13Feb1:42 pmEST

Do We Need Taiwan or Not?

Despite some notable weak spots underneath the surface today, such as transports, Microsoft (again), and Amazon, just to name a few, stocks are broadly higher after shrugging off a hot PPI print this morning. A headline crossed earlier that Trump may delay tariffs for another month or two, which seems to have assuaged fears of imminent negative consequences.

That said, Taiwan Semi, on the first daily chart, below, is sure acting like tariffs are coming for Taiwan.

Note the "diamond" topping pattern I have highlighted, which is trying to break down today on the move lower. This pattern denotes loose and sloppy price after a prior period of prolonged uptrend. It often implies that buyers are slowly losing their grip on that power trend.

Turning to commodities, gold remains a freight train higher. We have yet to see any open panic or even acknowledgment from the powers that be about gold's move, though it may be some time before we see that.

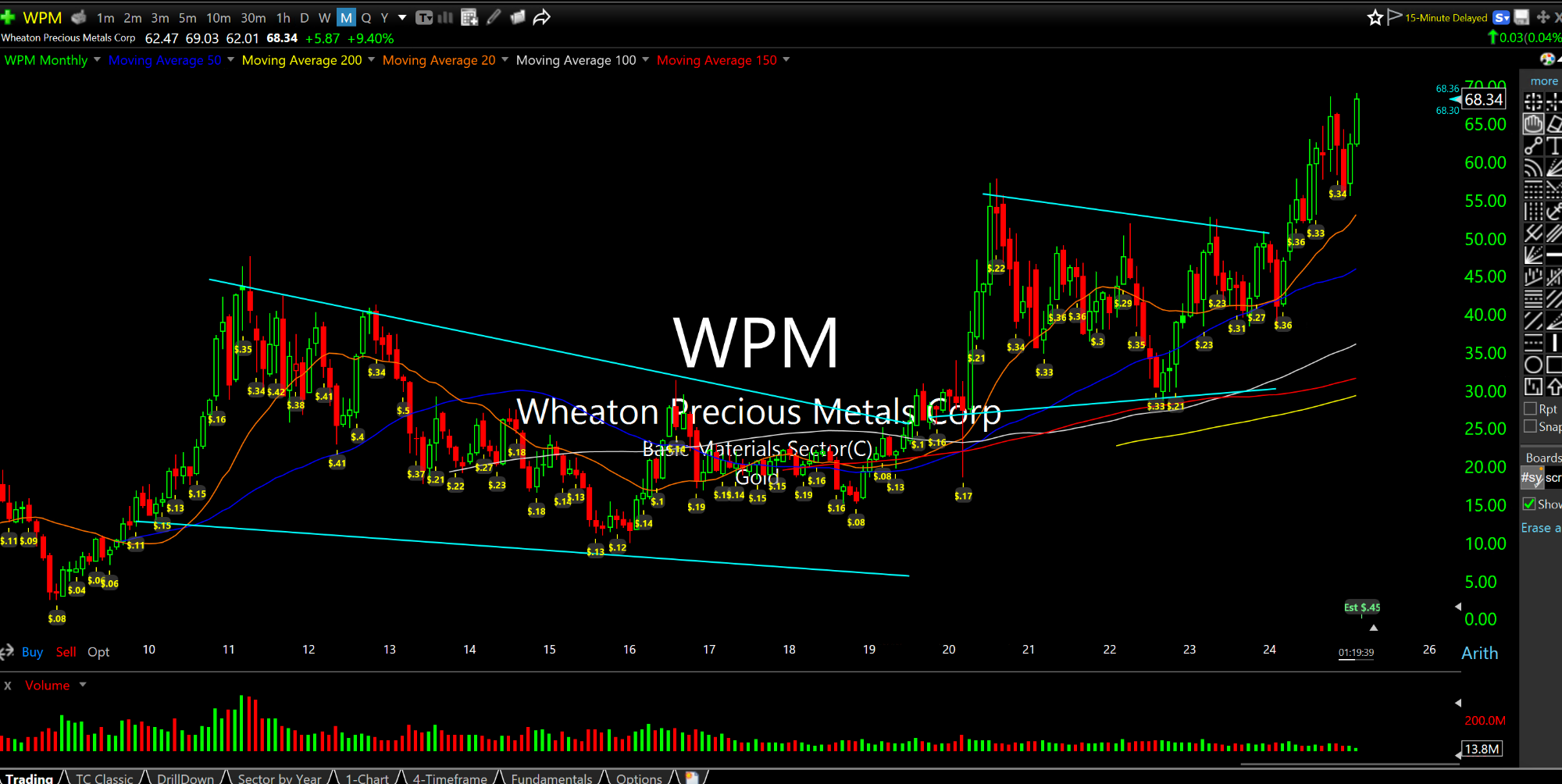

Still, on the second monthly chart for Wheaton, a name we have owned for VIP Members as a long-term investment for years, it is acting like a leader in a sector where many other precious miners have some catching up to do. Note the multiple base-over-base pattern dating back fifteen years, now breaking to new highs.

Denial Ain't Just a River in... Afternoon Update 02/14/25 {V...