06Mar3:29 pmEST

I Know a Dirty Crew When I See It

Headed into tomorrow morning's jobs report we have equities swooning again today. Bottom-callers expected the 200-day moving averages on the senior indices to provide more immediate support. But the battle wages on as the tariff headlines become more indecisive and murky by the day. In addition, some earnings disasters like MDB and MRVL are not helping the cause for a bottom.

On that note, we have Costco earnings tonight.

In my twenty-five years of trading and analyzing markets it is hard for me to overstate just how absurd COST has become as a stock. To be clear, the company itself is brilliant (even though I, personally, am not such a fan of shopping there): The management and execution are unparalleled.

Be that as it may, Costco is still a retailer trading at 51 times forward earnings with a $455 billion market cap, coupled with one of the most obnoxiously steep long-term parabolic charts you will ever see, especially for a large cap retail name.

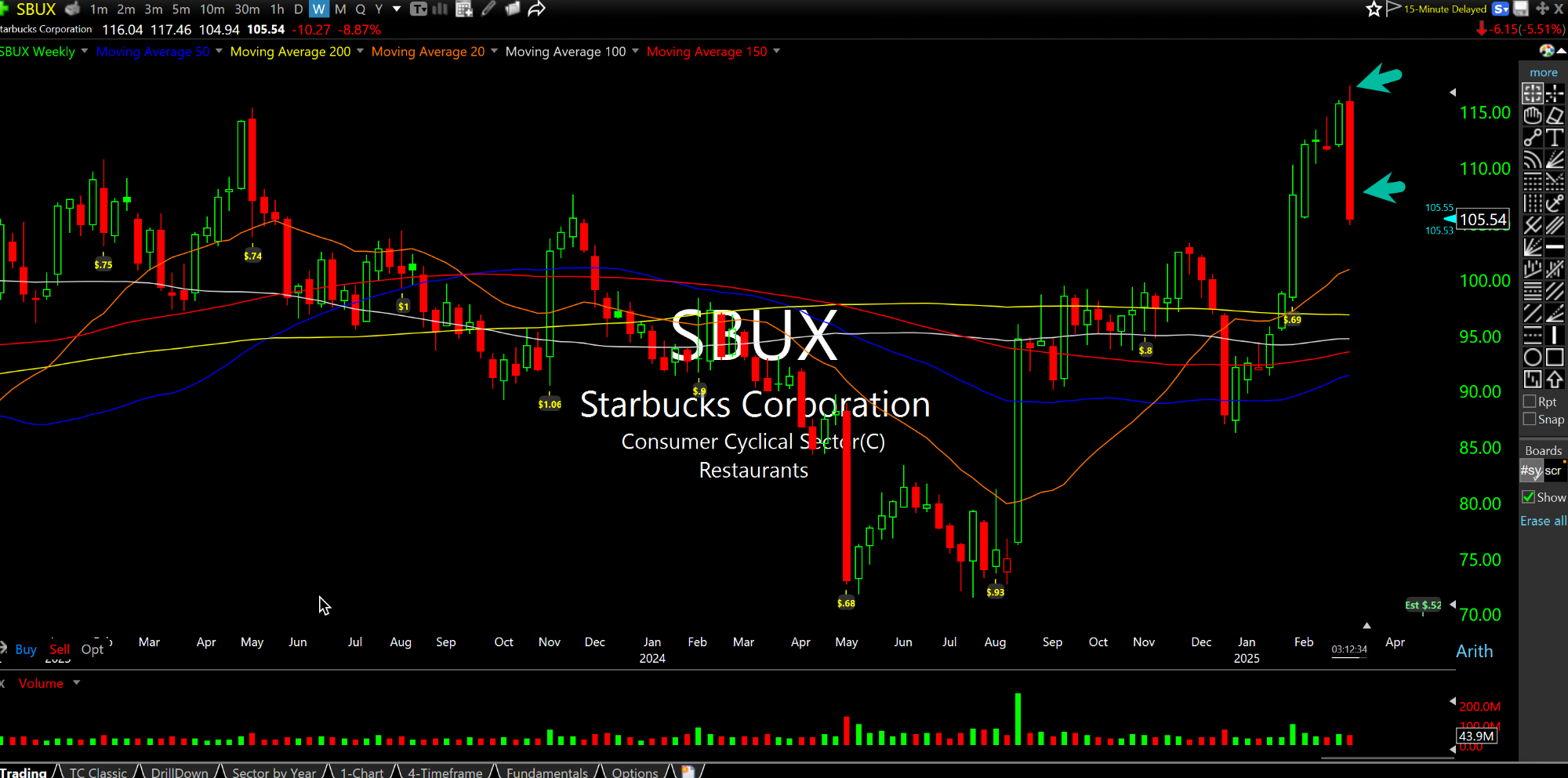

Along those lines, Starbucks and Visa, respectively below on their weekly charts, have also had recent steep rallies: Visa long-term as well like COST, while SBUX more recently with the new CEO.

Both SBUX and V are on track for bearish weekly engulfing candles, however, as I have been looking for their overdone moves to exhaust themselves.

Overall, the crowded, one-way leading names in this market are finally slowing down, at a minimum. Bifurcated markets historically end in a bearish manner, with the strongest breaking their uptrends while the weak parts of the market remain weak: Just see MRVL (strong semi) and MDB (weak software) as an example.

A Thousand Blows Could Ruin ... Afternoon Update 03/07/25 {V...