19Feb2:31 pmEST

Drifting At Sea

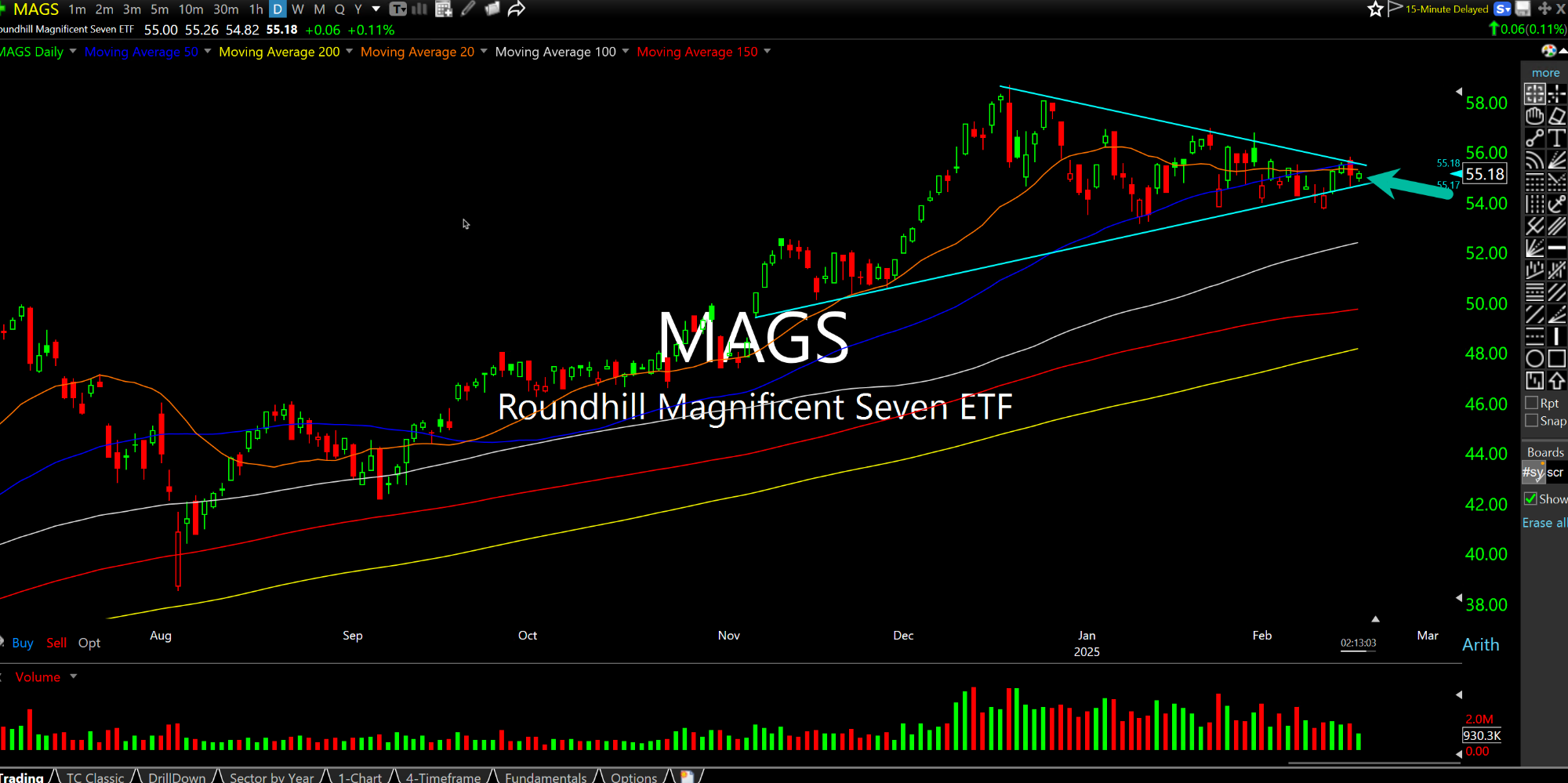

The ETF for the "Magnificent 7" leading mega cap tech stocks, below on the daily timeframe, pretty much sums up the state of things with this market: We have a drifting tape, low in volume and narrow in range. Note how tight the apex of the symmetrical triangle is getting, with the lower highs and higher lows nearly converging.

History says that periods of price compression (i.e. narrowing price action and subdued volatility and volume) *should* lead to periods of explosions, either way, with increasing price ranges. But this market has seemingly defied conventional wisdom for a good while.

Specifically, I cannot recall, in more than twenty-five years in markets and studying historical ones, a tape where this many red flags and bearish divergences have been ignored. Early-2020, leading up to the COVID panic, did have some similar characteristics. However. this market has dragged on much longer with its apathy.

The Fed Minutes today pretty much indicated a Fed on hold, perhaps with a hawkish lean but still nowhere close to hiking rates and eating humble pie again. Jobless claims tomorrow morning, then NVDA earnings and GDP, PCE next week are some events coming up.

But this market is drifting at sea, any way you slice it. And there is not much to do but wait for a break and a pick-up in the pace of the action.

Elsewhere, natural gas is running away to the upside, no doubt squeezing some big shorts offsides. A bunch of natty stocks report this week and next. But we will be stalking them with Members as the underlying commodity heats up.