13Mar10:34 amEST

Cooler Prints Prevailed...or Did They?

Earlier this morning a cool PPI print followed up yesterday's cool CPI. On the surface, many headlines boasted about inflation coming down and Fed rate cuts being more likely and numerous this year.

However, market pundits are still overlooking the reaction by the bond market. Rates on the 10-Year Note, for example, are clearly higher than they were before the CPI. Similar comments apply to the 30-Year Treasury.

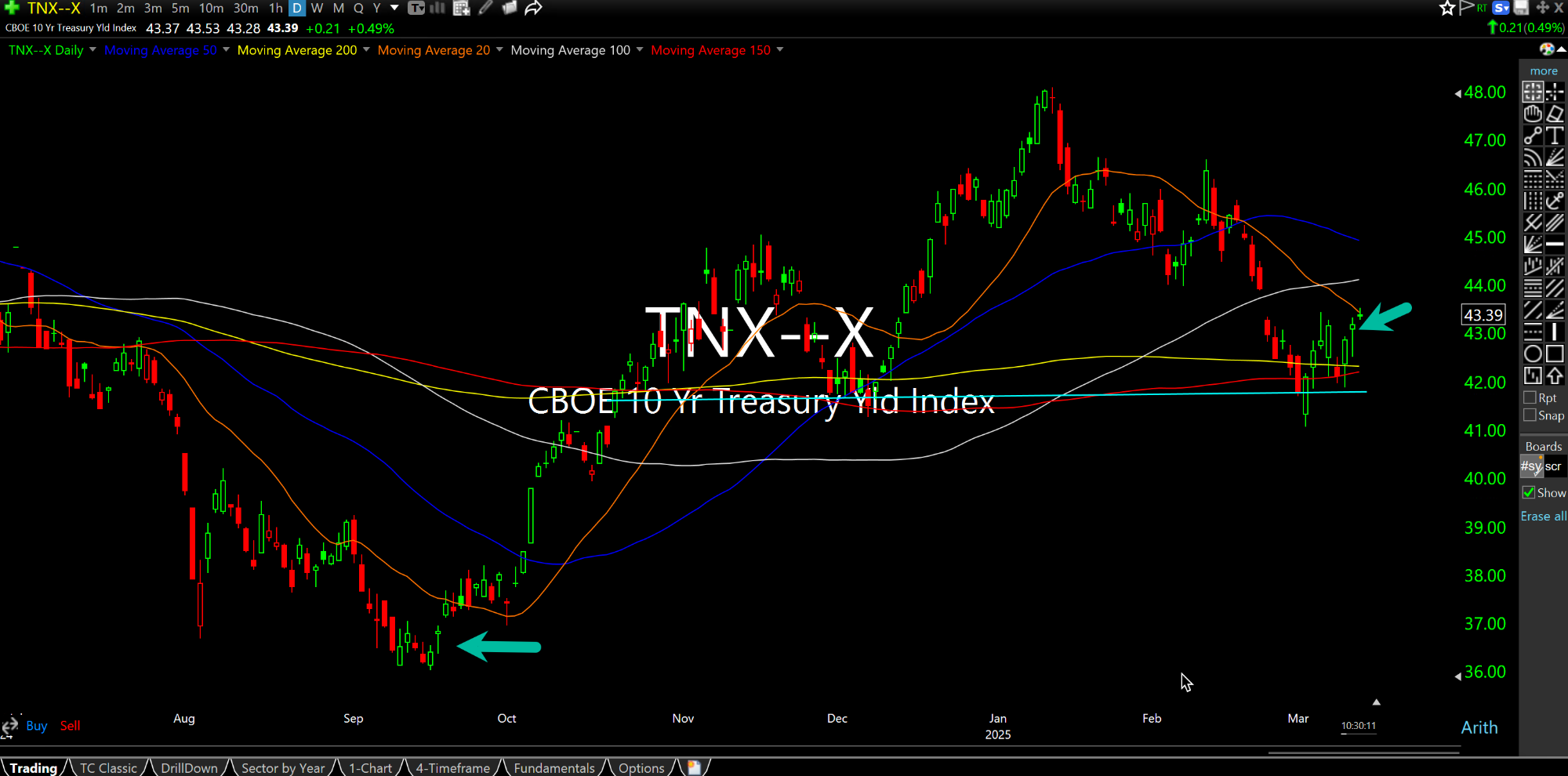

On the TNX daily chart, updated below, which is the Index for rates on the 10-Year Note, the bottom left arrow points to last September's jumbo FOMC rate cut. To the great surprise of many, the bond market sold off and rates on the 10-Year shot higher throughout the brief cutting cycle.

Since the Fed stopped cutting we have seen rates come down some, though they are still comfortably above where they were when the Fed started cutting in September.

Overall, the key issue here is whether the bond market "plays ball" with The Fed and now the Trump Administration's desire for inflation to come down alongside rates on the long end of the curve. Although the inflation prints have cooled a bit, they are still elevated long-term well above The Fed's 2% target.

Most importantly, though, the bond market is showing subtle signs of going rogue and not falling neatly into line with what the power players inside the Beltway want to happen--I still view this as one of the major black swan scenarios which few people are expecting. Should rates on the long end make another push to 5% this year I strongly suspect markets and parts of the economy will suffer shock.

Can You Handle the Drama and... Afternoon Update 03/14/25 {V...