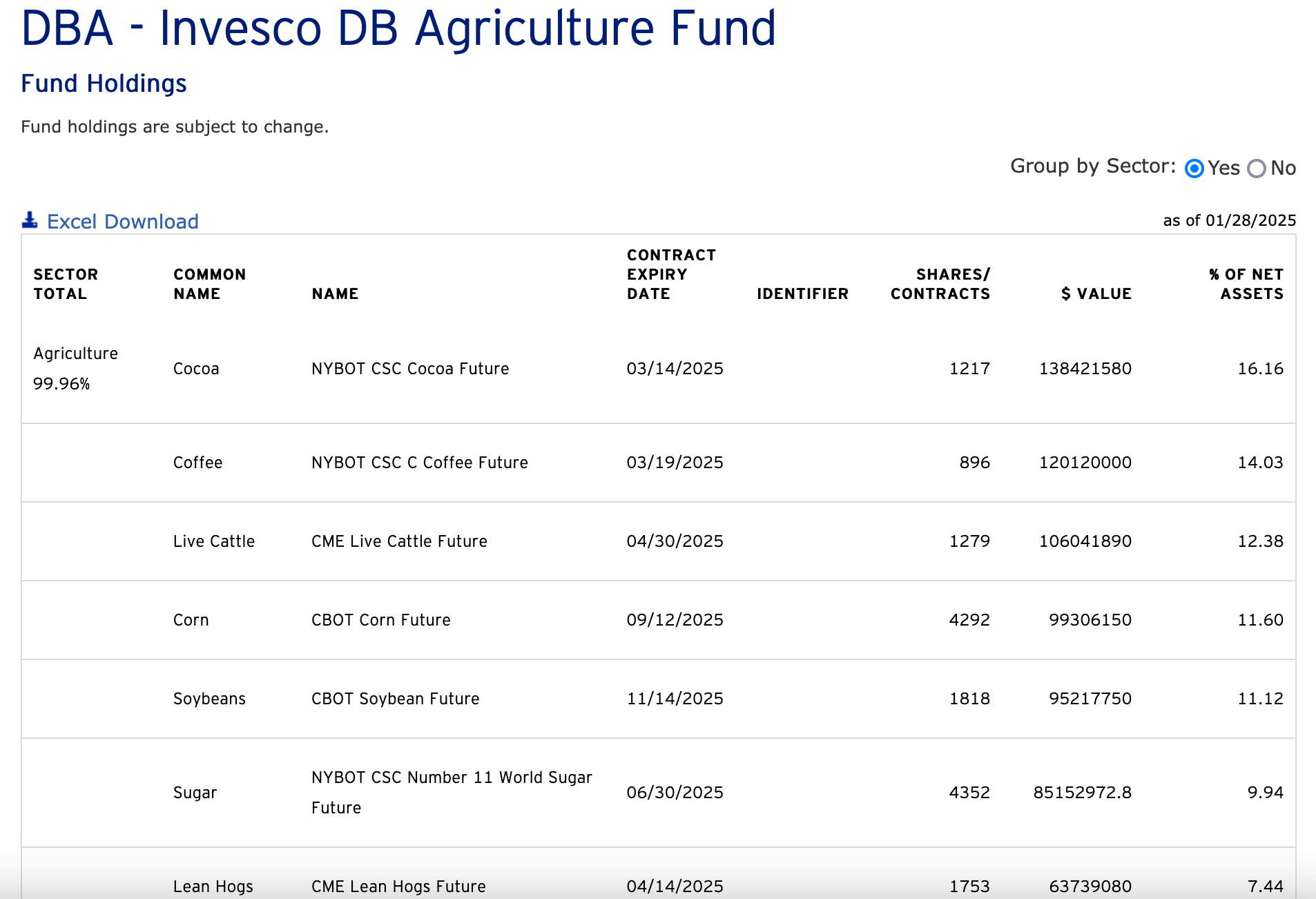

The first graph, below, shows the top-weighted components of DBA--Ask yourself how significant each one of these commodities is to your daily lives and to the lives of most Americans. The answer, of course, is incredibly significant.

In other words, even though Powell and The Fed are expected to hold rates steady later today at the FOMC, the key issue will be just how dovish they are for future meetings, especially with President Trump showing no apprehension about publicly pressuring Powell to cut rates immediately and aggressively.

If anything, a ten-year breakout in soft commodities, coupled with oil and gas turning back higher after recent dips, would be grounds for clear rate hikes this year rather than the multiple cuts the market currently expects.

Elsewhere, NVDA continues to sport massive daily price ranges. The stock is chewing up longs and shorts since Monday's massive gap down. And I continue to view this action as bearish in nature given the wild indecision.