18Feb2:13 pmEST

Housing is Dead; Long Live Housing

Rates continue to remain elevated--Higher for longer, indeed.

While I am still flabbergasted at the Nasdaq and VIX largely ignoring this issue (for now, at least), housing and related stocks have clearly gotten the message. And it may only be starting.

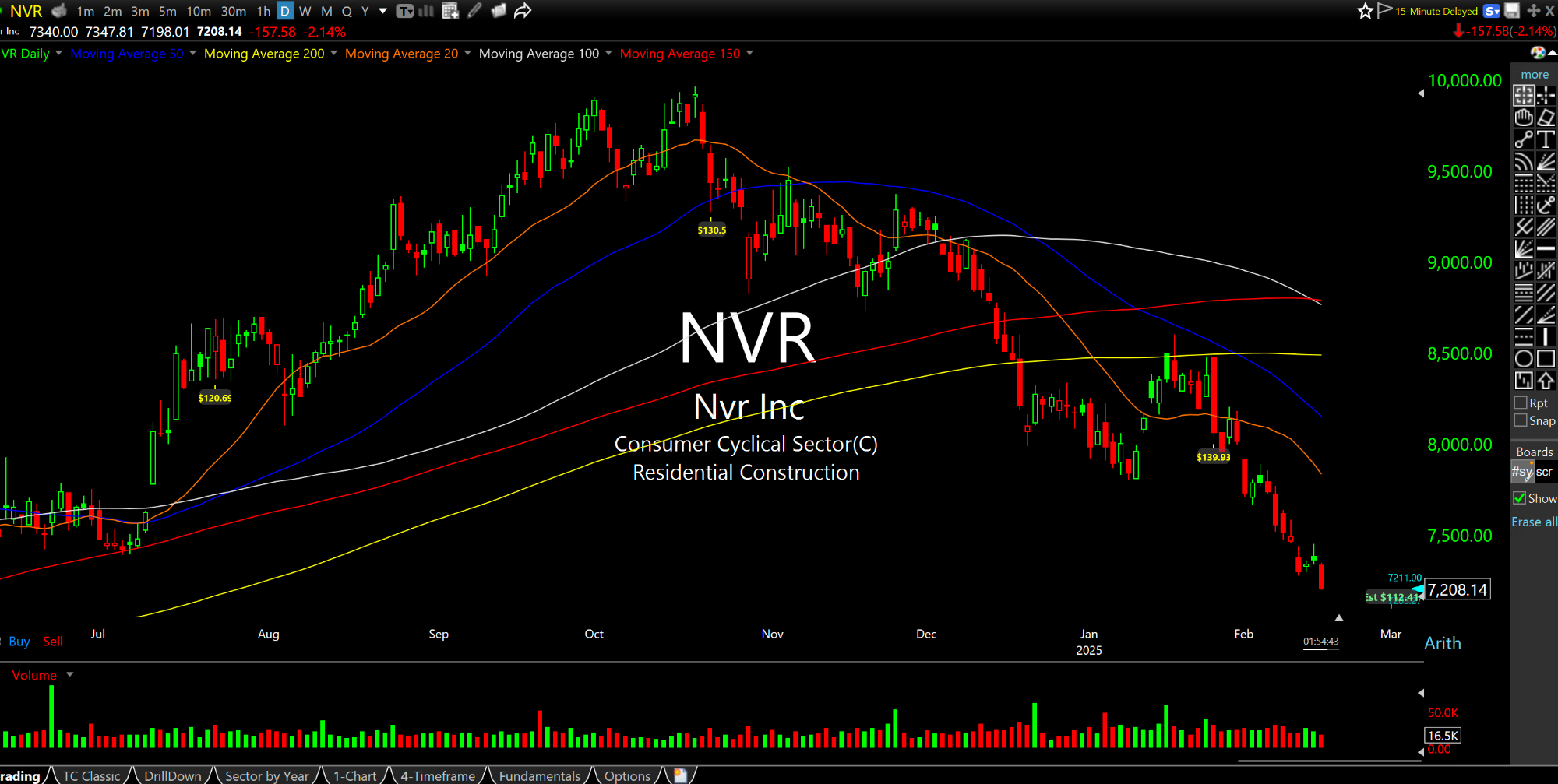

On the NVR daily chart, below, this homebuilder serves as just one of many examples of the kind of technical deterioration we have seen in the sector. Note how the stock is selling off again today even from oversold conditions, a classically bearish technical development. Other weakness in the ITB and XHB homebuilder ETFs of note are BZH KBH HOV.

And then there are the big housing retail stocks: HD LOW SHW all of which have the look and feel of topping out charts, albeit with HD LOW having earnings in the coming weeks.

There is also the Washington D.C. issue, where thousands of new listings have hit the market as Trump cuts the many fat-cat government jobs. However, if the issue were only contained to Washington I strongly suspect we would not see the market react this aggressively over a period of time.

If nothing else, this housing action serves as a reminder that embracing monetary and financial nihilism, as many have this cycle, that sticky-high inflation and rates mean nothing to equities, is not rooted in historical fact. The early-1973 analogy seems to make sense, which was when the NIFTY FIFTY had finally topped and equities got cut in half as profit margins got squeezed amid high inflation and rates.

Either way, housing is nationally dead, with of course pockets of locally strong markets. Long live the COVID/QE/ZIRP/Stimmies housing boom.